Last month I wrote a blog post entitled “The best plan you can stick with.” The purpose was to highlight the fact that, an investment strategy that makes all the sense in the world on paper may not be a good strategy if you can’t stick to it when faced with the emotion that comes with the experience of real market volatility. The point being, for Cordant (or any advisory working in a client’s best interest) to recommend an investment strategy, the strategy not only has to be supported by data, but it has to be one that we can implement, and clients can follow.

Generating a paycheck (or cash you can spend to support your lifestyle) from your portfolio in retirement is another area about which there is a great deal of research and a wide range of proposed strategies. And just like choosing an investment approach, the income generating strategies that perform best when you back-test the data, may not always be the best for an individual when you consider the difficulty in implementing or sticking with the strategy.

It is with this in mind, that in the next couple blog posts I want to discuss 1) how our clients receive a paycheck from their portfolio in retirement and 2) review how we evaluate other available strategies and explain why we use the strategy that we do.

How Cordant Clients Receive a Paycheck from their Portfolios?

For many retirees, the transition from spending a monthly or bi-monthly paycheck from an employer to spending from the portfolio they have accumulated proves to be one of retirement’s greatest challenges. The challenge is twofold: First, there is the challenge in determining the best way to generate cash from the portfolio, and second, the challenge in figuring out when to generate cash and the logistics of actually transferring that cash into an account one can spend from.

Let’s start with how Cordant generates cash for a client from their portfolio. We’ve previously written about this topic, and our process has not changed.

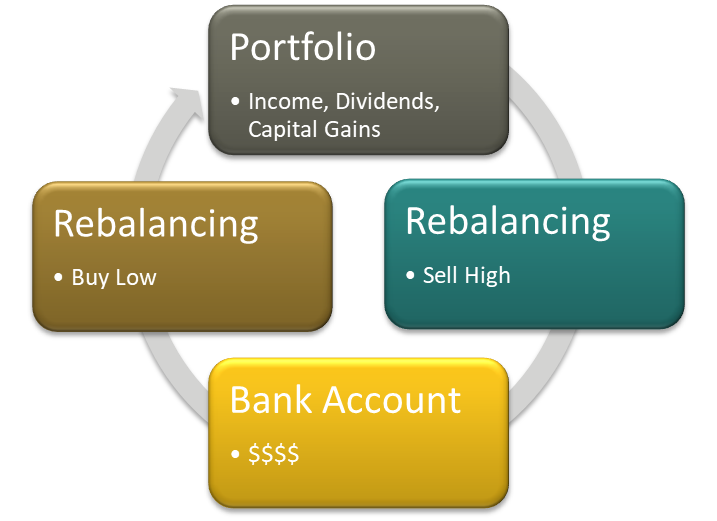

We use what’s called a “total return” approach and it works like this: Returns in the portfolio come from investment income, dividends and capital gains. Cash that can be used for spending is generated through a rebalancing process–we sell investments which have increased as a percentage of the portfolio and move some of the proceeds from those sales into the client’s bank account to fund spending. If there is cash left over, it’s used to buy assets which are below the target allocation—therefore completing the rebalancing process. The act of rebalancing not only generates cash which can serve as a paycheck, but also reinforces the “buy low, sell high” behavior that is critical to investing success. The process I outlined looks like this:

Now that we’ve reviewed how we generate cash, let’s discuss the logistics of when and how that cash actually becomes spending money for a client.

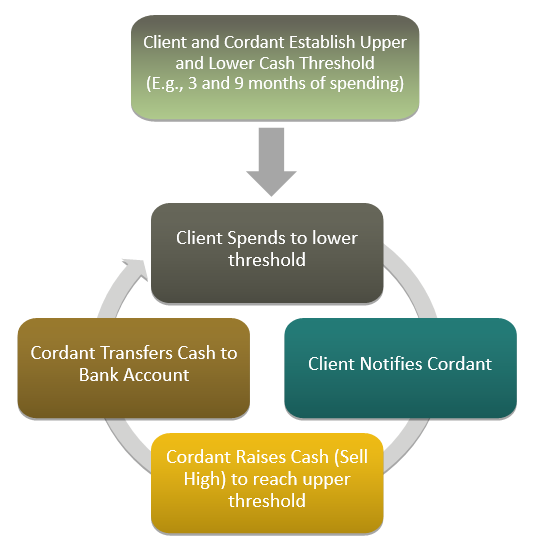

We need to determine when to generate cash. With our clients, we establish upper and lower thresholds for their cash accounts for this purpose. When a client’s cash account drops below the lower threshold we have agreed to, they contact us, and we raise enough cash to fill the account to the upper threshold. The lower threshold is usually the minimum a client wants to have in cash at any given time. Often this is roughly 3 months of projected spending, but it is dependent on the individual and their situation. The upper threshold is usually another 4-6 months of spending. For example, if a client spent roughly $8k per month, their lower threshold might be $24k (3 months of spending) and the upper threshold might be $56k (3 months + 4 months of spending).

The next step is implementing an easy process to move cash from the client’s portfolio to their bank account. We set up direct electronic transfer links between the investment portfolio and the client’s bank account so that we can easily move cash to a client’s account at their request. Using the example above, it happens like this: the client starts with cash in their bank account at the upper threshold to which we agreed ($56k in this example), and over several months they spend that down to the lower threshold of $24k. Once they reach that lower threshold, the client calls us and then we raise cash to fill the bank account back to $56k.

The benefit of this process is that we only raise cash from the portfolio when it is necessary limiting transaction costs while at the same time making sure the client doesn’t have too little or too much in cash at a given time. Further, because we use the total return approach described above, it forces a rebalance to raise the cash which helps to ensure the client’s portfolio remains aligned with their tolerance for risk.

In part two, we will review how we evaluate other available income generating strategies and expand on why we stick with this strategy.