What’s your motivation for investing? Simply answering this question and keeping it top of mind will make you a better investor. So says a recent study by the CFA Institute and the State Street Center for Applied Research. Whether you’re a D.I.Y. investor, an individual working with an advisor, or a financial professional, understanding the motivation and purpose of individuals... Read More

The Key to Great Investing

*This article was originally published on the CFA Institute's Enterprising Investor blog. All great investors have one thing in common: the “ability to clearly communicate their [investment] philosophy,” Michael Batnick, CFA, observed. I agree. Whether hedge fund managers, value investors, or index aficionados, the best investment professionals are great communicators. But great investors, no matter their investing styles, share one other... Read More

Cheaper Doesn’t Mean Do More

If more information were the answer, we'd all be billionaires with perfect abs." Derek Sivers We live in a world with more information at our fingertips than previously thought possible. According to Google’s Eric Schmidt, “Every two days now we create as much information as we did from the dawn of civilization up until 2003.” And as a result, many... Read More

Where Do We Go From Here?

The results of Tuesday’s presidential election were surprising to many and concerning to some, but they’ve left pretty much everyone asking: where do we go from here? In an attempt to answer this very natural question, we now have the very same pundits, prognosticators, and seers who couldn’t predict the outcome of the election lining up to tell us exactly... Read More

What To Do With Your Company Stock: A 3-Step Plan

Barron’s recently published an article titled ‘Does Your Company Give You Stock? Great. Sell It.’ As our clients will know, this is our default advice when it comes to company stock. Sure, it makes sense to evaluate company stock holdings in light of your unique financial situation—maybe it makes sense to hold from a tax perspective or to fund future... Read More

Diversification: More Important Now Than Ever

Diversification has gotten a bad rap as of late. Over the last five years, due to the strong performance of US equities, a simple 60% US Stock / 40% US Bond portfolio would have been one of the best portfolio allocations—outperforming the majority of more diversified asset mixes, especially anything including an allocation to international stocks. Increasing correlations between asset... Read More

The Difference Between Smart Financial Advice and Smart Financial Advice For You

The best strategy in theory might not be the best strategy for you. How can this be? Recently, on the Meb Faber Show, Gerstein Fisher’s Founder and CIO Gregg Fisher said the following: Sometimes the best investment strategy isn't the right investment strategy. He continued: Probably we’d all be well off if we bought nothing but small cap value stocks... Read More

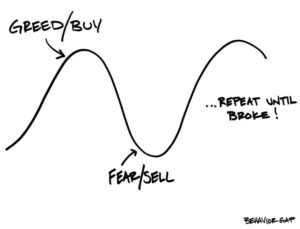

How Not To Evaluate Investment Performance

Harvard’s Endowment has been making headlines recently due to its $2 billion investment loss in the fiscal year 2016. And the Crimson (the student newspaper) is up in arms about this “unacceptable” loss. From their article The Urgency of the Present come the following gems: Harvard Management Company announced a $2 billion loss for the fiscal year 2016. Let’s not... Read More

How Concentrated is Too Concentrated? A Mistake That Costs You the Whole War

During the First World War, Britain had the greatest Navy ever assembled in world history. And yet, through most of the war, it used its Naval superiority to play defense, not offense. Dan Carlin in his excellent podcast Hardcore History describes the situation as follows: “The opportunity was there for the numerically superior British fleet to apply their numbers and... Read More

Q3 Investment Update: The Election’s Impact on Your Portfolio

After starting the year down around 10%, markets have rallied since early February (including the June Brexit blip) and through the third quarter global equities are up 6.6% for the year. But, the question on everyone’s mind is: will this continue? With an election looming five weeks away, many are expecting market volatility to pick up. And everyone is wondering what impact the... Read More