This past weekend marked the 38th running of the epic Hood to Coast (HTC) relays. For locals in the Portland area, most of us have either run, volunteered or have friends participate in the HTC.

For those not familiar, HTC is a relay race that starts in the Cascades on Mt. Hood, moves through the Willamette Valley and Portland, and ultimately finishes at the beach in Seaside, OR. Over 12,000 people embrace smelly vans, blistered feet and a sleepless night to race from the heights of the Cascades to the Pacific Ocean, all the while enjoying the beautiful landscape that Oregon has to offer.

Tax Planning: A Marathon, Not a Sprint

While HTC isn’t technically a marathon, the concept is the same: effective tax planning takes place over a lifetime and can’t be “won” without a strategy, endurance and discipline.

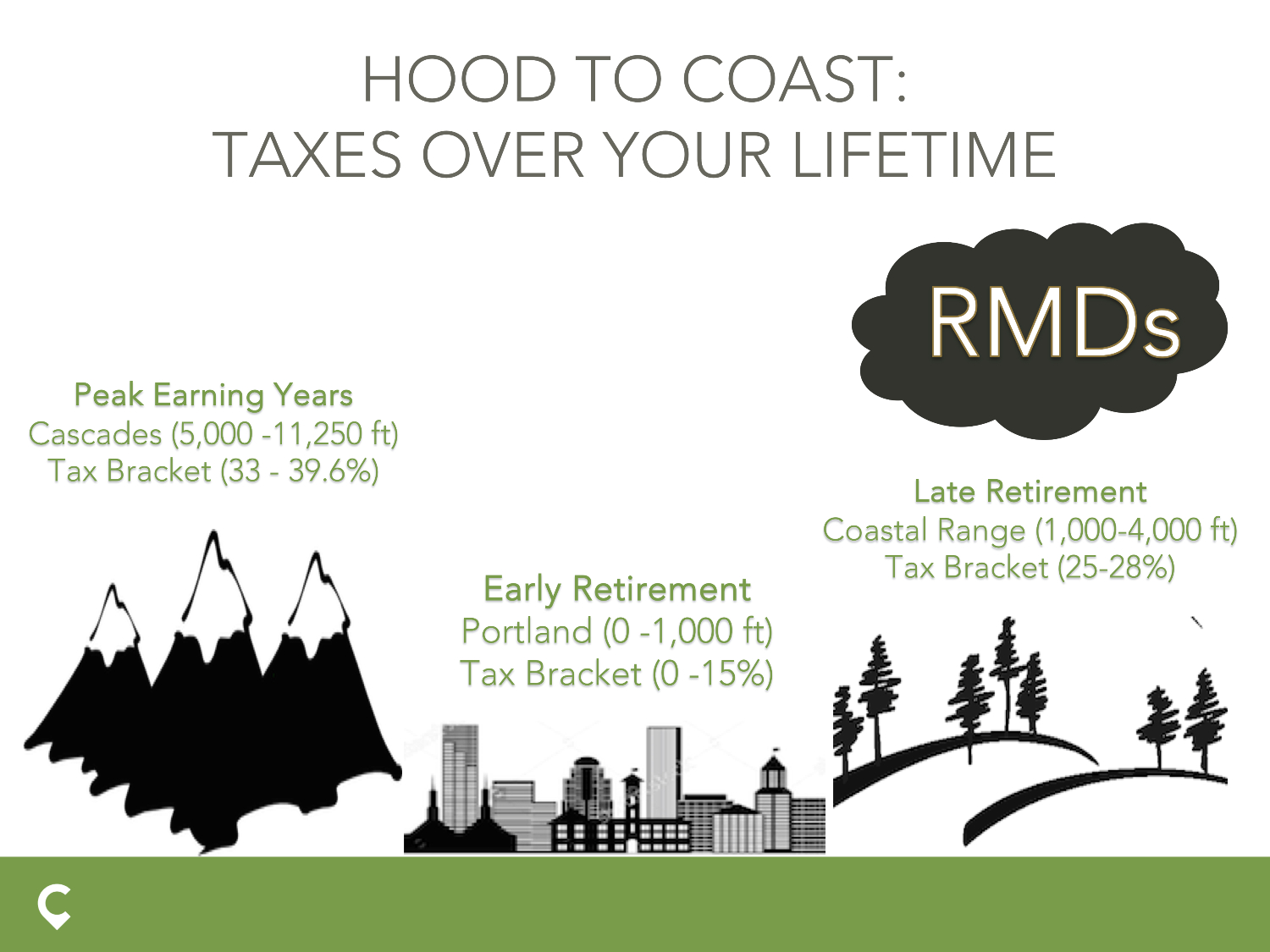

As depicted below, HTC has three distinct phases, just like taxes:

- Peak Earning Years

- Early Retirement (Before age 70.5)

- Late Retirement (After age 70.5)

Let’s review each phase and explore the tax planning opportunities that may apply:

Cascades: Peak Earning Years and the “little things”

Traversing mountain peaks is taxing on both your legs and lungs. Similar to running down Mt. Hood, taxes in high earning years can leave you in pain and out of breath. While not totally avoidable, there are some strategies that are in your control that will help to mitigate taxes during this phase of your life.

- Tax-Deferred Savings: Maximize opportunities to fund 401ks, IRAs, HSAs and 529 plans

- Tax Efficient Portfolios: Ensure investments are held in the appropriate account (IRA vs Brokerage) and if funds are held in taxable accounts, making sure they are tax-efficient.

- Charitable Giving (DAF): If charitably inclined, consider gifting appreciated stock through a Donor Advised Fund (DAF). You’ll avoid paying taxes on the realized gains and receive a deduction.

Willamette Valley: Early Retirement & Roth Conversions

Running down Mt. Hood is cool but running on the valley floor is much easier on the body. Like downhill running, committee meetings and late-night work emails are a thing of the past – life is good. Taxable income is low but so are taxes – a fair trade. The natural thing to do is enjoy these low tax years until Required Minimum Distributions (RMDs) begin at age 70.5. But does that make sense?

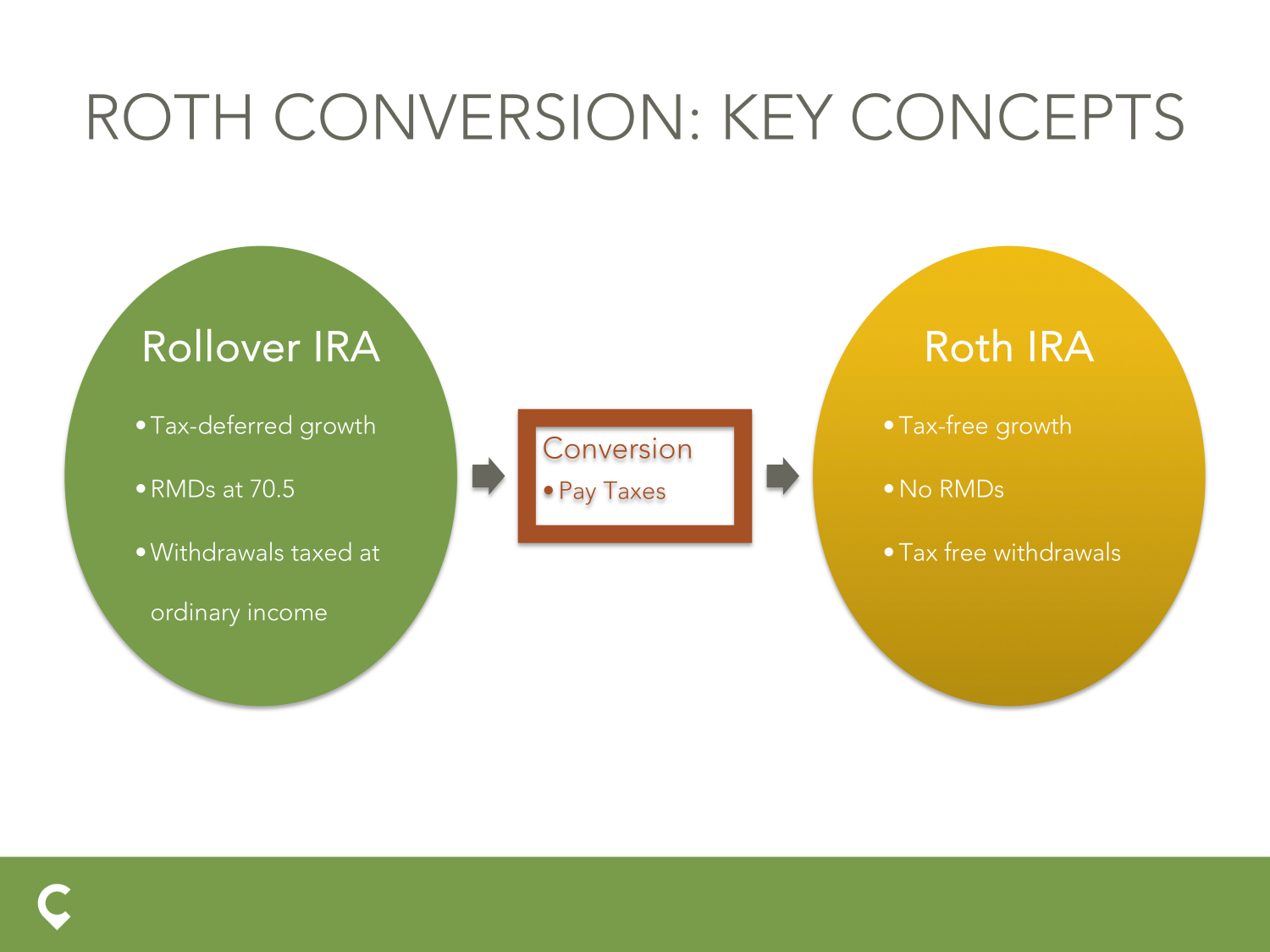

Consider converting tax-deferred assets to a Roth IRA via Roth Conversion.

Here’s why: the conversions will be taxed at ordinary income rates and might bump you up a bracket or two, but over time this is a winning strategy. Because you’re in a lower tax bracket, accelerating your distributions prior to RMD-phase when tax rates are higher will reduce taxes paid over time.

Coastal Range: Retirement

Runners have endured the grueling elevations to start, enjoyed their time on the valley floor, and are now onto the final phase of the race. There’s light (or beer) at the end of the tunnel but still work to be done. Like high taxes during peak earning years (i.e. Cascades), RMDs are unavoidable (i.e. coastal range) but there are still strategies worth exploring.

- Withdrawal Strategies: If funds are needed to support lifestyle, make sure they’re taken from the appropriate account.

- Charitable Giving (QCDs): In some cases, it makes sense to make charitable contributions directly out of an IRA and avoid paying taxes on those withdrawals. This can be done through a Qualified Charitable Distribution.

- Gifting Strategies: Want to gift funds to friends or family? Consider gifting appreciated assets instead of cash, especially if they are in a low tax bracket.

Embrace the Sweat

As Rosie Ruiz found out the hard way, taking a short cut is no way to win a race. It was reported that after Rosie infamously crossed the finish line in record time, she was barely sweating. Don’t take short cuts, embrace the opportunities available and accept that effective tax-planning takes place over many years. While the strategies reviewed require advanced knowledge of the tax code and retirement planning fundamentals, we find it’s the execution part of the equation that people struggle with. If you’re interested in learning more about the strategies that work toward reducing your tax bill, please get in touch.