Like any major corporation, Microsoft’s compensation package includes various programs and benefits for its employees. And while the Microsoft benefits package can be quite valuable, in most cases, it does require a fair amount of time, planning, and intentionality to take advantage of them and incorporate them into your overall financial strategy.

In this article, we’ll break it down for you by covering:

- The various forms of compensation at Microsoft

- The host of programs available to Microsoft employees to boost their savings

- The insurance and home & family benefits available to you

How Microsoft Employees are Paid

Your compensation at Microsoft consists of a salary, an annual bonus, and RSUs.

Microsoft Compensation: Salaries

Like any company, your base salary at Microsoft is determined by your role and experience. Common roles at Microsoft are Software Engineer, Product Manager, Solution Architect, Data Scientist, Software Engineering Manager, and many others. Within these roles, Levels are used to measure capability and experience.

For example, in the Software Engineer role, an entry-level employee may come in as a Level 59 and, throughout their career, progress to a Principle SDE (Software Development Engineer) at Level 67, where they become eligible for Deferred Compensation (discussed later in the article).

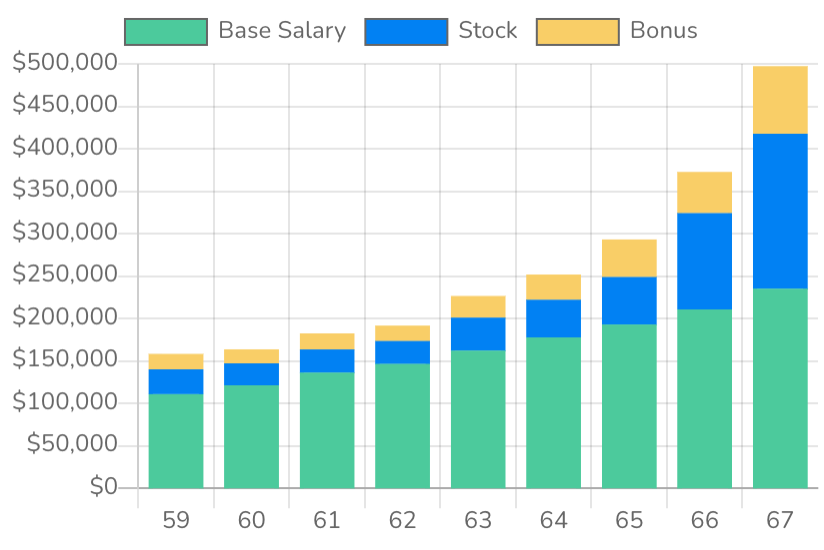

As you increase grade level (and total compensation), the variable component of your compensation (bonus and RSU income) becomes a greater percentage of your total compensation.

For example, base salary makes up around 70% of total compensation for the typical Level 59 Software Engineer versus less than 50% for a Level 67 Principle SDE. See the chart below.

Source: Levels.fyi

Planning opportunities with salary: Contribute to your 401(k), HSA, and (for those Level 67+) Deferred Compensation accounts to reduce your taxes today. Fund your ESPP account.

Microsoft Compensation: Bonuses

Bonuses are paid annually in September at Microsoft and typically range from 0-40% of your base pay. The higher your level, the higher percentage of your total compensation this cash bonus will represent. For example, for a Level 59 Software Engineer, the cash bonus might add 15% to their base salary, while at Level 67, it might add up to 30%.

Microsoft Compensation: RSU’s

Stock compensation at Microsoft is offered via RSUs. Restricted Stock Units vest over time and are taxed as income at vesting. Think of them as a cash bonus with an upside tied to the stock performance of your employer.

At Microsoft, annual stock awards are given out each August and vest over five years (20% each year). Vesting happens quarterly in February, May, August, and November.

On-hire stock awards typically vest over four years (25% per year), with the first vesting coming one year after your hire date.

Like with bonus income, the higher the level, the higher the percentage of your total compensation RSUs. So, for example, for someone at Level 59, stock compensation in the form of RSUs may be 25% on top of their base salary vs. 80% at Level 67.

Because of this quarterly vesting and new shares award, Microsoft employees with tenure at the company will have significant taxable income from RSUs each year and the potential, if the shares are sold, to have significant additional cash flow.

For savvy Microsoft employees, this additional cash flow can be combined with other benefits (like the Mega Backdoor Roth 401k) to maximize your financial wealth.

Planning opportunities with RSUs: Use RSU income to maximize contributions to other benefits programs. Incorporate tax planning with your RSU vesting schedule to minimize taxes.

Microsoft Compensation: Savings Opportunities

Microsoft 401(k)

Like most companies, Microsoft’s 401(k) is one of the first accounts you should consider saving money into. Microsoft matches 50% of your contributions up to the annual IRS limit of $19,500 for 2021 (or $26,000 for those over 50, thanks to the additional $6,500 catch-up contribution). This means that for those contributing the maximum of $19,500, Microsoft would contribute another $9,750 towards your retirement savings.

For a Level 59 Software Engineer at Microsoft, this full matching contribution from Microsoft is like an 8% raise!

Planning opportunities with the 401k: Maximize your contributions to get the maximum employer match. If needed, use cash flow from RSUs to max out your 401(k).

Microsoft Mega Backdoor Roth 401(k)

The Mega Backdoor Roth 401(k) is a fantastic way to boost your retirement savings. Here’s how it works at Microsoft:

For an employee under 50, the maximum pre-tax 401(k) contribution is $19,500, which Microsoft would then match with its contribution of $9,750. But, the IRS allows total contributions into a 401(k)—both pre-tax and after-tax—of $58,000 in 2021.

This leaves a gap of $28,750 that can be filled with an after-tax contribution and then converted within the 401(k) to a Roth.

While you get no tax deduction today for these additional contributions, the power of the Roth account is that the money grows tax-deferred and is tax-free when you pull it out at retirement.

Planning Note: In some of the proposed tax changes currently in Congress for 2022, this Mega Backdoor Roth option is eliminated. 2021 could be your last chance to participate.

Microsoft ESPP

Microsoft’s ESPP (Employee Stock Purchase Plan) allows employees to contribute up to 15% of their salary to purchase Microsoft shares. These shares are purchased through the ESPP program at a 10% discount to market prices.

As we’ve written before, if your employer offers an ESPP, you should jump at the opportunity to participate—it really is free money. In this case, you can purchase $100 worth of stock for $90 and immediately sell it at the end of the offering period for a tidy profit of 11%—way more than you can earn on a bank account these days—making this a good choice to fund short term savings goals.

For more about how ESPPs work, how they are taxed, and how to incorporate them into your overall wealth-building strategy, see our article Employee Stock Purchase Plan (ESPP): The 5 Things You Need to Know.

Planning opportunities with the ESPP: Enroll! Get the 10% bonus on your savings.

Microsoft Deferred Compensation

Deferred Compensation at Microsoft is available for employees at Level 67 and higher.

These plans come with a couple of tax benefits. First, contributions in the plan get invested and grow tax-deferred. And second, you can defer income today to years in the future when you may potentially be in a lower tax bracket.

At Microsoft, eligible employees can defer up to 75% of their base salary and 100% of the bonus into the deferred compensation program. The window for salary deferral contribution elections for the following year is typically November.

Deferral elections for the next fiscal year’s annual bonus are made in May for the bonus period from 7/1-6/30. These contributions are credited to your Microsoft Deferred Compensation account on 9/15 for the prior period.

The money is distributed per a pre-elected distribution schedule, typically either a set number of years (e.g., 10 years, 15 years, etc.), at retirement or upon leaving the company.

With all deferred compensation plans, it’s important to remember that they are unsecured liabilities and subject to the company’s credit risk. Care should be made to balance the tax benefits versus your total exposure to Microsoft via stock, salary, and deferred compensation, the percentage of your net worth in the plan, and the credit health of Microsoft.

For more information on balancing the risks of deferred compensation plans, see our post, Three Risk Reduction Strategies for Deferred Comp Plans.

Microsoft Compensation: Insurance & Health Benefits

Microsoft HSA & FSA

The HSA (Health Savings Account), the only triple tax-advantaged account (Pre-tax, Tax-Deferred Growth, and Tax-Free withdrawals), is available for Microsoft employees in a High-Deductible health plan. Microsoft will contribute $1,000 per year to this account. The annual limits for 2022 contributions in this account are $3,650 for an individual or $7,300 for a family.

The Flexible Spending Account (FSA) allows participants to set aside pre-tax dollars to pay for qualified medical expenses (including dental, vision, and dependent care expenses).

Microsoft Health Care Benefits

Microsoft offers Health, Vision, and Dental insurance at no cost to the employee. Additionally, they offer the ability to participate in FSA and HSA programs for employees to set aside pre-tax dollars for medical expenses.

Life Insurance

Microsoft carries life insurance, at no cost to the employee, at 2x your salary. Additional life insurance up to 10x your salary (not exceeding $2.5M) can be purchased. The premiums are age-based, and while a health exam is typically not required for lower coverage amounts, it may be required at higher coverages. Additional coverage can also be purchased for spouses and children up to age 26.

Life insurance policies are not portable, meaning if you’re planning on leaving Microsoft, it would be best to have additional coverage elsewhere if needed.

Gym/Wellness Reimbursement

Through the “Stay Fit” program, Microsoft will reimburse employees up to $1,200 per year in wellness-related expenses. In addition to the traditional gym membership, this program can be used to cover the costs of meditation, weight-loss programs, caregiver support, and financial advising (hey, that’s us!).

Microsoft Compensation: Home & Family Benefits at Microsoft

Microsoft Relocation Package

The relocation package at Microsoft can be offered at any level for employees moving more than 50 miles. While flexible per situation, the packages are typically structured in two ways.

Relocation Assistance (Reimbursement)

- Relocation allowance of $2-$5k to cover typical moving expenses like new deposits, changing addresses, etc.

- Moving costs

- Flights

- Temporary housing (typically two months)

- Temporary Transportation

Lump Sum

- Single cash payment to cover the expenses listed above

- Typically range from $12,000 for a cross-country move to $25,000 for an international move

Additionally, Microsoft may cover housing-related costs such as house hunting and closing costs for homeowners. For renters, it covers the costs of breaking your old lease.

Microsoft Sabbatical Policy

Microsoft offers a sabbatical program for eligible employees. After ten years of service with the company, these employees are eligible for a paid, eight-week sabbatical and standard paid time off.

Maternity/Paternity Leave

At Microsoft, birth mothers are entitled to 20 weeks of paid time away. All other new parents are entitled to 12 weeks of fully paid leave. This leave is included for adoption and foster parents as well. Leave can be split and must be used in the first year.

Microsoft Childcare Reimbursement

Microsoft reimburses up to 160 hours of childcare care expenses. The company has offered this benefit for a long time but substantially increased the hours it reimbursed in 2019.

Adoption, Fertility, Immigration Assistance

According to TechRepublic, “Starting in January 2018, [Microsoft] began offering assistance with fertility treatments; covered expenses include three fertility treatment cycles, genetic testing, and egg/embryo freezing and storage for up to four years.”

Additionally, “Microsoft offers adoption assistance up to $10,000 per child, and covers some surrogacy-related expenses.”

Paid Family Leave

According to Microsoft’s benefits page, Employees can take “four weeks of fully paid leave to care for an immediate family member with a serious health condition. You can also take up to an additional eight weeks of leave paid under the Microsoft’s voluntary Washington Paid Family Leave plan, for 12 weeks of leave per leave year.”

Charitable Donation Matching

If you’re charitably inclined, this is a benefit you don’t want to miss. Microsoft will match up to $15,000 annually for gifts of stock or cash to a charity of your choice. Additionally, Microsoft will donate $25 per hour worked by an employee at an eligible organization.

Planning opportunities with charitable donations: Donate low basis shares in order to reduce your capital gains taxes and get the Microsoft match.

Tuition Reimbursement

Microsoft offers up to $10,000 annually to cover the cost of tuition, books, or fees at an accredited institution.

Final Thoughts and Action Items

As financial advisors, our job at Cordant is to accelerate our clients’ progress toward their definition of financial success.

And optimizing the benefits available to you at Microsoft is one way to do just that.

Whether you work with an advisor or not, ensure you take full advantage of the compensation, savings, health, charitable, and other benefits available to you.

Action Items:

- Review the benefits you qualify for and plan to maximize how you use them

- Fund your 401(k) to the maximum extent possible to maximize your match from Microsoft

- Participate in the Microsoft ESPP plan and get the discount

- If you give charitably, take advantage of Microsoft’s matching program

This information is supplied from sources we believe to be reliable. However, this information is subject to change without notice, and we cannot guarantee its accuracy. Please reach out to your benefits department for the most up-to-date information. Cordant is not affiliated with Microsoft.