The Mega Backdoor Roth is a powerful new feature in many employer 401(k) plans that can turbocharge your savings. In this guide, we will walk you through everything you need to know about how the Mega Backdoor Roth works, why you should consider it, and some of the rules you need to know—including contribution limits for 2021.

What is a Mega Backdoor Roth 401(k)

The Mega Backdoor Roth 401(k) is a relatively new benefit that’s gaining popularity among tech companies, where high salaries typically limit how much you can contribute to a Roth account—or your ability to contribute at all. This feature makes it feasible to save more via after-tax contributions than traditional 401(k) limits will allow.

For many tech employees, a conventional Roth contribution, with its income caps, is not an option. Based on the 2021 limits, Roth contributions are not allowed when Modified Adjusted Gross Income (MAGI) is above $140,000 for those who file taxes as a single person and above $208,000 for those married filing jointly.

What’s more, a conventional Roth contribution tops out at just $6,000 per year or $7,000 if you are aged 50 or older.

Enter the Mega Backdoor Roth 401(k) as a way around these two limitations on traditional Roth contributions.

But, before we outline how the Mega Backdoor Roth works, first, let’s define a few key terms.

- Roth vs. Traditional IRA – Contributions to a Roth account don’t come with a tax benefit today. But instead, all earnings grow tax-free. Importantly, at retirement, when your money is withdrawn from the Roth IRA, these withdrawals are free of tax as well. A traditional IRA, or 401(k), on the other hand, contributions are made pre-tax (reducing your taxes today), but all withdrawals are taxed as income at retirement.

- After-tax contributions – This is simply money that is contributed to your 401(k) after taxes have been paid on the earnings. Unlike traditional 401(k) contributions, you don’t receive an immediate tax benefit on these contributions, but they do allow you to increase your savings. To participate in the Mega Backdoor Roth, your plan must allow after-tax contributions. According to a 2017 survey of large and midsize employers by consulting firm Willis Towers Watson, 43% of employers allow after-tax contributions.

In summary, if your employer’s 401(k) plan allows after-tax contributions, the Mega Backdoor Roth will enable you to increase your tax-advantaged savings.

And, if you’re over the income limits for a Roth IRA, the after-tax salary deferral feature of your 401(k) allows you to not only fund a Roth vehicle but to contribute much more than a standard IRA contribution.

How the Mega Backdoor Roth Works

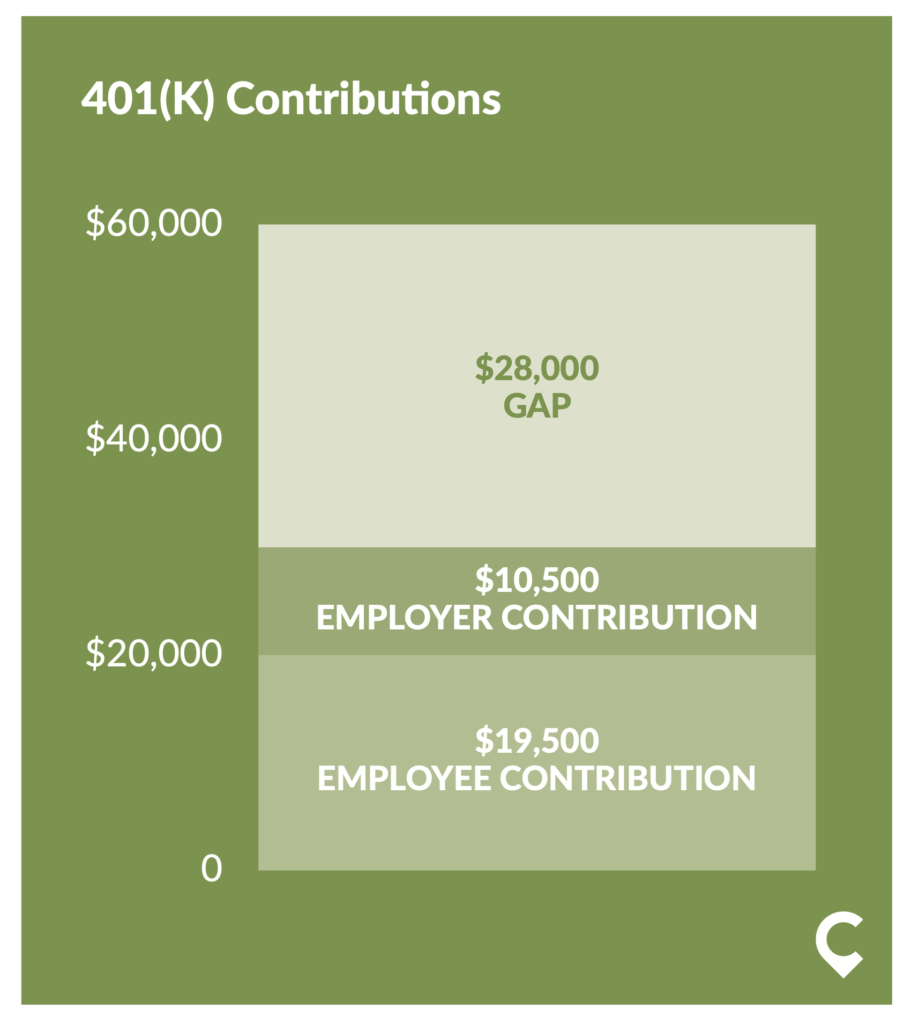

For a typical 401(k) in 2021, you’re allowed to contribute $19,500 before-tax. Your employer can also contribute to your 401(k), usually done via a match.

So let’s say your employer contributes $10,500 for a total contribution of $30,000.

IRS Mega Backdoor 401k contribution limits

While your before-tax employee contributions are capped at $19,500, you can still make after-tax contributions (enter the Mega Backdoor Roth). For 2021, IRS limits total contributions in defined contribution plans to $58,000. That makes the maximum Mega Backdoor Roth contribution $38,500 after the cap on before-tax contributions. But note: this $38,500 amount is reduced by your employer contributions as well.

Continuing the example above, if you max out your 2021 before-tax contributions and your employer contributes $10,500 to your 401(k), you have the opportunity for up to $28,000 in after-tax contributions.

And importantly, you can steer those after-tax contributions into a Roth account.

To accomplish that, you must do one of two things after making an after-tax contribution depending on what your plan allows:

- Either select an in-plan Roth 401(k) rollover/conversion (if your plan allows)

- Or rollover the after-tax contributions into a Roth IRA of your choosing. (Your plan must allow in-service, non-hardship withdrawals.)

Can I Contribute to a Mega Backdoor Roth?

Now that you understand the strategy, the next question many ask is, can I participate?

There are three primary questions you should ask.

- Does my employer allow after-tax contributions to a 401(k)?

- Are my total contributions (both employee and employer) under the 2021 cap of $58,000? (For those 50 and older, the upper threshold is $64,500 due to $6,500 of potential catch-up contributions)

- Does my cash flow allow for additional retirement savings? (We’ll address this point later in the post)

For a more comprehensive answer to your own specific situation, download a FREE detailed flow chart: Can I Make a Mega Backdoor Roth IRA Contribution in 2021?

The Pros and Cons of the Roth IRA

As with any financial decision, there are pros and cons of a Roth account that must be weighed with your own goals and circumstances in mind before the optimal strategy is clear. Let’s look at both the tradeoffs and benefits of the Roth account.

Cons of a Roth IRA

- No immediate tax benefits. Contributions are made after-tax.

- Income limits. With a Roth IRA, contributions begin to phase out above $125,000 of income (MAGI) for individuals and $198,000 for those filing taxes as married (completely phases out at $140,000 and $208,000 for single and joint filers, respectively).

- Low maximum contributions. IRA contributions are limited to $6,000 for those under age 50 and $7,000 for those over 50.

Thankfully, the Mega Backdoor Roth 401(k) solves the last two issues!

Pros of a Roth IRA

- Earnings grow tax-free

- Withdrawals are made tax-free

- No RMD’s (Required Minimum Distributions) on the account.

Consider the significant advantages of the Mega Backdoor Roth: you can realize both tax-deferred growth while the money is invested, plus when you retire, the money you withdraw will be tax-free.

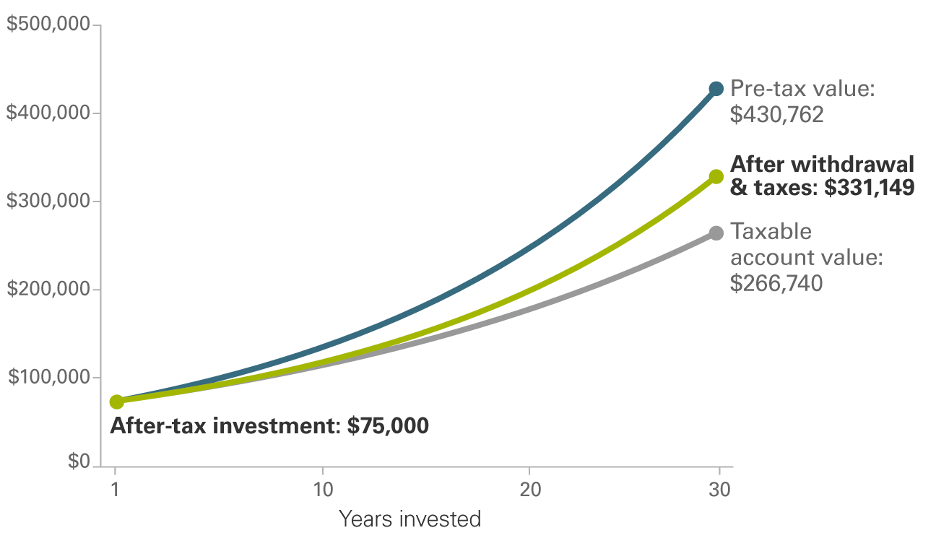

Due to compounding, the benefits of this tax-free status really can add up. Consider the following hypothetical example for Vanguard on the difference in final value between a tax-free (Roth), tax-deferred (i.e. taxes are due when your money is withdrawn like a traditional IRA or 401(k)), and fully taxable account.

In this example, a $75,000 investment grows to a final balance after 30 years that is nearly $100k greater with a tax-free account (Roth) than a tax-deferred account (Traditional IRA or 401k) and nearly $170k greater than a taxable account.

Source: investors.vanguard.com

Case Study: Incorporating the Mega Backdoor Roth 401(k) Into Your Strategy

Obviously, not everyone can afford to fully fund annual contributions to a Mega Backdoor Roth out of their salary.

That’s where your equity compensation via RSUs or Stock Options can come into play. Perhaps it makes sense to draw from a taxable account, your RSUs, or cash in your ESPP shares so that you can fund a Mega Backdoor Roth.

You can prepare for this decision by conducting a detailed cash flow planning exercise with a spreadsheet or a qualified financial adviser.

Before you make a large contribution, ask yourself:

- Can my cash flow support it? Make sure the loss of income doesn’t hamper your ability to pay for routine living expenses

- Do I have an emergency savings account? Always a good idea to maintain a cash buffer of about 3-6 months of living expenses.

- Do I have any large expenditures on the horizon? Don’t be caught off guard when tax season arrives and a large cash payment is required.

Let look at a case study.

Situation

Ramesh and Riya are both in their early forties and L5 Software Engineering Managers at Amazon. Their total income (MAGI) from all sources of $450,000 leaves them unable to make traditional Roth contributions.

They are both maxing out their 401(k) with contributions of $19,500 each and receive $3,000 in matching contributions on the base salary from Amazon. They feel they can save another $10,000 each annually towards retirement, but living expenses, including a new home and childcare, prevent them from saving any more.

In addition to their base salary, both receive $70,000 in stock compensation via RSUs and $36,000 in bonus income annually.

Strategy

After consulting with their financial advisor, the following strategy is developed to increase their retirement savings and reduce their tax bill in retirement.

First, Ramesh and Riya both elect to participate in Amazon’s HSA plan and contribute the maximum allowable amount for a family in 2021—$7,200 (increase to $7,300 in 2022). This takes up the majority of the $10,000 of additional savings they thought they had available, but funding their HSA account is priority one as this account has been called the “Taj Mahal of retirement savings accounts” with its triple tax advantage of pre-tax contributions, tax-deferred growth, and tax-free withdrawals.

Next, it’s identified that they have an opportunity to contribute another $15,500 in after-tax 401(k) contributions. Amazon limits Mega Backdoor Roth contributions to 10% of your base salary, so in this situation, the $15,500 available is less than the $35,500 under IRS rules (The $58k IRS annual limit minus their contributions of $19,500 and Amazon’s contribution of $3,000).

While they can’t fund this amount of out of their cash flow, they do have RSU shares that are vesting each year of about $70,000 each. In past years, they’ve sold enough shares to pay the taxes in the RSU shares as they’re due and held the remaining stock. And, thankfully, Amazon’s stock price has had a good run from which they’ve benefitted. However, at this point, they are becoming worried about continuing to increase the percentage of their net worth in their employer’s stock.

So, it’s decided that as the RSU shares vest each year, at least $15,500 of shares will be sold each to supplement their cash flow so that they can defer this amount in after-tax contributions to fund their Mega Backdoor Roth accounts. It’s important to note that if RSU shares are sold at vesting, this doesn’t increase your tax bill today as the shares are taxed as income at vesting.

In summary, Ramesh and Riya take the following actions:

- Use the extra cash flow to fully fund their HSA accounts

- Use vesting RSUs to maximize their available Mega Backdoor Roth contributions of $15,500

- Begin managing their concentration risk in Amazon shares by periodically selling the RSU shares at vesting.

Does your Company Offer the Mega Backdoor Roth?

Many of the largest Tech companies now offer this benefit to their employees, including Amazon, Google (Alphabet), Microsoft, Apple, Intel, Facebook, Uber, and Salesforce. For a more comprehensive list, see this page at Levels.fyi.

Action Items and Next Steps

As anyone familiar with Cordant could attest, we’re big fans of the maxim “knowledge is power, but knowledge without action is useless.”

If you think the Mega Backdoor Roth option may be right for you, here are your action items:

- Check with your HR department or plan documents to find out if the Mega Backdoor Roth is part of your 401(k)

- Calculate how much you can contribute in after-tax contributions based on your plans contribution limits and current 401(k) contributions

- Determine how much you can afford out of cash flow and other sources (including RSUs) to fund these contributions