In this article, we will outline how the Employee Stock Purchase Plan (ESPP) works, where you have an advantage (and where you don’t), so you can tip the odds in your favor.

We’ll cover the five things you must know to maximize the benefit you get from your Employee Stock Purchase Plan:

- What is an ESPP

- How an ESPP works

- When should you participate in your ESPP

- How ESPP shares get taxed

- And how to use ESPP shares to accelerate your financial goals

But first, a question for you:

If I offered to sell you a nice, crisp $100 bill for $85, would you buy it?

A no-brainer, right?

The popular employee compensation program, known as an Employee Stock Purchase Plan (ESPP) allows you to do just this—to buy your company stock at a discount.

Let’s get started to learn how you can take advantage.

#1 – What is an ESPP?

Offered by most publicly traded companies, an ESPP is an employee benefit that allows you to purchase shares of your company stock at a discount. It’s this discount that’s the most significant advantage of Employee Stock Purchase Plans.

For most employers, you can expect that discount to range between 5%-15%—obviously, the higher, the better for you! These shares can then be sold immediately (assuming your company offers a “Quick Sale” program), locking in a tidy and risk-free profit.

It’s this discount that allows you to use an ESPP to turbo-charge your savings.

Now, there are some specific rules on how much and when you can contribute, how the shares get taxed when you sell them, and other logistics that we’ll get to, but for now, just remember: An ESPP lets you buy shares of your company stock for a discount, and then immediately sell them, locking in a nice profit.

So, if you take only take one thing away from this post it should be this:

If your employer offers an Employee Stock Purchase Plan, and you are not participating already, in most cases, you should immediately stop what you are doing and go enroll!

#2 – How an ESPP works?

Under an ESPP program, employees can elect to defer salary and bonus up to the IRS limit of $25,000 per year (the “Contribution Limit”). You elect how much to contribute per pay period during an initial “Enrollment Period”.

At the end of this enrollment period, typically every six months, this money is used to purchase shares at a discount of up to 15%. This discount is often applied using a “Lookback Period” where shares are purchased based on the price either at the beginning of the enrollment period (the Offering or Grant Date) or the end of the period (the Exercise or Purchase Date), whichever is lower.

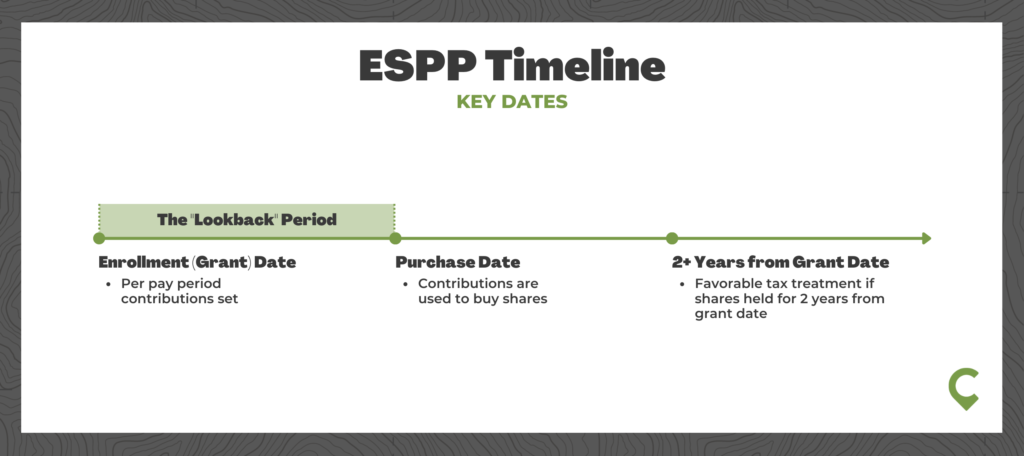

A typical ESPP timeline will look something like the one depicted below.

Let’s look at the key terms mentioned above in more detail.

Enrollment Period

Typically, every six months, your ESPP will have an enrollment period. You’ll elect to participate in the plan and select how much to contribute each pay period. Your contributions to the plan will be directly pulled from payroll at each pay period and accumulate in your ESPP account.

At the end of the period, on the purchase date, the money will be used to purchase shares of your company stock at a discount to their market value.

Now, for plans with a “Lookback Period,” there are two ways that discount can get applied.

Lookback Period

On the Purchase Date (at the end of the Enrollment Period), your shares are either purchased at a discount to the market value or, if your plan has the attractive “lookback” feature, at the price (if it’s lower) from the beginning of the period (the Grant Date).

This “lookback” feature is appealing because it allows you to buy shares at whichever price is lower – the price at the beginning of the period OR the end of the period. Let’s look at an example.

Example 1 – Rising Share Price – Your employer’s stock is trading at $10/share at the beginning of the offering period and $15/share by the purchase date. Due to the lookback provision, you get to buy shares at a discount to the lower of these two prices, $10/share.

Example 2 – Falling Share Price – Your employer’s stock is trading at $20/share at the beginning of the offering period but drops to $15/share by the purchase date. Here the lookback provision doesn’t come into play and you buy shares at a discount to the current price, $15/share.

The lookback provision is a fantastic benefit as it either magnifies your gain under a rising share price scenario or with a falling share prices still allows you to buy the shares at a discount to the current market value (and sell immediately, if desired, to lock in this gain, known as a “Quick Sale”).

Contribution Limits

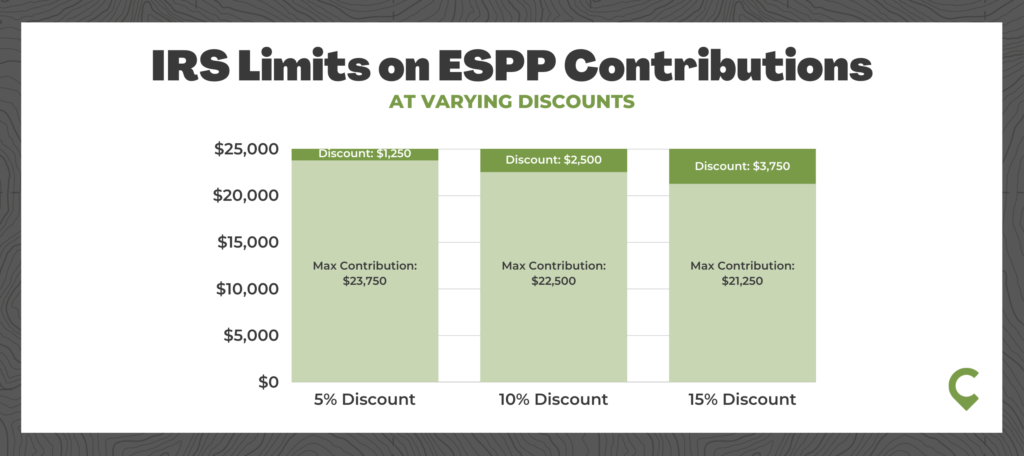

The IRS limits your Employee Stock Purchase Plan (ESPP) contributions to a pre-discounted $25,000 per calendar year.

Here’s what your contribution limit looks like with varies discounts:

Companies can further restrict your contributions, if they choose, to either a percentage of your salary or a flat dollar amount. A typical range for maximum salary contributions to an ESPP is between 10%-20%.

It’s important to note that your ESPP contributions are based on your gross salary (before taxes or withholdings are deducted).

An Example: You elect to contribute 10% to your ESPP; your salary is $200,000 per year, and you’re paid monthly. Your total annual ESPP contributions are $20,000 or $1,666 per month. Now assume your typical take-home pay, after withholdings and deductions for taxes, 401(k) contributions, health insurance, etc. is $10,000 per month.

So, this $1,666 monthly contribution (10% of gross salary) is a larger percentage (16.6%) of your net, take-home pay.

#3 – Should You Participate in Your Company’s ESPP?

Is an ESPP a good investment?

Well, as we asked at the beginning of this article, would you buy a $100 dollar bill if I offered it for $85?

As long as you have $85, it’s a no-brainer, right?

Participating in your Employee Stock Purchase Plan is no different. If you can swing it from a monthly cash flow perspective, you should jump at the chance to participate.

As mentioned above, the discount is the primary advantage to exploit in an ESPP. Shares can be sold immediately (known as a “Quick Sale”), and assuming a 15% discount, lock in a minimum 18% pre-tax gain on your money.

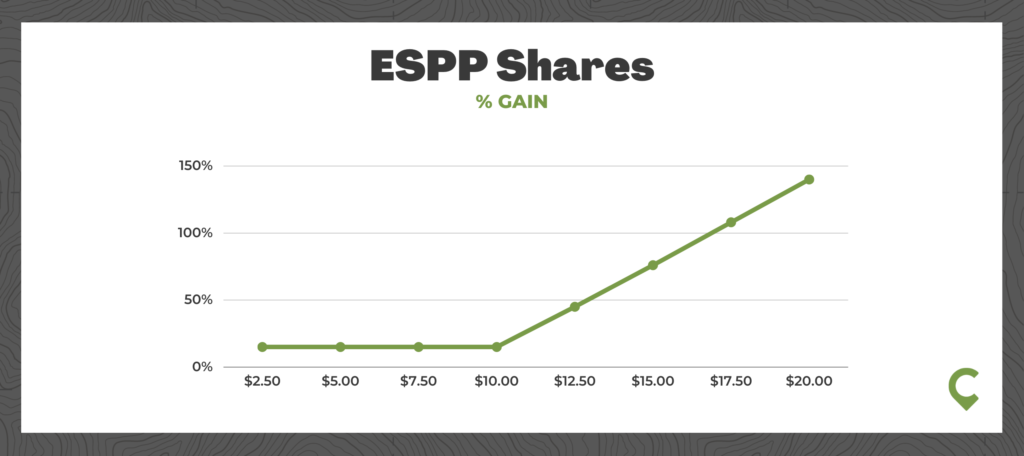

With a lookback period, we are always getting a minimum of 15% off the market price at the Purchase Date and sometimes more if the stock price has increased from the beginning of the offering period. The payoff profile assuming a $10 price at the beginning of the offering period, and a 15% discount, can be seen in the chart below.

Due to the discount, you have guaranteed minimum gain with upside potential.

Pretty good investment, right?

#4 – How ESPP Taxes Work

An ESPP is a fairly straightforward program that only gets complicated when introducing taxation into the equation.

Under an ESPP, taxes are not due until you sell your shares, but the tax treatment works in two different ways depending on if the sale results in a “Qualifying” or “Disqualifying” disposition.

The two types of dispositions are:

- Qualifying: Shares are held for two years from the grant date and one year from the purchase date.

- Disqualifying: Doesn’t meet the criteria above. Shares are not held for two years from the grant date and one year from the purchase date.

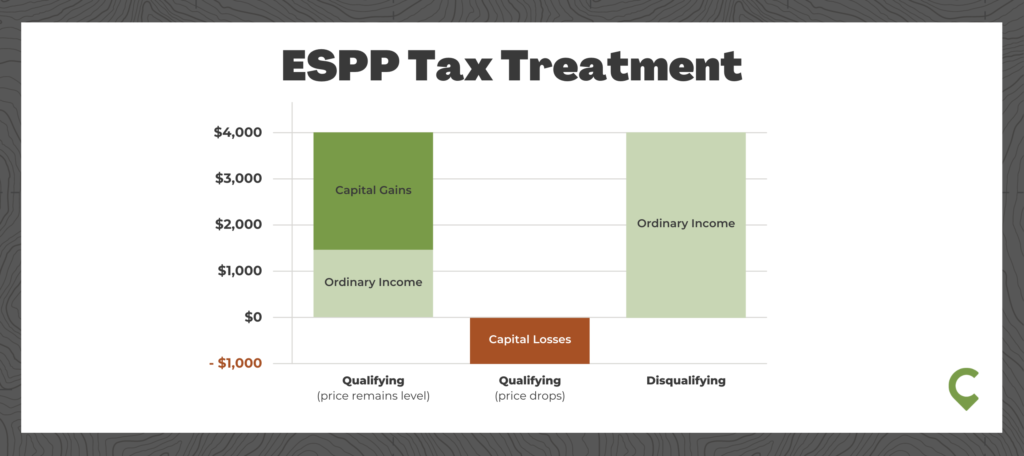

If shares are sold under a Qualifying disposition, a portion of the discounted purchase price is treated as income while the remaining gain (if any) is taxed at lower long-term capital gains tax rates.

That may sound attractive, but it comes with a major drawback.

You must hold onto the shares for at least another year after the purchase date and run the risk that the price of the shares drop.

Unless you’re intentionally trying to accumulate shares of your company stock, the tax benefits of ESPP shares are not an area where you have an advantage.

To lock in the free money from the discount (which could be lost if the stock price falls while waiting for the disposition to become Qualified) we typically recommend selling the shares as soon as possible using a “Quick Sale”.

So, the tax treatment on ESPP shares work as follows:

- If Qualifying: The discounted purchase price is taxed as ordinary income. Any gain above this amount is taxed at the lower capital gains rates.

- If Disqualifying: The difference between the market value when you sell the shares and your (discounted) purchase price is taxed 100% as ordinary income and subject to federal and state and local taxes.

Let’s look at a scenario with examples of qualifying and disqualifying dispositions:

Scenario: Morgan’s company offers an ESPP every six months with a lookback period and a 15% discount. The price at the beginning of the period is $40/share and rises to $50 on the purchase date. Morgan’s contribution is used to purchase 250 shares of her employer stock at $34/share ($40 x 15% discount = $34/share).

- Example #1 – Qualifying Disposition (Share price remains level): Morgan must hold her 250 shares for another 1.5 years to get favorable tax treatment. Assuming the price does not drop in that time and her shares are sold for $50/share, the $1,500 discount ($40-$34 = $6 discount/share) is taxed as ordinary income and the remaining $2,500 gain ($50-$40 = $10 gain/share) is taxed as a capital gain.

- Example #2 – Qualifying Disposition (Share Price drops): As mentioned above, if the stock price falls while Morgan is waiting for the disposition to become qualified, she will miss out of the benefit of the discount. In this example, when Morgan’s shares are sold at the end of the 1.5 years, the price drops to $30/share. Morgan’s original $1,500 discount ($40-$34 = $6 discount/share) is negated by her $2,500 capital loss ($40-$30 = $10 loss/share). The entire position results in a $1,000 capital loss.

- Example #3 – Disqualifying Disposition: Now, let’s assume Morgan sells her 250 shares immediately after the purchase date (a “Quick Sale”) for $50/share. With no favorable tax treatment, the entire gain of $4,000 ($50-$34 = $16 gain/share) is taxed as ordinary income.

As it’s hopefully clear if your shares rise sharply between the beginning of the offer period and the exercise date, this results in much of the gain taxed at capital gains rates; however, again, this leaves you subject to market movements on the stock for an additional year. (A helpful ESPP tax calculator can be found here.)

Typically, unless there is a specific financial objective to accumulate share in your employer, we recommend the shares are sold immediately and the funds used to either fund an immediate financial objective or reinvested as part of your diversified portfolio.

And on that note, we’ll wrap up by looking at how you can use ESPP shares to accelerate your financial goals and as part of your overall financial strategy.

#5 – Using an ESPP Strategy to Achieve Your Goals

Given the discounted purchase price with ESPP shares, they can act as turbo-charged savings account that you can use to accelerate your financial goals.

Let’s look at a handful of ways to do that.

- Supplement your Cash Flow — While initially a drag on monthly cash flow, given that shares are purchased for a 5%-15% discount, the program can actually boost your annual cash flow after your initial enrollment period. Think of it like this, you contribute $10k every six months to an ESPP and with a 15% discount, use that to buy (then immediately sell) approximately $11,760 of stock (assumes no price appreciation; gains would be greater if the share price increases). Even after income tax (assuming a 35% total tax rate), you’re left with $1,055 increase in your cash flow every six months.

- Fund Short-Term Goals — Building on the example above, you can use your Employee Stock Purchase Plan to accelerate your savings towards short-term goals. $10,000 saved becomes $11,055 towards your goal. Quite a few years ago now (before kids and grey hair 😂), when I was working in corporate finance, I used my ESPP to help fund the down payment on our first home.

- Accelerate Long-Term Savings — Even if you aren’t saving for near-term goals, your ESPP gains can be used to boost additional savings in a retirement account (Traditional IRA, Roth IRA), HSA account, or simply increase your savings in a taxable account.

- Transfer ESPP Shares to a Brokerage Account — Lastly, if you are trying to accumulate shares of your employer’s stock, the ESPP program can be a way to do this at a discount. You may want to do this if you are especially bullish on your employer’s future (and risk-seeking) or if you have a minimum holding requirement in your company stock that you are working towards (required at many companies for senior executives and directors). Once the shares are purchased as part of the ESPP, they can be transferred to a brokerage account of your choosing.

And finally, let’s look at how to incorporate an ESPP strategy into the rest of your financial plan and investment strategy.

Often, folks will ask, “When should I sell my ESPP shares?” To that we would answer that it depends on the following:

- Determine how much of your company stock you want to hold — As we’ve outlined before, holding company stock can be a risky strategy (read more about the risks of owning individual stocks and our 3 step plan for your company stock). Not only are you taking on the risk of investing in individual stocks, your salary, bonus, and other equity compensation like RSUs are already tied to the success of your employer. The first step is determining the maximum amount of employer stock to hold. No more than 10% is a good rule of thumb to start with.

- Automate Your Plan — Once you’ve set a plan on how much company stock to hold, the easiest way to stay true to the plan is to automate it. Whether you chose to hold 0% or 10% of your liquid net worth in your employer’s stock, we recommend once you’ve reached that threshold, you set your ESPP sale strategy to sell immediately so that you don’t need to remember to sell the shares later and accidentally exceed the threshold you set.

As it’s hopefully clear by now, if your employer offers an ESPP you should jump at the chance to participate. With a little knowledge about how the program works and some consideration around how to incorporate ESPP shares into your overall financial strategy, they can be a powerful tool to accelerate your financial progress.