Diversification has gotten a bad rap as of late. Over the last five years, due to the strong performance of US equities, a simple 60% US Stock / 40% US Bond portfolio would have been one of the best portfolio allocations—outperforming the majority of more diversified asset mixes, especially anything including an allocation to international stocks. Increasing correlations between asset... Read More

The Difference Between Smart Financial Advice and Smart Financial Advice For You

The best strategy in theory might not be the best strategy for you. How can this be? Recently, on the Meb Faber Show, Gerstein Fisher’s Founder and CIO Gregg Fisher said the following: Sometimes the best investment strategy isn't the right investment strategy. He continued: Probably we’d all be well off if we bought nothing but small cap value stocks... Read More

How Not To Evaluate Investment Performance

Harvard’s Endowment has been making headlines recently due to its $2 billion investment loss in the fiscal year 2016. And the Crimson (the student newspaper) is up in arms about this “unacceptable” loss. From their article The Urgency of the Present come the following gems: Harvard Management Company announced a $2 billion loss for the fiscal year 2016. Let’s not... Read More

How Concentrated is Too Concentrated? A Mistake That Costs You the Whole War

During the First World War, Britain had the greatest Navy ever assembled in world history. And yet, through most of the war, it used its Naval superiority to play defense, not offense. Dan Carlin in his excellent podcast Hardcore History describes the situation as follows: “The opportunity was there for the numerically superior British fleet to apply their numbers and... Read More

Q3 Investment Update: The Election’s Impact on Your Portfolio

After starting the year down around 10%, markets have rallied since early February (including the June Brexit blip) and through the third quarter global equities are up 6.6% for the year. But, the question on everyone’s mind is: will this continue? With an election looming five weeks away, many are expecting market volatility to pick up. And everyone is wondering what impact the... Read More

Using Buffers to Become a Better Investor

“To attain knowledge, add things everyday. To attain wisdom, remove things every day.” ― Lao Tzu One of the wonders of the modern world is our access to information. The answer to (or at least someone’s opinion on) every question under the sun is right at our fingertips, just a google search away. But this limitless information and the apparently continuous increase in... Read More

Underperformance: Not a Bug, a Feature

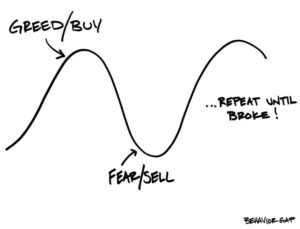

“Most lack the courage and stamina to stand apart from the herd and tolerate short-term underperformance to reap long-term rewards.” - Seth Klarman Ask anyone off the street to name a great investor and chances are you'll hear Warren Buffett---often held up as the paragon of investing success. But what if I told you he spent more time underperforming the... Read More

How ‘Withdrawal Order’ Can Increase Wealth and Reduce Taxes

Last time we looked at how to generate a paycheck from your investment accounts. Getting money out of your portfolio is important, but just as important is knowing from which account to pull the funds as most retirees are going to have some mix of taxable, tax-deferred (IRA, 401(k), etc.), and tax-free (Roth IRA) accounts at retirement. The order in... Read More

How to Generate a Paycheck in Retirement

For many retiring or simply leaving their jobs to pursue other opportunities, one of their primary questions is: how do I get a paycheck now that it’s not coming from my employer? I still need to pay bills, buy groceries, etc., so how do I fund my bank account? For most, it means a transition from accumulating assets (contributing to the... Read More

What are Interest Rates Forecasting for Stocks?

What are interest rates telling us about the current state of the economy? And, more importantly for investors, what are they telling us about the markets? A few weeks back Ben Carlson had a good post addressing the first question. He asks what interest rates (specifically the spread between 2-year Treasury yields and 10-year Treasury yields) are telling us about... Read More