Intel’s SERPLUS (Deferred Compensation) plan is eligible for those employees level 10 or higher and can be a fantastic way to reduce taxes and boost savings.

But, there are a number of trade-offs with the program and issues to consider.

So if you want to know exactly…

- What is SERPLUS and how it works

- How it compares to other Intel benefits

- How to make your election decisions

…then you’ll love this SERPLUS guide.

But first, grab your free resources (no email required!) 👇

- Intel SERPLUS One Page Overview

- Intel SERPLUS Contribution Scenario and Tax Calculator (excel download)

What is Intel’s SERPLUS plan?

Intel’s SERPLUS (Deferred Compensation) program is available to employees at grade level 10 or higher. The enrollment window typically opens around mid-November for salary and bonus deferrals for the following year. The program allows you to defer income and invest the money in a tax-deferred investment account.

You can defer up to 60% of your salary and up to 75% of bonuses and commissions into SERPLUS.

The two key advantages of the SERPLUS plan are:

- Reduce your tax bill today by deferring income

- Dramatically increase your savings into a tax-advantaged account well above what you could do in your 401(k)

But, this does come with a drawback. As a 409(a) non-qualified retirement plan, the SERPLUS account is an unfunded liability of Intel. Meaning if Intel were to go bankrupt, you would have an unsecured general claim against the assets of the company—just like any other unsecured creditor.

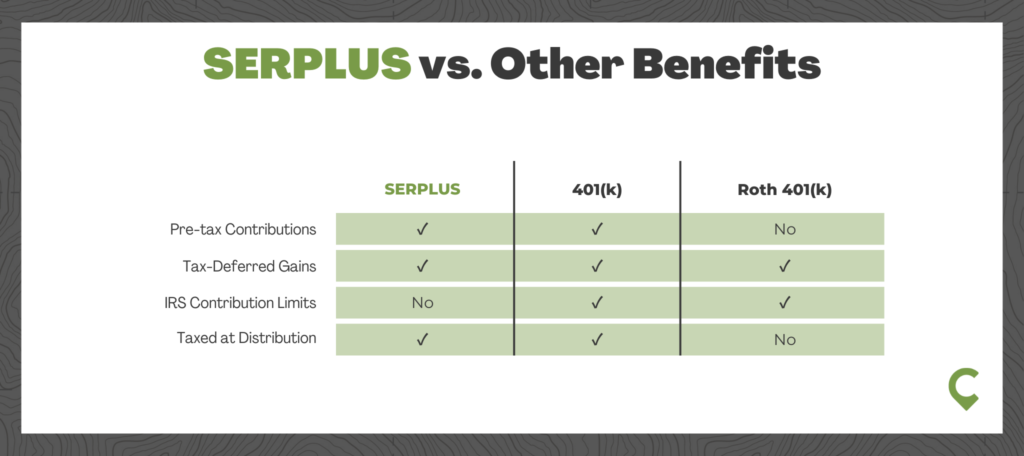

How Does SERPLUS Compare to Your Other Intel Benefits

Contributions into the SERPLUS plan are pre-tax reducing your taxable income like the 401(k) and are taxed at payout, also like your 401(k). However, the main difference to the 401(k) are the ability to contribute well to the SERPLUS well in advance of the IRS 401(k) annual contribution limits. Additionally, unlike a 401(k) your distribution timing but be set in advance with a deferred compensation plan.

Compared to the Roth 401(k) option, SERPLUS gives you a tax break upfront, while the Roth 401(k) gives you tax-free income in retirement.

How to Make Your SERPLUS Elections

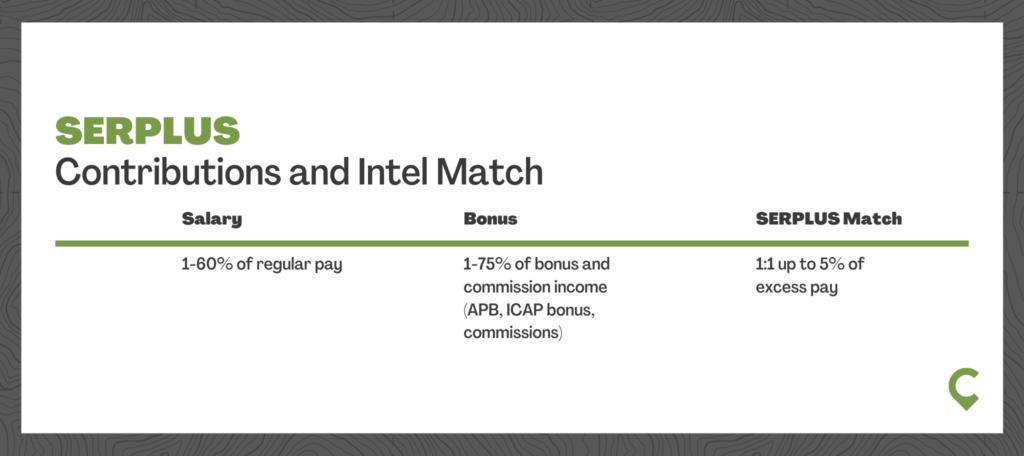

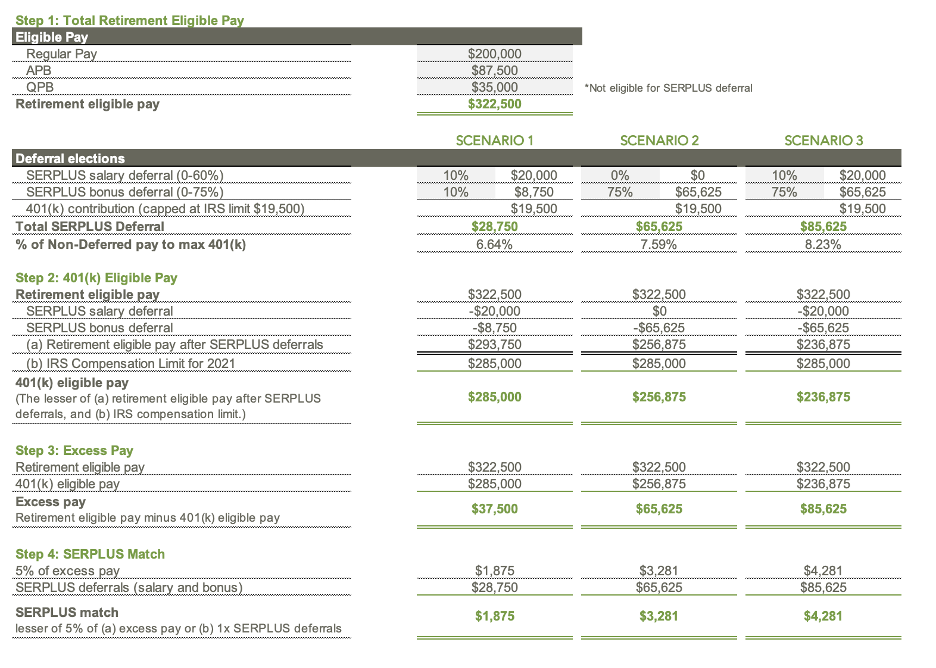

Contributions: How much can I defer?

- Salary: 1–60% of Regular pay

- Bonus: 1–75% of Bonus and Commission Income (APB, ICAP bonus, commissions). Quarterly bonuses (QPB) are not eligible to defer to SERPLUS.

- SERPLUS Match: Intel matches dollar for dollar up to 5% of “excess pay.” This match is 100% vested and typically credited after year-end in Q1 (for 2022 contributions, the match would be paid in Q1 2023).

Distribution options

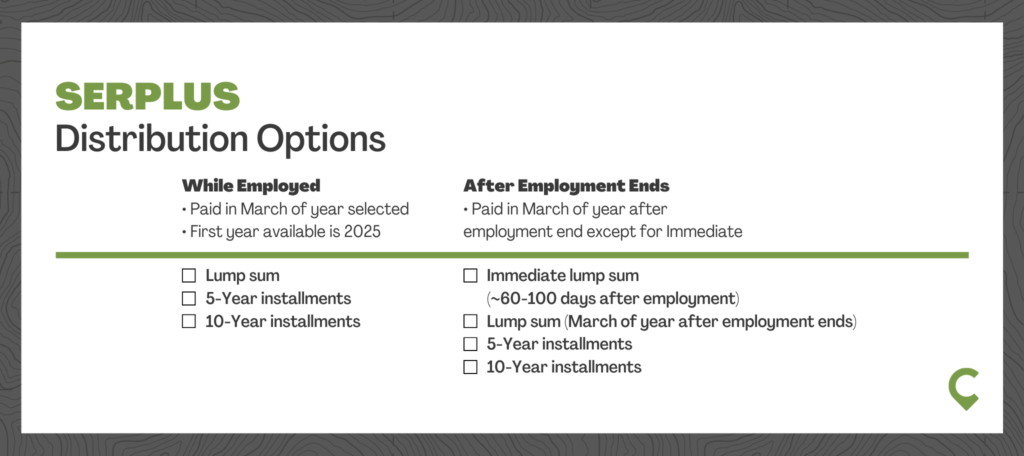

You can elect to distribute your deferred compensation while still employed by Intel or after your employment ends.

Options while employed

- Lump-Sum: Paid in March of the year elected. It must be at least three years in the future, so 2025 or later for this year’s elections.

- 5-year installments: The balance is paid in fifths starting in March of your selected year. The first year available is 2025.

- 10-year installments: The balance is paid in tenths starting in March of your selected year. The first year available is 2025.

Options after employment end

- Immediate Lump Sum: Balance is paid ~60-100 days after employment ends. Please note: this option is very similar to the lump sum option below but will likely be paid out in the same tax year as your last year of employment at Intel.

- Lump-Sum: Paid in March of the year after your employment ends. By definition, this option will be paid in a different tax year as your last year of employment at Intel.

- 5-year installments: The balance is paid in fifths starting in March of the year after your employment end.

- 10-year installments: The balance is paid in tenths starting in March of the year after your employment end.

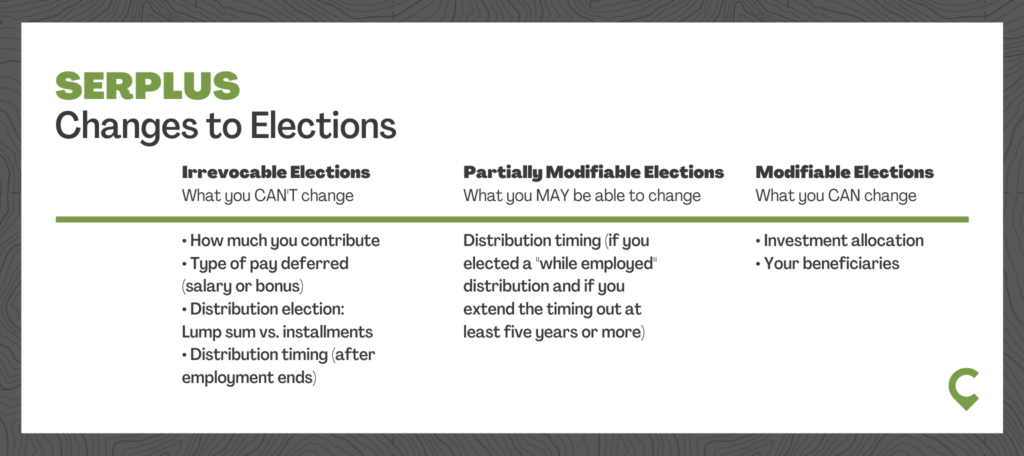

Changing Intel SERPLUS Elections

What you CAN’T Change (Irrevocable Elections)

- How much you contribute

- Type of pay deferred (salary or bonus)

- Distribution election: Lump sum vs. installments

- Distribution timing if “after employment ends” is selected

What you MAY be able to change (Partially Modifiable Elections)

- Distribution timing (If you elected a “while employed” distribution and if you extend the timing out at least five years or more)

What you CAN change (Modifiable Elections)

- Your investment allocation in the SERPLUS account

- Your Beneficiaries

Now that we’ve covered how the SERPLUS works, how it compares to other Intel benefits, and the various election decision you’re faced with each year, the rest of this article addresses will address the four common questions we are frequently asked during the SERPLUS enrollment window.

Common SERPLUS Questions:

- What’s the risk of the Intel SERPLUS plan?

- Second, what’s the magnitude of the tax benefit from deferring income?

- Third, should I participate, and how much should I defer if so?

- Finally, what distribution schedule should I elect?

What’s the Risk of the Intel SERPLUS Plan?

As a non-qualified deferred compensation plan, your SERPLUS account is, by rule, an unsecured liability of Intel. Meaning if Intel goes bankrupt, you could lose part, a majority, or all of your balance in this account. By participating, you become a creditor of your employer—and lower in priority to any creditor whose loan is secured by the company’s assets.

This is the primary risk and the main drawback of participating in the deferred compensation plan.

So how do you think about assessing this risk in order to capture the potential benefits?

We like to think about this in terms of factors specific to Intel and factors specific to your personal situation.

Intel Specific Risk Factors

The key question here is how likely is it that Intel will default on its deferred compensation obligations, and what’s the magnitude of the default if so. To answer this, we can look at a few scenarios ranging from the most general to the most specific.

First, how likely is a publicly-traded company to file for bankruptcy?

On average, around 80 public companies file bankruptcy each year. During a recession, this number obviously goes up (136 and 210 filed for bankruptcy protection in 2008 and 2009, respectively) but drops in times of economic expansion (58 and 64 filed in 2018 and 2019, respectively). Taking that 80 companies per year into the 3,700 listed companies here in the U.S. tells us that roughly 2% of public companies file bankruptcy each year.

Of course, not all companies are created equal. Smaller companies should be higher risk, and Apple isn’t the same risk as J.C. Penny.

And of course, even in the case of bankruptcy, some creditors end up recouping a portion of their money.

So, the next question becomes, what happens to the deferred compensation liabilities of a company in the event of a bankruptcy?

The two main types of business bankruptcies are chapter 7 (liquidation) and chapter 11 (reorganization). Chapter 11 typically involves negotiation with creditors and is usually more favorable for those with liabilities in a deferred compensation plan.

Here are a few examples from past corporate bankruptcies that are instructive:

- CIT Group – November 2009 Chapter 11 bankruptcy. Executive benefits, including deferred compensation plans, survived intact.

- Eastman Kodak – January 2021 Chapter 11 bankruptcy. Executive Deferred Compensation plan paid out only 4-5% of the balance (although executives were given shares in the newly issued stock). Those below the executive level were largely made whole along with other creditors.

- GM – June 2009 Chapter 11 bankruptcy. Participants received a two-thirds “haircut” of any benefits in excess of $100,000 annual distributions.

- Nortel Networks – June 2009 Chapter 7 bankruptcy. Participants recovered 97% of the funds in their deferred compensation accounts on the day of bankruptcy.

The last question is then, how likely is Intel, given its current financial positioning, to file bankruptcy?

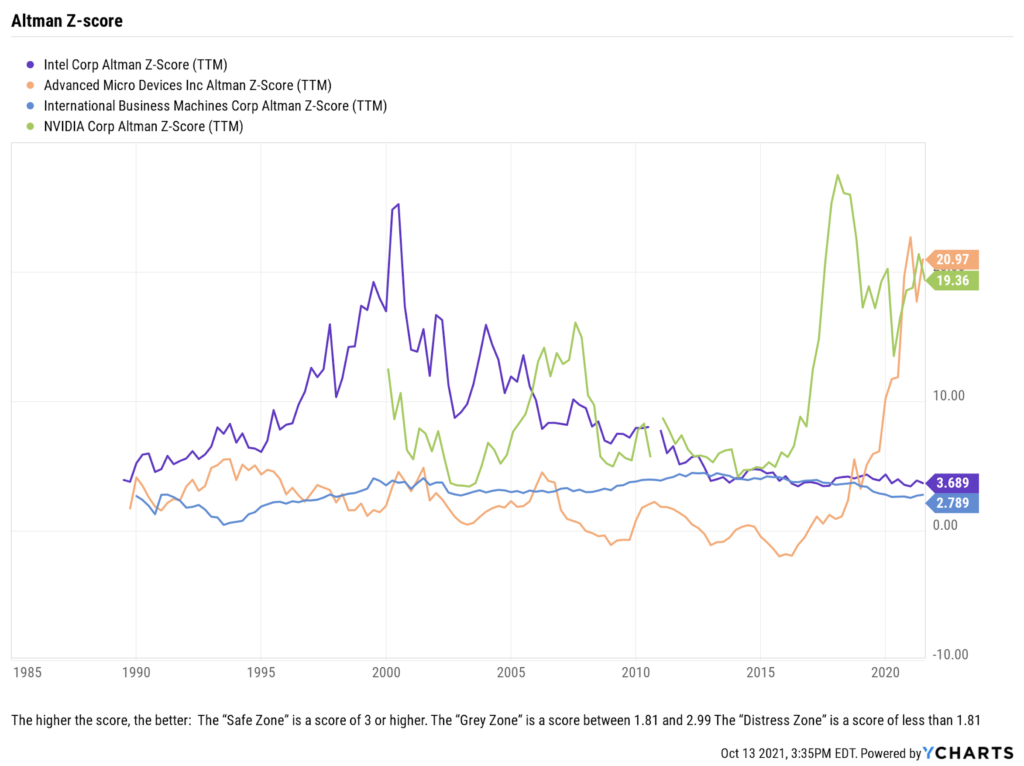

The Altman Z-score, developed by NYU Professor Edward Altman in the late 1960s, is a metric devised to assess a firm’s bankruptcy risk. Altman’s Z-score uses a blend of publicly available financial statement information (working capital, retained earnings, profit, market value, assets, and liabilities) to predict companies’ bankruptcy risk (at least in the near term).

The higher the score, the better:

- The “Safe Zone” is a score of 3 or higher.

- The “Grey Zone” is a score between 1.81 and 2.99

- The “Distress Zone” is a score of less than 1.81

Currently, Intel’s Altman z-score is 3.69, which is up from 3.59 at this time last year. This score puts them in the safe zone, but it has been trending down for the last decade and is lower than competitors AMD and NVIDIA. IBM is also shown for reference (See chart below).

It appears Intel is safe in the short term, but obviously, with deferred compensation plans, we need to look out many years in the future. Here is where factors specific to you as an individual come into play.

Personal Risk Factors

In addition, to assess the risk of Intel, you should assess three personal risk factors.

- Your distribution timeline. The longer you defer the money, the greater the benefit from the tax deferral, but the more risk you take on. We typically suggest a 10-year distribution schedule after employment ends, but if you are planning to be employed at Intel for many years, know that this comes with added risk.

- Action item: Calculate your distribution timeline for prior deferrals

- Your current exposure to Intel. This includes money in the deferred compensation plan in addition to Intel stock (RSUs, ESPP shares, other shares), any Intel options, and the minimum pension. While the deferred compensation plan is a debt of the company, not equity, like your shares, if things go wrong at the company, the shares are at more risk. If you’re concerned about reducing your exposure, equity holdings are a good place to start.

- Action item: Calculate total exposure to Intel (SERPLUS balance + Market Value of Intel Stock + Lump Sum Pension balance / Total Net Worth)

- What percentage of your total net worth is in the SERPLUS account? The higher the percentage, the greater the risk and the more cautious you should be about deferring additional income.

- Action item: Calculate SERPLUS balance as percent of total net worth (SERPLUS balance / Total Net Worth)

Concerned about your risk in the SERPLUS plan? See our post 3 Risk Reduction Strategies for Deferred Compensation Plans.

What are the Tax Benefits?

The main benefits of any deferred compensation plan are the tax benefits which can essentially show up in two ways. The two types of potential tax benefits are:

- Tax Rate Benefits

- Tax Deferral Benefits

Tax Rate Benefits

These are more difficult to pin down and quantify, but this potential benefit can show up in three places.

First, you may expect to be in a lower tax bracket after leaving Intel. With the end of salary, bonus, and RSU income, this may very well be the case. But depending on the size of your deferred compensation distributions and other sources of income, this isn’t always a foregone conclusion.

Second, you might expect a beneficial tax rate change if you plan to move from a higher income tax state to a low- or no-income tax state in retirement. Moving from Oregon to Washington during the distributions of your deferred compensation account would save the 9% Oregon income tax bill.

Lastly, deferred compensation is a chance to wager on future tax rates. Although given the current tax environment, a bet on lower tax rates in the future doesn’t look wise.

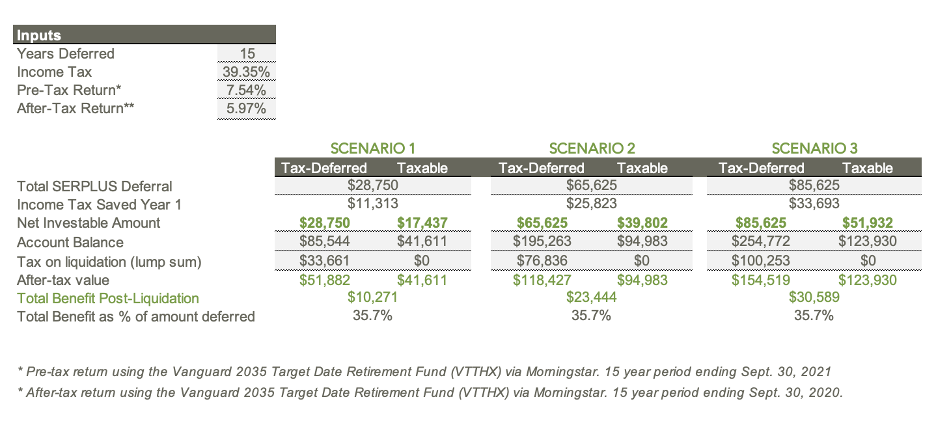

Tax Deferral Benefits

The main tax benefit of a deferred compensation plan is the ability to defer taxes—allowing you to invest your money pre-tax and have it grow without tax until the money is paid out.

The longer the tax deferral is in place, the more valuable this is. Deferring taxes one year before retirement and then over a 10-year distribution schedule has value, but deferring taxes for 20 years (allowing your money to grow pre-tax) has a lot more value.

Of course, this comes with the risk of your company not being around to make good on its deferred compensation obligations in 10 or 20 years.

Let’s look at an example. Using the assumptions listed in the Table below, we can see that deferring income for fifteen years at the top marginal tax bracket results in 36% more of wealth than investing the same earnings in a taxable account (see the bottom row in the table). This 36% result holds even after paying income taxes on your distribution from the deferred compensation plan.

You can download the SERPLUS Contribution Scenario and Tax Calculator here.

Behold the power of compounded tax-free gains!

How much to defer to Intel SERPLUS?

Before contributing to a deferred compensation account, you want to make sure you are allocating funds to other tax-advantaged and safer accounts. Fully fund your 401(k), HSA, and IRAs first.

Next, this decision is mainly going to come down to factors specific to each individual.

- How risky do you perceive Intel to be now and in another 10-15 years?

- How much risk do you have individually tied to Intel? Include salary, bonus, and stock in addition to money already in the deferred compensation plan?

- How much can you afford to defer from a cash flow perspective?

- Do you want to contribute some money in order to get the Intel match?

To help you assess different deferral amounts and their impact on the Intel match, we created a Contribution Calculator where you can run up to three different deferral scenarios. An example is below.

You can download the SERPLUS Contribution Scenario and Tax Calculator here.

Planning Opportunity: If cash flow is an issue to deferring additional income, consider using cash from selling RSUs as they vest to fund deferred compensation. RSUs will be taxed as income as they vest, increasing your tax bill today. Deferring income can be a way to offset that additional income and invest those proceeds tax-deferred.

What distribution schedule should I select?

Lastly, once you decide how much to defer, you must select a distribution schedule.

Again, this decision comes down to the tradeoff between deferring taxes and the account being an unfunded liability of Intel. The earlier you elect to take a distribution, the lower tax-deferral benefit you receive. But a longer distribution schedule means a greater time period the liability remains with Intel.

Typically, we suggest deferring for ten years as this is the biggest tax benefit—if we’re not comfortable with the risk out to ten years, it’s questionable if we should defer at all.

The caveat there is if there are some specific individual circumstances where you know your tax rate will be lower in the future, it may make sense to defer out to a specific year.

Also to note, SERPLUS balances are paid to your beneficiaries at your death.

Action Items: SERPLUS

Wow! Congrats on making it to the end of this massive article on maximizing your SERPLUS benefits. You mission, if you choose to accept it, is to:

- Determine how much risk you have in the Intel plan

- Calculate how much to defer this year, the tax benefit, and funding source

- Optimize your distribution schedule

While SERPLUS may seem like a lot of work, getting it right can add up to huge tax savings over your career.

—

The information contained in this post is based on Cordant’s understanding of the Intel SERPLUS plan as of 2022. The Plan is subject to change by Intel. Please see your latest Plan document for the most up-to-date information.