In 1986 the Lost Angeles Lakers had what some were saying could be the best team in the history of basketball. They started the season hot, jumping out to a fantastic 29-5 record, but ultimately were eliminated in the playoffs before even playing for the NBA championship.

The anointed “best team in the history of basketball” wasn’t even the best team that year.

After this defeat, Pat Riley the Lakers’ coach, put in place a system for the upcoming season called the Career Best Effort program (CBE). In the program, each player got a baseline level of their own performance. Then after each game, they received a score along with scores for competition across the league. The baseline assessment coupled with ongoing measurement gave his players extra motivation and the specific feedback needed to put in their best effort each game.

As a result, over the next two years, the Lakers went on to win back-to-back NBA championships, the first team in twenty years to do so.[1]

Financial best effort

Just as feedback is critical to improving athletic performance, we can use it to make progress financially as well.

After many conversations with business owners, we’ve developed a financial assessment specific to business owners to help them get a financial baseline and measure improvements from there.

We know that most business owners have some version of the following questions when it comes to their finances:

- If something were to happen to me, how do I make sure my spouse and kids are taken care of?

- I have a lot going on, what am I missing or ignoring with my finances?

- What do I need from my business to achieve my personal financial goals? How do I know I’m on track?

- My tax bill is outrageous, are there ways to pay less?

- I read and hear about various financial strategies, but I don’t have time to research them. How do I monitor what’s available and make educated decisions?

- How should I best plan for a liquidity event or cash withdrawals from my business?

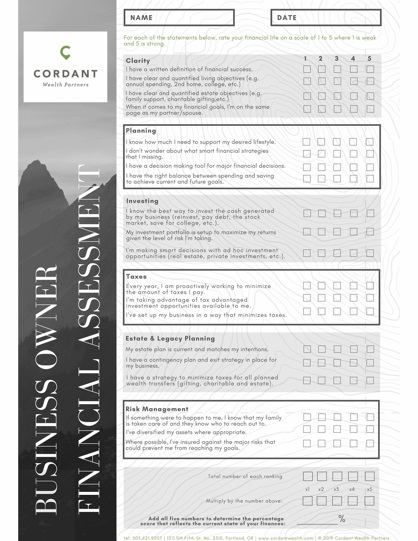

The 20-question assessment should take about 10 minutes to complete and help you get clear on where you stand today, help to identify the areas where the most progress is needed and give you areas to take action today when it comes to getting answers to these questions.

It’s organized into the six areas of financial health: Financial Clarity, Planning, Investments, Taxes, Estate and Legacy planning, and Risk Management.

Download the assessment here and start making progress today towards your financial best effort.

At Cordant, we have the opportunity to work with busy business owners to help them achieve financial clarity in life. Part of this responsibility includes doing this type of assessment on their behalf and pushing progress forward in the critical areas. If this is something that you’d like help with, please get in touch.

[1] For more on Pat Riley’s Career Best Effort Program see James Clear’s article here: https://jamesclear.com/career-best-effort

![Developing a Financial Best Effort [Introducing a Business Owner Financial Assessment]](https://www.cordantwealth.com/wp-content/uploads/2019/05/markus-spiske-1269203-unsplash.jpg)