Golf is a stupid game. Yet I love it. The late Robin Williams sums it up here in this expletive ridden comedy sketch.

My scorecard typically consists of the occasional birdie, a handful of pars, mostly bogeys and a hole or two that never make the scorecard. Needless to say, I’m pretty average. Never one to lose sight of my day job (especially on the golf course), I can’t help but think of all the parallels between golf and investing. And there are a lot of them. This post is going to focus on two – costs and risks.

Empty the Golf Bag

For purist golfers like myself, a round of golf means walking the course, not taking a cart. Aside from the extra exercise and lower cost, I find I have a better feel for the course and develop greater rhythm when I walk.

My first round this summer was at a local public course that’s cut into the lush, rolling forest that sits northwest of Portland. At this course, when you’re not climbing hills or navigating steep ravines, you’re walking a good distance in between holes. Needless to say, after 5 hours of lugging my golf clubs, the weight of the golf bag had a negative impact on my stamina and, ultimately, score. This particular day happened to be hot too. Between the heat and the taxing walk, my play suffered.

As if I don’t have enough hurdles to climb to play good golf, I found out after the round that I had been carrying extra weight in my golf bag – an extra pair of running shoes, a winter rain coat and a few adult sodas that were holdovers from the previous summer. All items that were dead weight and of no use to my golf game. In retrospect, I should have reconciled everything in my bag before the round and removed the items I didn’t need. Of course, this wouldn’t have guaranteed that I played my best that day, but it would have tilted the odds in my favor.

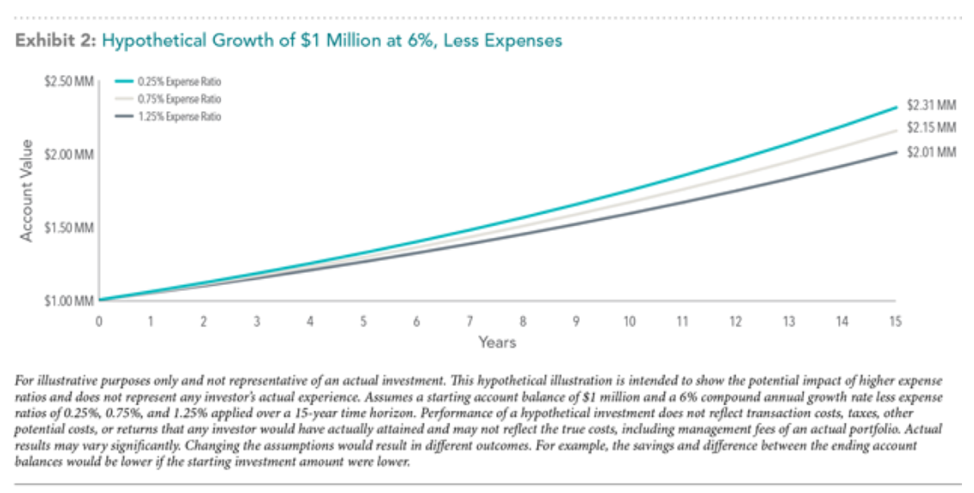

While not as physically taxing as my overweight golf bag, the majority of investors are carrying “heavy” portfolios. Importantly, these portfolios are being weighed down by excess costs – expense ratios, transaction costs, turnover and cash drag – that are most likely not adding any value to their investing experience The below chart from Dimensional Fund Advisors illustrates the impact that higher expense ratios can have over a 15-year period:

These costs may seem immaterial, but over time they add up and create an unnecessary hurdle for investors to overcome. Don’t be like me, take a look at the funds you’re holding and empty the bag.

Calculated Risk

Like investing, golf is the ultimate game of risk & reward. One classic example is the short par 4 over a hazard. Should I hit off the tee when a 3-iron will do?

If I opt for the driver, the chances of hitting a spectacular shot are increased significantly. My playing partners will have something to talk about and I might score an eagle or easy birdie if execute well. Of course, my odds for disaster increase, leaving this type of shot as an “all or nothing” proposition. The other, safer option is to play my 3-iron to the middle of the fairway and take all hazards out of play. This option won’t be anything to write home about and will all but ensure the elusive eagle is out of play. However, given my desire to make pars, this option is the smart play.

The investing equivalent of trying to drive the green is investing in one’s company stock. We see this all the time with prospective clients. For some, the strategy is intentional. They’re familiar with the company and industry, and feel they know something others don’t. Others that are less intentional simply hold onto the stock to avoid paying capital gains. In some cases, it’s hard to argue with the results over the years, but in light of long-term objectives, does taking on this type of risk make sense?

First, consider the risk to your human capital. This type of concentration risk impacts more than just your investments. Your human capital includes your salary, bonuses, company stock options, and is heavily tied to the performance of your company. For anyone still working, your financial success is tied to both your human capital (future cash flows) and investment capital.

If you’re thinking, “I know my company and industry, we’re positioned well”, consider the range of performance for companies in the S&P 500 Index for 2017. While the index was up 21.8%, the best performer NRG Energy Inc. was up 132%, while the worst performer, Baker Hughes, was down 51%.

Behavioral finance tells us that most of you reading this likely believe your company is closer to +132% than -51%. And who knows, you may be right, but are you willing to bet your long-term financial success on it when you don’t have to?

Don’t invest like I golf, put the driver away and play it safe. While diversification won’t make any headlines, it will likely improve the odds of achieving long-term success.

Creating a positive investment journey

As a financial planner and Advisor at Cordant, a big part of my job is to create a positive investment journey for our clients. More than just achieving returns within expectations, this means helping our clients ignore the main stream media, maintain discipline in down markets, stay humble in the up markets and focus on things we can control (i.e. risk, taxes, expenses).

If this is something you’re interested in, get in touch.