“…people always live forever when there is an annuity to be paid them,” or so says Fanny Dashwood, the step-daughter in Jane Austen’s Sense and Sensibility. She says this in persuading her husband against making annuity payments to her step mother-in-law. We never find out how the annuity would have worked out for Mrs. Dashwood, but the US government doesn’t appear to be paying its retirement annuity (Social Security) to anyone in perpetuity (though they have been paying it to a large segment of the population a bit longer than anticipated!). In fact, the government is so confident we’re not going to live forever, they incentivize delaying the benefit by increasing it each year you hold-off between ages 62 and 70.

Thus, the big question around Social Security for most is, “Should I delay pulling social security to increase the benefit?” We’ve written about this before and in most cases, the analysis comes down to the life expectancy for which one seeks to optimize. Because the benefit increases by 7% each year that you delay after full retirement age, there is a break-even point at which the increased benefit from delaying equates to more money at the end of your life than it would have had you started drawing sooner. Let’s say for example that breakeven age is 83. If you’re trying to optimize your finances for living to age 90, then delaying is best, but if you’re planning for age 80 it makes sense to take the benefit sooner.

What is often overlooked in social security decisions, however, is the potential down-market protection that Social Security can provide.

Social Security Could Provide Down Market Protection

Social security can provide some protection against what’s known as “sequence of returns” risk. Simply put, sequence of returns risk is the risk that low or negative returns occur early in retirement or in years that one is drawing heavily from their investments. Those who retire prior to drawing on social security are particularly susceptible to this risk (absent other income) because they are drawing more heavily on their portfolio to support spending. In many cases, all of their spending is generating by what they have saved and invested.

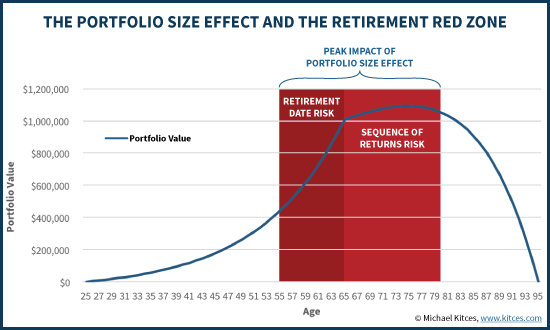

Financial planner Michael Kitces illustrated this “danger-zone” well with this chart:

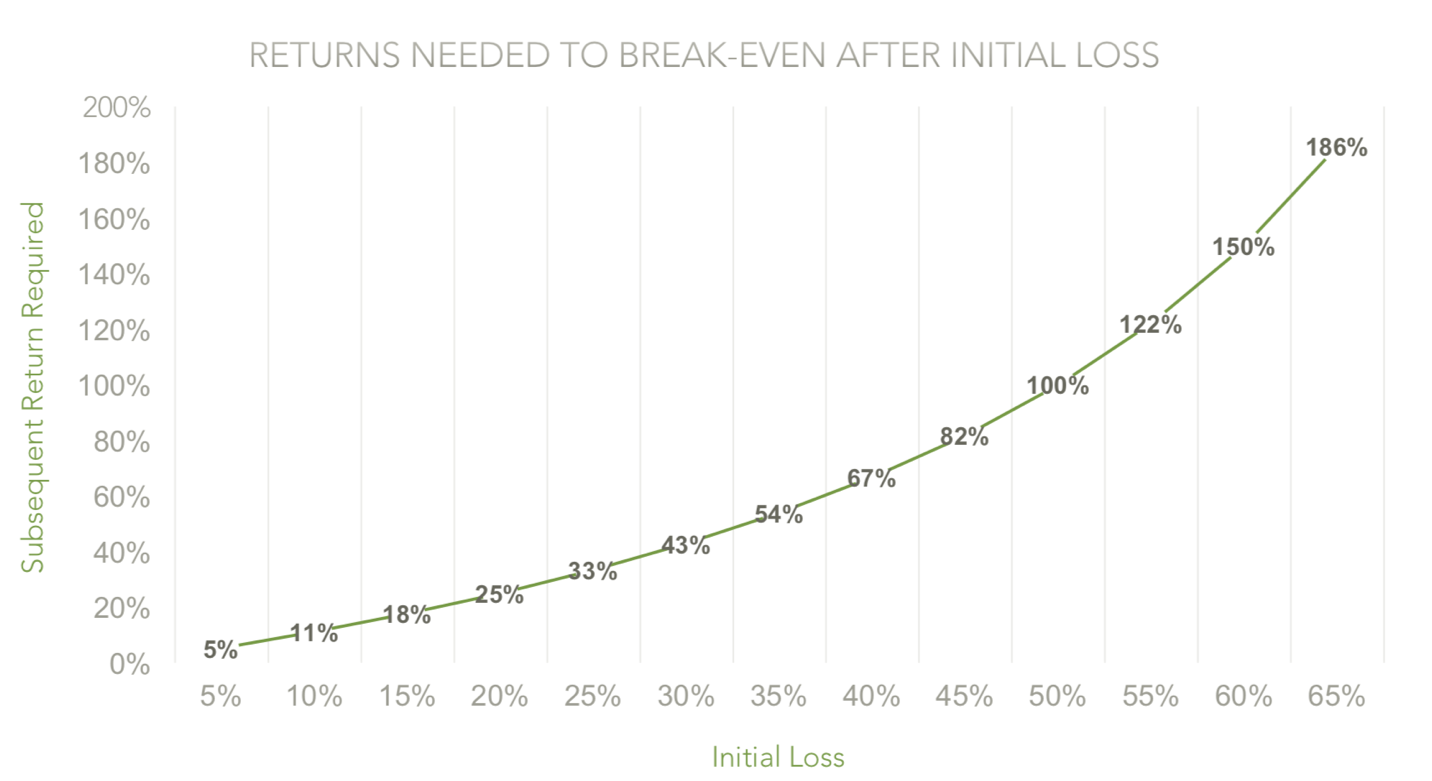

In the red zone illustrated above, people are more detrimentally affected by a down market during this period in large part due to the mathematics of compounding returns illustrated below: a return following a loss needs to be greater than the loss to get back to even. A down market combined with heavy spending from the portfolio means it will take an even greater return to recover than a portfolio supporting less spending.

Drawing Social Security sooner, even though the benefit will be less, can provide protection because it means drawing less on investments when they have a loss. The additional income equates to needing less from the portfolio to support spending. In a down market, this reduced draw on the portfolio means less in future returns is required for the portfolio to recover.

At Cordant, when we review a financial plan for a client, we look to the historically low probability scenarios to see if the plan works. Most people aren’t concerned whether their financial plan works in average markets or historically “good” markets, people want (and should want) to know whether it works in the down markets. I recognize that in most planning scenarios the break-even analysis described for Social Security at the beginning of this post is sufficient. However, Social Security should not be overlooked as a tool for protection in down markets. A comprehensive decision on Social Security should include an analysis of its impact on protecting against a down-market early in retirement.