Employee Stock Purchase Plans (ESPPs) are a valuable form of equity compensation and an attractive benefit of working for many tech companies. And this form of compensation is becoming more popular, from startups to blue-chip firms, as companies realize that the plans are a cost-effective way to reward, motivate, and retain employees.

But just because your company offers an ESPP as part of its benefits package, how do you know how generous and attractive it is? And, if you are comparing multiple offers from competing potential employers, how do you compare different ESPPs?

In this post, we will break down the four key components of ESPPs and review company benchmarks across these components, so you can assess where your plan stacks up. All company data is from an analysis by equitymethods.com, who analyzed 150 West Coast technology firms based on SEC disclosures.

The four key components to consider when comparing your ESPP are:

- The Discount

- The Lookback Window

- Reset and Rollover Features

- The Flexibility to Change Contributions

1. Look for a 15% discount on your company’s stock

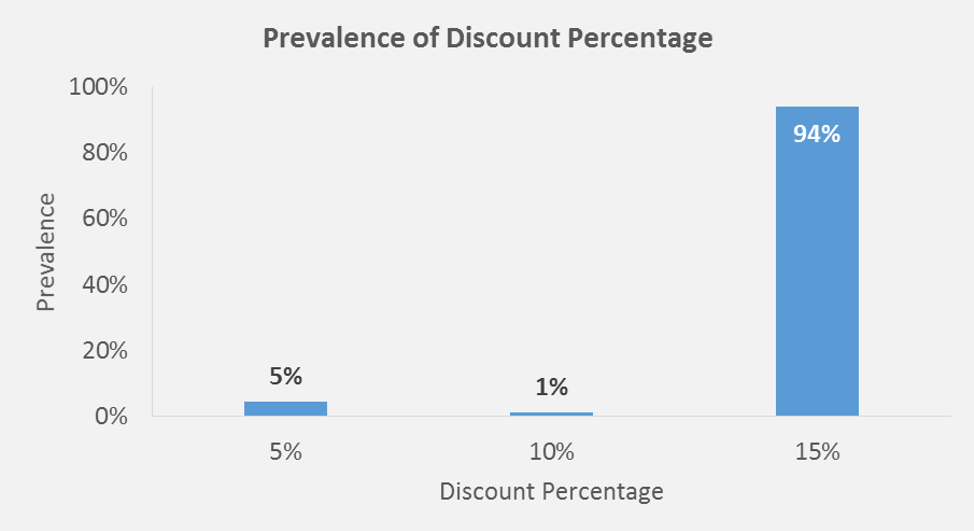

One of the main benefits of ESPPs is the discounted purchase price on your company’s stock. These discounts can vary, extending to a maximum of 15% for tax-qualified plans, but can’t exceed that amount and maintain their tax status.

And it turns out, the vast majority of plans (94%) offer the full discount making the 15% discount table stakes.

Bottom line: Look for a 15% discount on your company’s ESPP.

Source: EquityMethods.com

Source: EquityMethods.com

2. Expect a Lookback Provision

The next key feature of ESPPs is the lookback provision, which allows you to buy the stock at the lessor of the ending price or the initial price of the offering period—putting a floor on your stock but enabling you to participate in the upside.

Consider the following two examples, one with an increase in stock price and the other with a declining stock price.

Increasing Stock price:

- Initial price: $10/share

- Ending price: $20/share

- Purchase price (at 15% discount): $8.50/share

- Profit: $11.50/share (135%)

Declining Stock price:

- Initial price: $10/share

- Ending price: $5/share

- Purchase price (at 15% discount): $4.25/share

- Profit: $0.75/share (18%)

As you can see, with a lookback provision, you are still guaranteed (if you quick sell your shares at expiration) a minimum profit (thanks to the discount) with the potential to participate in the upside of your company’s stock.

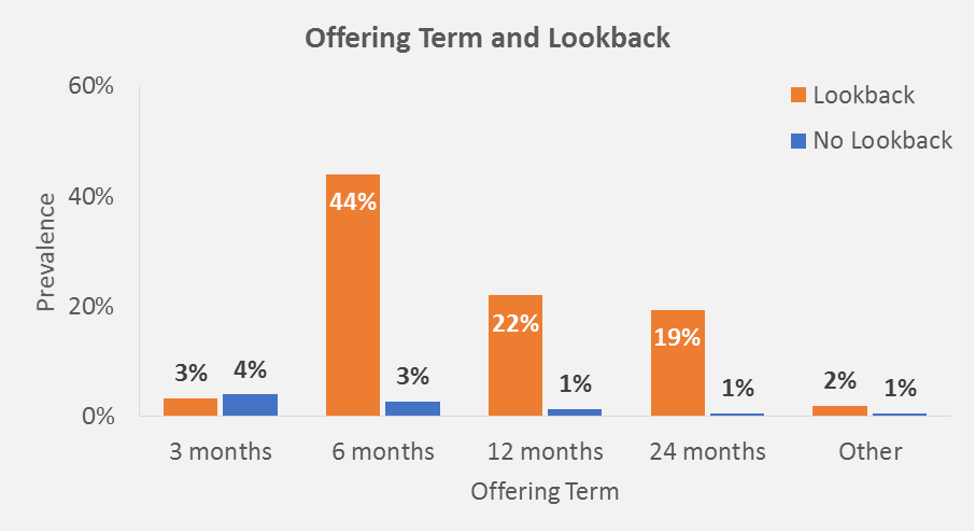

Like with the discount, the lookback provision is common, with 90% of the companies analyzed offering it.

Bottom line: Look for a lookback provision, and the longer, the better.

3. A Reset or Rollover Provision

You can think of this as basically a “do-over” provision. If your company’s stock price declines from the beginning of the offer period to the end, with this feature, the plan gets reset or rolled over to a new plan. Instead of using the price at the original grant date, this gets reset to the lower current price.

These provisions ensure the lowest possible price for both purchase periods.

For example, under a twelve-month offer period with purchases every 6 months, if the stock price was $10 at the beginning of the period, dropped to $5 after 6 months, and then fell to $4 at the end of the offering period (12 months later), all shares could be purchased at a discount to the ending price of $4 per share.

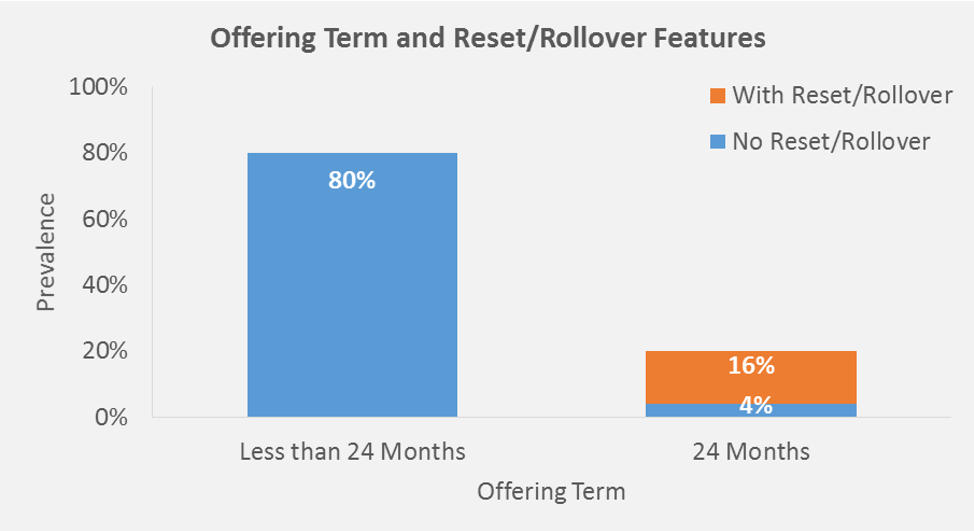

While less common than the 15% discount or lookback provision, 16% of firms (and 75% of firms with a 24 month offer period) provide the favorable Reset feature.

Bottom line: If your offering term is 24 months, look for a Reset or Rollover feature in the plan.

4. How flexible in your plan

While ESPPs are one of the most attractive employee benefits (a 15% discount = free money), stuff happens. What you may have thought you could defer at the beginning of the period you can now no longer manage. Or conversely, maybe you got that raise and you can now defer more income.

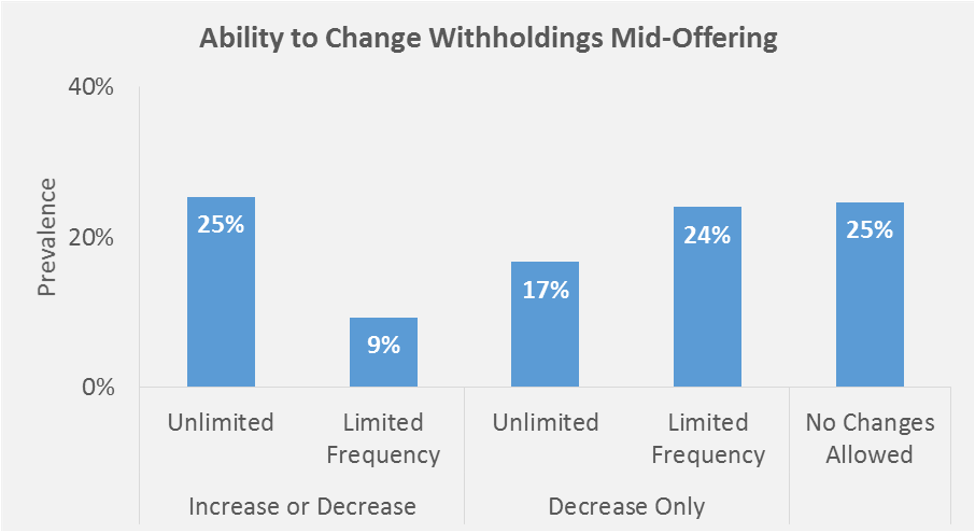

Different plans offer the ability to lower and potentially raise your contributions. Only 25% of companies don’t allow any changes, with another 25% of firms on the other side of the spectrum, allowing unlimited increases or decreases. The other 50% of firms are somewhere in the middle, either limiting the frequency of changes or allowing reductions only.

Bottom line: The more flexible your ESPP is in allowing changes to contributions, the more employee-friendly it is.

So there you have it. Four key features to assess how your company’s ESPP plan measures up. And don’t forget, if possible, DO participate in these plans if your employer offers one. They can be a powerful savings vehicle and the discount = free money!

If you liked this post, please consider subscribing to our newsletter for more financial tips like this, where we simplify the complex so you can take action.

Or, for more on ESPPs, you can check out our post on how they work, the tax treatment, and your biggest advantage with the plans here.