The new year kicks off a lot of exciting changes to the Intel benefits plan. We’ve written about changes to the 401k, Employee Stock Purchase Plan, and SERPLUS (to name a few). What we haven’t touched on yet is the change to Intel’s HSA provider.

As a reminder, an HSA is a Health Savings Account and is offered to employees enrolled in High Deductible Health Plans (HDHP). HSAs are primarily used to help families offset the rising cost of health care by enabling individuals to set aside pre-tax earnings. For individuals who incur out-of-pocket costs and don’t have the resources to cover them through their income or savings, using the HSA as a conduit account for covering health care costs makes perfect sense. Please click here for an in-depth review of HSAs and their great benefits.

Long-Term Savings

For individuals who can afford to cover health costs through regular income or savings, the HSA becomes a great long-term planning tool.

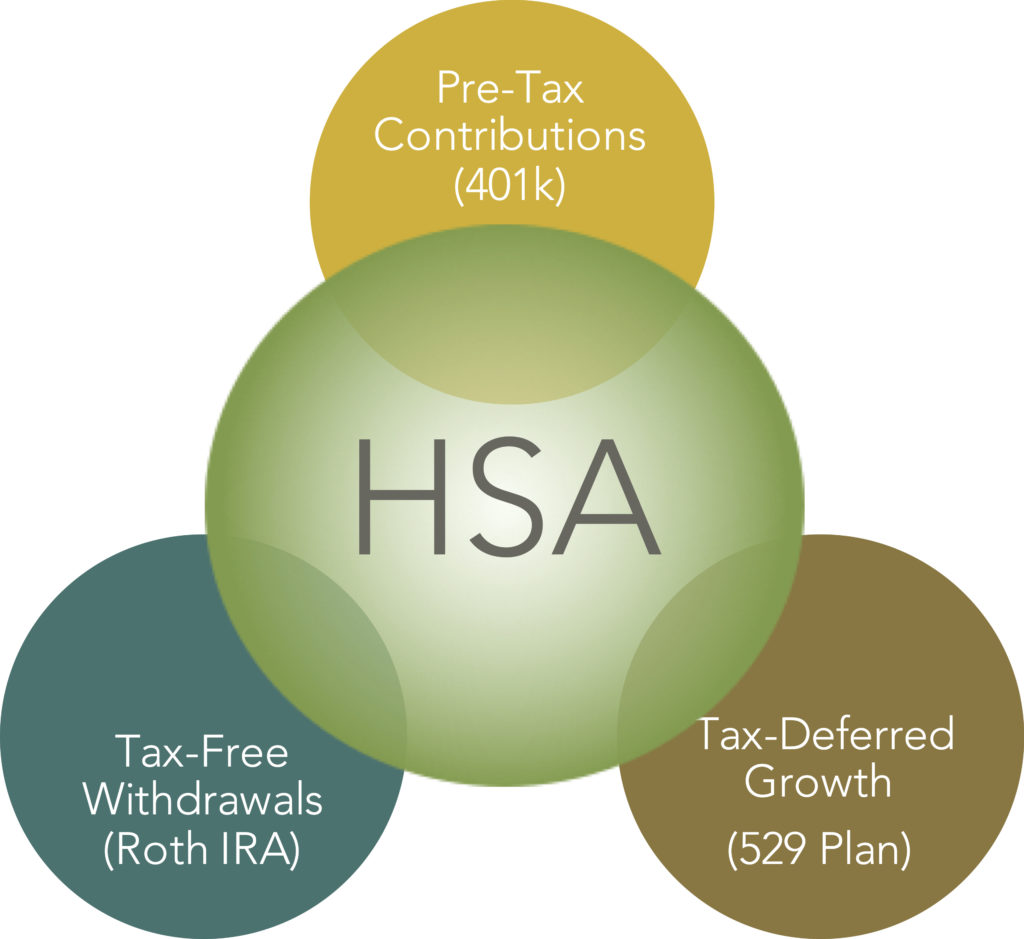

All contributions can be invested for future growth in which any earnings are tax-free (like a 529 plan). When it comes time to access the funds for health care costs, any withdrawals used towards qualified medical expenses are also tax-free (like a Roth IRA). Essentially, the IRS has created a utopian form of savings vehicle:

Transition to Fidelity

For Intel employees, the HSA’s plan was previously offered through BenefitWallet. Starting in 2020, Intel offers the plan through Fidelity. From a simplicity perspective, this makes a lot of sense as the majority of Intel’s benefit programs are administered through Fidelity.

For employees who consented to the bulk transfer of funds to Fidelity, the following are key dates:

- Jan 1, 2020:

- New HSA Contributions will be deposited into new account with Fidelity

- Jan 17 – 31, 2020:

- Blackout period: accounts with BenefitWallet will be terminated.

- Access to contributions at Fidelity will granted after first paycheck of 2020.

- Jan 31, 2020:

- All funds transferred from BenefitWallet will be eligible for medical expenses.

- The one-time incentive of $75 from Fidelity and $175 from Intel will be deposited in your account.

Access to Funds

The easiest way to pay for health care expenses with HSA funds is to use the Debit Card issued by Fidelity. If for some reason this isn’t an option, the following are ways to reimburse yourself for expenses paid out-of-pocket:

- Transfer money online from your HSA to your personal bank account

- Write a check to yourself online via Fidelity BillPay

- Call Fidelity at (800) 544-3716 to request a check be issued or funds transferred online

- Write a check to yourself using your HSA checkbook

Next Steps

Investments

If the HSA will be used as a conduit account and funds withdrawn the same year as contributed, then all contributions should remain in cash.

For those utilizing the HSA for long-term planning purposes, be sure to get the account invested appropriately. Remember, risk equals return so the investment options chosen should reflect the investor’s time frame, risk tolerance and other planning strategies. And of course, remember to check the cost of the funds, otherwise known as the Expense Ratio.

Beneficiaries

Like a 401k or IRA, an HSA comes with beneficiary designations. Be sure to update the beneficiaries online at Fidelity. It’s important to align the designations with the rest of your estate plan.

Still have questions?

At Cordant, we’re committed to helping our clients understand the tradeoffs that come with each financial decision. Admittedly, optimizing an HSA won’t make you filthy rich or save you from the next bear-market but remember, it’s the little things that count. If you’re interested in maximizing your resources or accelerating your path to retirement, get in touch.