If you’re contemplating retirement, there’s a lot to consider. You may be asking yourself, how do I create an income stream in retirement? Am I being smart with taxes? Is there anything I’m missing? If you happen to be a long-tenured Intel employee, there are factors unique to Intel that need to be considered in order to answer these questions. Our most popular web search is our blog on the Intel Minimum Pension Plan (MPP). Not far behind is our blog on Intel’s Deferred Compensation Plan, or SERPLUS. For most, these two benefits are independent of each other and have no interaction. However, for some high-level employees who have been with Intel since the early 2000s, there’s a benefit that links these two together which needs to be considered: Intel’s QSERP Benefit.

What is Intel’s QSERP?

The Qualified Supplemental Employee Retirement Plan (QSERP) provides additional benefits to the Intel MPP that offset certain benefits from the SERPLUS plan. It dates back to 2005 and was created as part of a corporate tax strategy. In short, Intel moved more than $200mm from their deferred compensation pool (which they were liable for) into the MPP, which allowed for a significant write-off and increased profits. This one-time benefit was offered to employees who had more than $5,000 in their SERPLUS plan at the end of 2003.

Am I Eligible?

If you think you might have been eligible and opted into the plan back in 2005, you can check on the NetBenefits website. Once logged in, click on the Intel Minimum Pension Plan on the right:

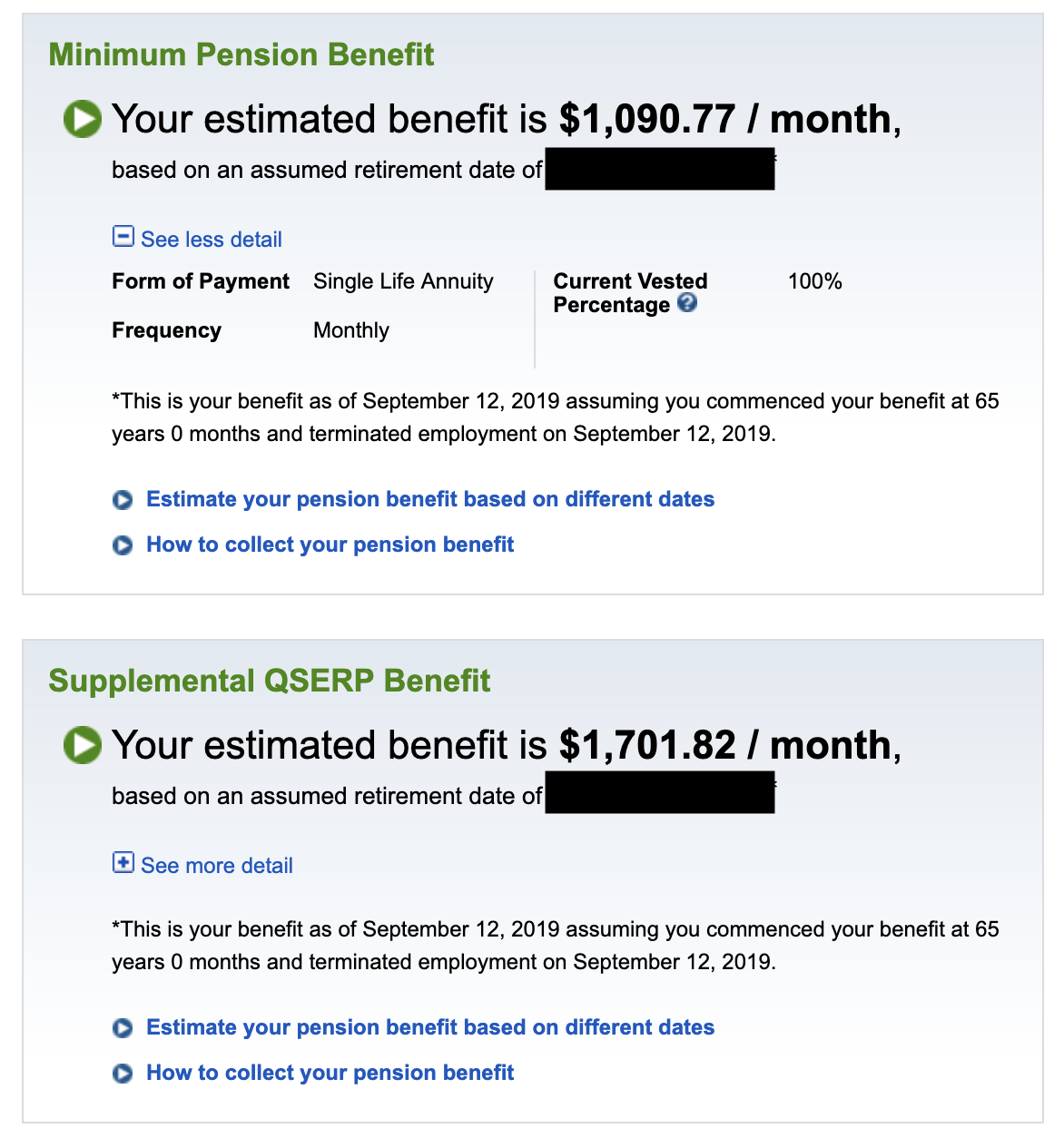

If eligible, you’ll see your estimated monthly benefit for both the Minimum Pension and QSERP:

How Does the Intel QSERP work?

Upon retiring from Intel, the monthly QSERP benefit and prevailing interest rates will be used to calculate the lump sum value of the QSERP benefit. That value will then be subtracted from your SERPLUS balance and added to your MPP. Since the QSERP is part of the MPP, all the same factors for assessing whether a lump sum distribution or monthly payment election apply. For a review, refer to our blog on understanding the Intel Pension Plan.

Example

Using the calculations above, let’s assume Erica the Engineer retires and has the following account balances and benefits prior to and after her official retirement date:

Pre-Retirement:

- Intel Minimum Pension Plan – Monthly Benefit or Lump Sum

- Minimum Pension Benefit – $1,090 or $200,000

- Supplemental QSERP – $1,701 or $325,000

- SERPLUS Account Balance – $1,000,000

Post-Retirement:

- Intel Minimum Pension – Monthly Benefit or Lump Sum

- Minimum Pension Benefit – $1,090 or $200,000

- Supplemental QSERP – $1,701 or $325,000

- SERPLUS – $675,000

Notice the difference? The balance of Erica’s SERPLUS account was reduced by the lump sum value of her QSERP benefit. She’ll need to make the election on the MPP but will also have the additional QSERP benefit to consider.

When assessing your retirement readiness, remember not to double count your QSERP benefit. It’s easy to do because Fidelity shows the estimated benefit of the QSERP while also showing the full SERPLUS account balance on a separate page. If you haven’t read the fine print (or this blog), it would be easy to overestimate the assets available at retirement.

QSERP Benefits: Added Flexibility and Tax Planning Opportunities

As you have hopefully gathered, the QSERP benefit doesn’t provide additional compensation at retirement. So, what’s the benefit? Keep in mind that after Erica retires, the yearly deferral elections for the SERPLUS will dictate when her funds get distributed (e.g. lump sum, 5 years, 10 years). By taking advantage of the SERPLUS option, she reduces her taxable income in high earning years and defers taxable activity (i.e. dividends and capital gains). But what she loses is the flexibility of when her SERPLUS is distributed in retirement.

By opting into the QSERP in 2005 and moving a portion of her SERPLUS (defined distribution schedule) to the Minimum Pension Benefit, she’ll have the option of taking the lump sum and rolling it into an IRA or annuitizing the benefit into a monthly pension. If the lump sum election is made, the funds will then be held in her Rollover IRA where a world of tax planning opportunities await.

There are many factors to consider when looking at your benefits. If you’re interested in learning more about the Intel QSERP benefit (or your other Intel benefits), please reach out.