Understanding Entity Structure

Most small businesses are started by those that are particularly skilled and/or passionate about providing a service or product. For many, providing this service or product is the fun part of running a business. From technology consultants to golf pros, it’s the running of the actual business that causes headaches. Under the headache category often falls the handling of finances and legal matters. Luckily, understanding a few key principles will go a long way in ensuring your small business is set up properly.

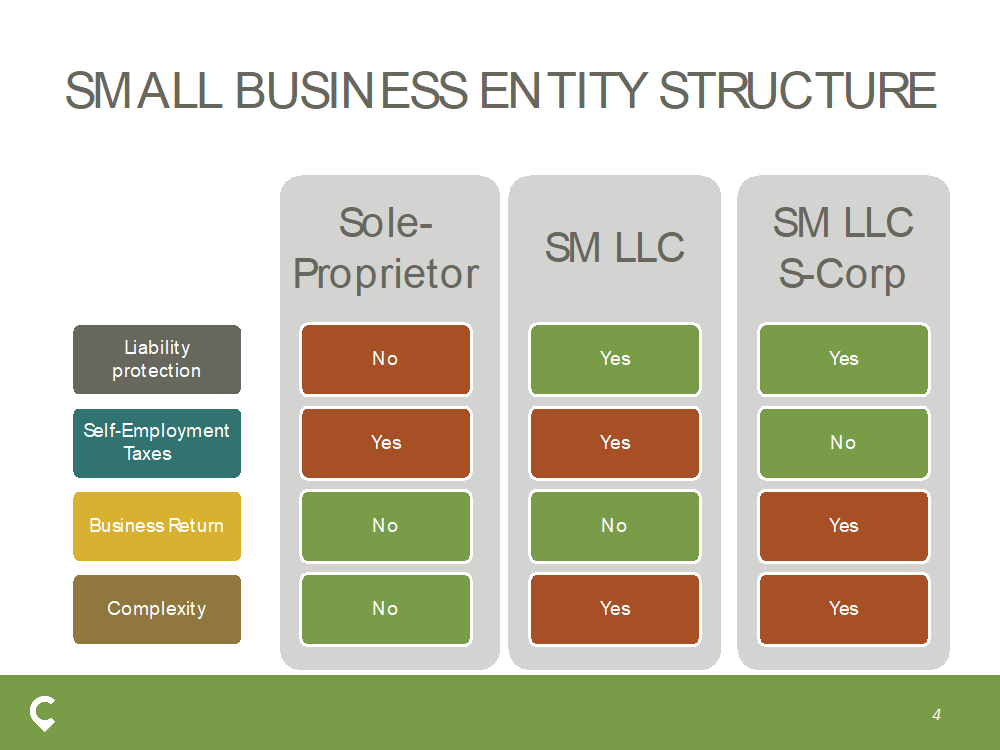

In this post, we’re going to review your options for setting up a business in a way that minimizes the personal liability of the business owner and optimizes the tax structure of the business, and ultimately the owner.

Separating Church and State

Anyone that’s ever started their own business understands the myriad of challenges of turning a great idea into a profitable business. One of the challenges is protecting your business from liabilities related to injuries, accidents, and mistakes. For this, there are various business insurance policies that can and should be put into place. But what about your personal assets? Are they subject to claim? Enter the LLC.

Most of us have heard of an LLC. As a reminder, the acronym LLC stands for Limited Liability Company. You can look up the IRS’ definition here , but an LLC is essentially a business structure that separates the business owner’s assets from their personal assets, thus limiting the liability of the company to itself. An LLC can have one-member (Single-Member LLC) or multiple members (Partnership). Since this post is focusing only on solo business owners, we will refer to Single Member LLCs as SMLLC.

Self-employed individuals working outside of an LLC arrangement are sole-proprietors. In the eyes of the law, there’s no separation between the personal assets and business assets of a sole-proprietor. If creditors from an individual’s business activity come calling, both business and personal assets will be exposed and subject to claims. For this reason, setting up an LLC is not a requirement for starting a business but a recommendation. The rules vary but they are typically easy and inexpensive to set up (note, each state has different rules for set up and compliance) and will go a long way in ensuring a mistake in your business doesn’t jeopardize your personal assets.

Now that your business and personal activity are separate entities, let’s review how different types of business structures are taxed and which might make the most sense for solo business owners.

Sole-Proprietors & Single-Member LLCs

Despite the differences in liability protection, sole-proprietors and single-member LLCs are taxed the same way. For both, the IRS views the business activity of the individual as that of her own. This means that any income or expense generated from business activity will flow through directly to individual’s personal tax-return. Unlike more complicated arrangements (keep reading), there is no need to file separate business tax returns, making life easier.

There are benefits to having your business and personal activity treated one in the same. In addition to the simplicity factor, expenses like health-care costs and contributions to retirement plans are considered “above the line” deductions and come with the most preferential tax treatment. Other ordinary business expenses like utilities or advertising costs get reported on a Schedule C.

On the downside, “self-employment taxes”, or contributions to the Social Security and Medicare systems, must be made entirely by the individual totaling 15.3% of net income up to $128,400. For context, salaried employees only pay half of the FICA taxes and their employers pay the other half.

Single-Member LLC filing as an S-Corp

For some solo-business owners, filing as an S-Corp might make sense. Though nothing changes from a liability perspective, there are key differences to how the business income is taxed.

For starters, the owner of the business is treated as an employee and gets paid a salary. This means that the employee/owner’s salary will get reported as income on their individual return, in addition to the remaining profit from the business. The benefit of this is that the business pays FICA (Social Security & Medicare) taxes on the salary portion only and the business owner has flexibility as to when they want to take the profit out of the company in the form of distributions.

The drawback of filing as an S-Corp is the loss of the “above the line” deductions that was reviewed earlier. It should also be noted that because the LLC is filing as an S-corporation, there needs to be a separate business tax return filed. While not a huge deal, this added complexity makes working with a qualified tax professional worthwhile.

Example

Daniel Theodore, owner of Patrick Radio Solutions LLC, makes $100,000 of profit. Dan has the option of being taxed as a sole-proprietor (he still has liability protection) or he can make an S-Corp election.

If he chooses to file as Sole-Proprietor, he’ll have to pay Social Security and Medicare taxes on the entire $100,000. If he elects the S-Corp, he’ll avoid paying self-employment taxes and the company will pay FICA taxes on his salary only, $50,000.

As noted earlier, filing as an S-Corp has more complexities and costs. Despite the obvious tax savings in the above example, all scenarios should be reviewed with a qualified tax professional to determine the appropriate election.

The info-graphic below summarizes the key variables discussed in this blog:

If you’re considering starting a new business or have questions about one already in existence, please get in touch.