This post isn’t meant to minimize the human impact that the Coronavirus has on those affected but simply to share perspective on the impact of the outbreak to the markets and a well-diversified investment portfolio.

With the coronavirus pandemic now impacting the entire globe, markets across the world are reacting. As of Tuesday’s close, the S&P 500 index is off 26% from its all-time high less than a month ago. What’s surprising is not the size of the drop (we’re not to an average bear market drop yet), but the speed in which the selloff occurred.

While all bear markets seem to come out of nowhere—this one literally came out of thin air.

In this post, I’m going to cover our four-part “bear-market playbook,” which outlines how we operate on behalf of clients during these periods. And if you are not a client, this will give you some actions to consider taking now.

At a high level, the playbook is:

- Design Your Plan

- Stick to the Plan

- Take Appropriate Action

- Eliminate the Noise – Only Pay Attention to Key Factors

Simple. Not easy.

Before we dive into each of these steps, a couple of comments first.

During these periods, especially given the heightened health concerns of this particular bear market, it’s okay to be nervous or scared. That doesn’t make you a lousy investor; it makes you human. Most people own stocks because of the evidence of higher returns compared to bonds or other investments. But, during bear markets, the desire to do something, to cave to the fight or flight instinct, is only human. Unfortunately, bear markets are the price of admission to investing in stocks.

Many people are panicking because they don’t have a plan. But know that, if you are a client of Cordant, you have a financial plan in place.

Let’s take a look.

Step 1: Design Your Plan

As the old adage goes, “The best time to plant a tree was 20 years ago. The second-best time is now.” The same thing applies to a financial plan. So, if you don’t have one in place, don’t beat yourself up. But do take action.

For our clients, a plan means three things: a financial blueprint, a financial plan, and an investment portfolio that’s linked to that plan.

The financial blueprint is an important guiding document as to what goals and objectives matter and provides a great reference point in times of market stress.

The financial plan includes modeling and stress-testing for bear markets and recessions. In fact, in our post How to Stress Test Your Financial Plan, we looked at the worst-case historical time to retire (1929) and stress-tested a plan based on it (check out that post for all the details).

And a well-designed portfolio not only matches the risk assumed in the plan to your actual portfolio but also includes an allocation to cash and bonds that, while a drag on performance in the good times, provides a much-needed buffer and access to liquidity in these types of market environments.

Again, if you are a client of Cordant, know that you have a financial plan in place, and it is stress-tested against bear markets and recessions.

Step 2: Stick to Your Plan

As the philosopher/boxer Mike Tyson once said, “everyone has a plan until they get punched in the face.” This second step is important but perhaps the hardest part.

Make no mistake: bear markets like the one we have just entered pose a real danger to your future financial health. But the real threat is in selling at the bottom and then missing out on the recovery.

What makes sticking to your plan so hard is that, in every bear market, things feel unprecedented. Our focus narrows to what feels like three feet in front of our face. It becomes challenging to plan for three days down the road, let alone three years.

However, if we examine past bear markets and look at how investors have reacted in the past, hopefully, it can help us pull out of a purely short-term lens.

Prior Bear Markets

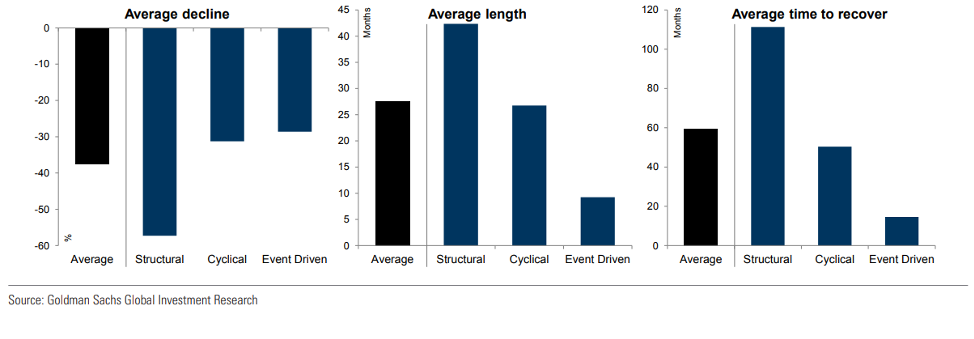

While every bear market feels different in the moment, we’ve been through drops like this before. Analysts at Goldman Sachs recently looked at past bear markets and divided them into three types: Structural, Cyclical, and Event-Driven. Structural bears include periods like the 2008 financial crises while the “Event-Driven” category includes “exogenous shocks” like war, oil price shocks, or now, a global pandemic.

The “good news” is that historically these “event-driven” shocks tended to be the shallowest, with average drops around 30%, and typically regained their previous levels within 15 months.

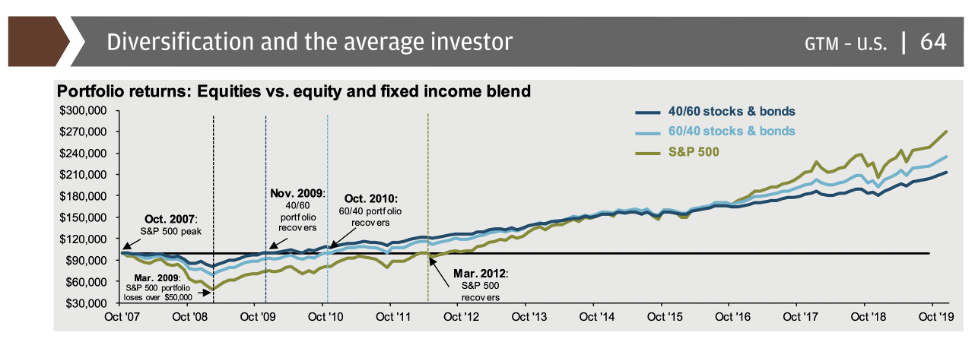

What’s more, for a portfolio holding both stocks and bonds, the time to get back to previous levels is even quicker. Looking back at the 2008 financial crises shows that while the S&P 500 took three years to recover, a 60% stock/40% bond portfolio recovered in roughly half the time.

You are not alone

That last piece of perspective that might help is knowing that you are not alone. In these bear markets, it can feel like everyone is selling and that only a fool would ride it out. While it may seem that way, it’s not the reality.

As the late Jack Bogle, the founder of Vanguard, once stated:

“My rule — and it’s good only about 99% of the time, so I have to be careful here — when these crises come along, the best rule you can possibly follow is not “Don’t stand there, do something,” but “Don’t do something, stand there!”

There will always be those who start coming out of the woodwork saying they predicted this (no one did). And saying things like ‘stocks are risky’ (they always are), asking if you’re getting out, and that everyone is panicking (everyone isn’t).

To that last point, Eric Balchunas at Bloomberg pointed out that during the market selloff of over 7% on Monday the 9th, money poured into the most popular Vanguard equity ETF’s to the tune of $1.2 billion and over $6 billion in the five days up to March 17th.

Clearly, not everyone is selling.

Despite this, the natural question remains: should I get out now and avoid more of the same?

It has never been a good idea to sell when everybody else is selling, just as it has never been a winning strategy to buy stocks when everybody else is wildly bullish. The best approach has, in the past, been to ride out the downturn and experience the subsequent upturn—which may come tomorrow, next week, next month, or next year.

During the global financial crises, Vanguard conducted a study of individual investors. From 2008-2012 they found that the investors who faired the best were the ones who didn’t touch their portfolio and that these investors outperformed those who did by 1% annually.

While the talking heads encourage action, the best response is sticking with your strategy.

Step 3: Take Appropriate Action

While it’s best to stick to your strategy, even a bear market creates opportunities on which to capitalize within that strategy. Our playbook here is:

- Monitor portfolio risk and predetermined tolerance bands for the portfolio

- Rebalancing as needed

- Tax-Loss harvesting

- Investing excess cash, accelerate contributions if the ability exists

- Accelerate Roth conversions

- Withdrawal order management and timing withdrawals to minimize taxes

- And social security timing strategies where they make sense

- Mortgage refinancing

- Portfolio tweaks based on market opportunities (typically oversold areas)

Since we have written about most of these strategies before, I won’t elaborate here except to say that this is our checklist of actions to make the most of a down market.

Step 4: Eliminate Noise – Pay Attention to Key Factors

It’s important to remember that financial media exists for one purpose—ratings. It’s not there to break actionable news, give you profitable trading advice, or make you smarter. They simply want as many eyeballs as possible.

But Joshua Brown writes, “This week, there will be 1.9 million coronavirus tests shipped out to hospitals, government agencies and public health professionals all over America. The one thing we know for sure is that a lot of people will test positive for COVID-19.”

In short, the news about the outbreak is probably going to get worse before it gets better. But as investor Jeremy Grantham once said, “[B]e aware that the market does not turn when it sees light at the end of the tunnel. It turns when all looks black, but just a subtle shade less black than the day before.”

So, instead of following the news minute by minute, if you’re an information junky (like I am), watch these six things and then, as hard as it is, take a break.

- Health Updates from National and Local Authorities. Since this is both a pandemic and market event, make sure to follow updates and guidance from the CDC, WHO, and local authorities.

- The number of new cases in the US and Globally. China and South Korea largely saw the number of new cases decline after two to three weeks of large-scale social distancing. How quickly can the rest of the world slow the spread? Click here for current data.

- Is the US economy in recession? What is the timing and severity of the recession? Most economists are now predicting at least one-quarter of negative GDP growth. With First Trust calling for a 10% drop in Q2 and Goldman Sachs calling for a 5% drop. According to First Trust’s Chief Economist, Brian S. Wesbury, in a note to clients on March 16th,

- “We now think the economy will take a huge hit in the second quarter, contracting at an annual rate of around 10% (like in the first quarter of 1958, during the Asian Flu) with growth returning to a 4.5% to 5.0% average rate in the second half of 2020 and all of 2021.”

- He continues, “A Coronavirus Recession may sound like a reason to sell, but it’s not. Stocks typically rise starting 3 – 6 months before a recovery. We’re already in that window. Those who sell now are likely to regret it.”

- Has a recession already been priced into markets? According to an analysis by RBC, in the twelve recessions since 1937, the average market drop was 31% (the lowest was 15% in 1953/1954, and the largest decline was 57% in 2008/2009). The good news is we’re already close to the average recessionary drop.

- Will policymakers’ response be sufficient to restore confidence? Actions so far include:

- The Federal reserve dropping rates near zero and resuming bond-buying to provide liquidity in the markets

- Fiscal Stimulus and testing packages which the Wall Street Journal does a nice job of summarizing below and here.

- How many potential sellers might still be out there? CNN has a good dashboard in their Fear & Greed index. Currently, we’re at the “extreme fear” level. As Warren Buffett says, “be fearful when others are greedy and greedy when others are fearful.”

If you are a client, know that we are watching these things on your behalf, but if you must, these are the six things to watch and then take a news break.

In closing, just a quick reminder that, like all bear markets, “this too shall pass.” We are resilient and have survived many economic bumps in the past, and we will again. In periods of market stress, remember to keep the big picture in mind. No one knows precisely what will happen next, but it’s a fair bet that, like they always have, stocks will go both go up and down.

To paraphrase the Mandela quote, “courage is not the absence of fear, but moving forward despite that fear.”