Interest Rates and Stock Markets

“Interest rates are bound to rise.” We’ve all heard this for the last 10 years. And while it may be true, it might not matter for long-term investors. In fact, contrary to popular belief, history tells us that the relationship between interest rates and stock market returns isn’t as powerful as we’ve been led to believe. But before we get into that, let’s look at what leads to the perceived impact.

Here are three recent headlines from three major news publications:

“Investors Sound Warning About Markets’ Complacency on Interest Rates”

“How Interest Rate Hikes Will Trigger The Next Financial Crisis”

“Flip-Flop by Fed Scrambles Outlook for World Markets”

Speculating about which direction interest rates are headed will always be the topic de jour of financial journalists and pundits alike. After all, when it comes to investing, one’s ability to predict the direction of interest rates should help them successfully navigate capital markets, leading to out-performance. Or so the story goes…

These are the two most common arguments in support of those headlines:

Bears (Bulls)

- “Higher (lower) interest rates will slow (increase) the growth of the economy, and ultimately have a negative (positive) impact on stocks”

- “Higher (lower) yielding bonds will pull (push) money from (to) stocks, send the stock market into a downward (upward) spiral “

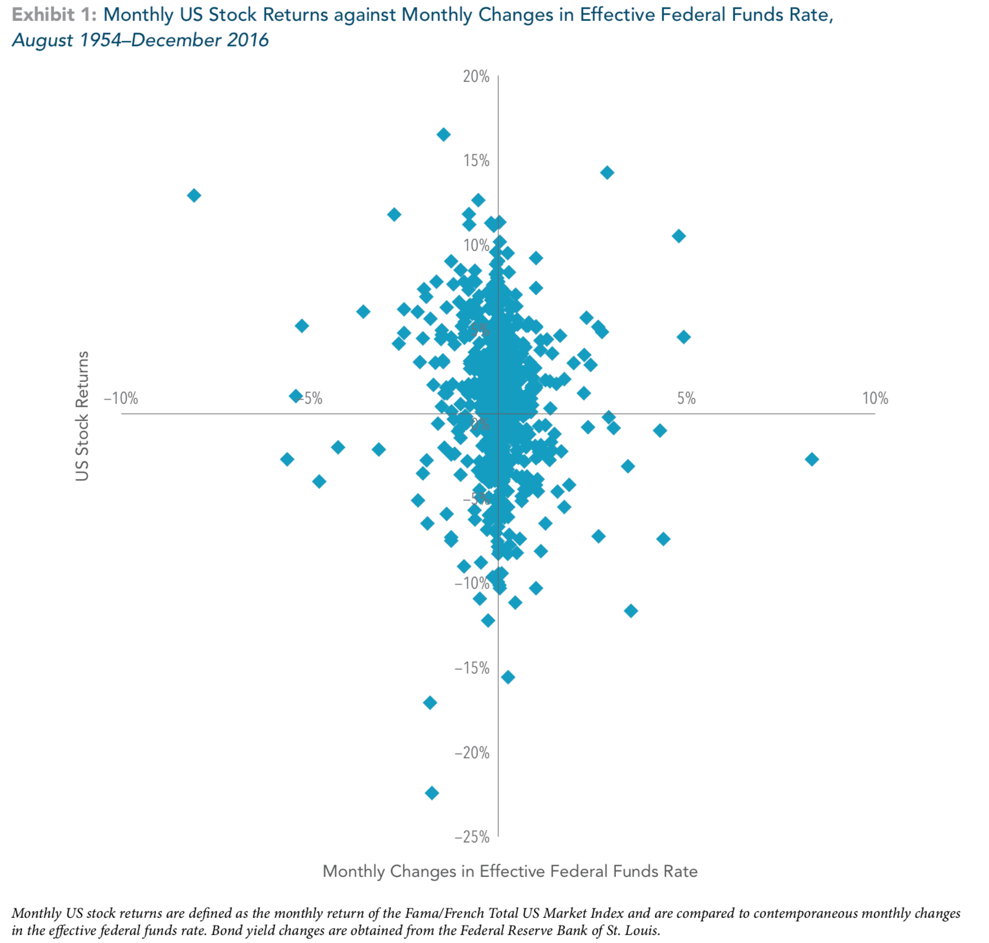

So that’s the argument, but here’s the reality: there’s almost no correlation between interest rates and stock market returns. In other words, trying to manage your stock investments based on the future movements of interest rates is futile. Below is a scatter-plot provided by Dimensional Fund Advisors that illustrates the point:

If interest rate movements impacted stock market returns, one would expect to see a diagonal slope from the upper left quadrant down to the lower right. Instead, the stock returns are almost equally distributed. For those that were awake during their statistics class, the R2 (measurement of correlation) between interest rates and stock returns ranges from 0.00 to 0.02 depending on the interest rate used. For context, a similar analysis done by Vanguard shows that average rainfall is a better indicator of future stock returns with an R2 of 0.06.

Focus on What Matters

At Cordant, we’re big proponents of focusing on what’s in our control. So instead of trying to make sense of media headlines or hot tips heard at cocktail parties, focus on:

- Risk (stocks vs bonds and other diversifying strategies)

- Costs (expense ratios, transactions, turnover)

- Taxes

- Return premiums (small, value, profitability)

These bullets will never make any headlines, but these are the silent drivers that will tilt the odds in your favor for long-term success.