If you’re like most business owners, you spend most of the day running your company—working with employees, customers, and trying to grow it. Then you might make time for family, friends, and maybe (hopefully!) some hobby or activity that you enjoy. However, I’m guessing time for retirement planning is pretty far down the list.

And this might seem rational: it’s off in the future, it can be complex, and there’s always at least one fire to put out today.

And, on top of that, if you’re running a growing and successful business, the return you can achieve there tops anything you could or should expect by investing in the S&P 500. Higher risk equal higher potential return (and any small business is certainly higher risk than an index of 500+ publicly traded companies).

However, consider the notion of control. One reason a lot of people go the entrepreneurial route is to control their own destiny. But, by ignoring your retirement plan, you are giving up control at a critical phase of life—retirement.

THE FOUR BUCKETS

Think of the money generated by your business as flowing into one of four potential buckets:

- Building your emergency funds

- Funding your lifestyle (i.e., spending)

- Back in the business, and

- Savings (with retirement savings being a tax-advantage form of savings)

Funding all of the buckets are necessary but by ignoring the last one, you will have less leverage, less flexibility and less control when exiting your business. If your retirement plan IS your business you become subject to the whims of the economy, the pool of potential buyers, and drain of taxes and fees at the time of your exit.

By fully funding your fourth bucket, you are in control of your exit (and reduce your taxes in the process!).

For those ready to explore this path, there are five critical questions to get moving.

THE FIVE QUESTIONS

- Do I fund the fourth bucket? Hopefully, I’ve made a strong case that you should not ignore saving for retirement but it’s the first question to answer. Maybe you feel like you need to shore up the other three buckets first (lifestyle, emergency funds, business growth) but don’t ignore it too long. At a minimum, schedule time to review this decision annually if your answer now is “no.”

- What’s my primary goal? Retirement plans come in many different flavors and varieties and it’s helpful to determine your objectives up front before getting stuck in the weeds. Typical goals are to:

- make it simple/easy/low cost;

- gain flexibility in rules and employer contributions;

- or to maximize contributions.

- How much do I want to contribute? The next critical question is how much do you wish to contribute and what can you afford. Different plans have different contribution limits but typically the higher the limits, the more expense and complex the plan.

- Does my business have employees? Easiest question of the bunch (!) but it will narrow down your options. For example, a solo 401(k) isn’t an option if you employ others and a SIMPLE IRA is only for companies with less than 100 employees.

- If so, how much do I want to contribute for them? For those with employees, another critical question is how much do you wish to contribute on their behalf? Different plans have different rules about contributions and matching.

RETIREMENT SAVING OPTIONS

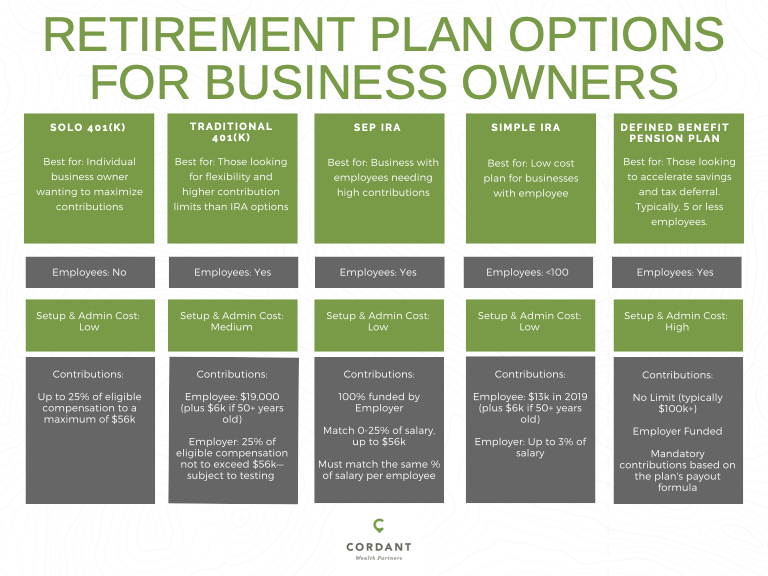

Armed with these questions and answers in mind, we can start to narrow down our options. In the infographic below, you will find the five main types of retirement savings plans for business owners with key information for each option.

This should be enough to get you started on the path to filling your fourth bucket and taking control of your retirement.

If this is something that you’d like help with, you can get in touch here.