Every November, the Microsoft Deferred Compensation Plan (DCP) opens for enrollment and salary deferral elections for the upcoming year.

And every year, we hear similar questions from those eligible to allocate money into a deferred compensation plan.

This post provides an overview of the program and outlines the four questions we hear each year.

The Four Key Deferred Compensation Plan Questions:

- What’s the risk of the Microsoft DCP?

- Second, what’s the magnitude of the tax benefit from deferring income?

- Third, should I participate, and how much should I defer if so?

- Finally, what distribution schedule should I elect?

We’ll start by laying out the specifics of Microsoft’s DCP program and highlight any changes from 2021 when they are announced. And as promised, we’ll make several resources available to you throughout this post, or you can download them below.

Free Resources

- Issues to Consider When Getting a Raise or Promotion (pdf)

- Cordant Whitepaper – The Tech Employees Guide to Deferred Compensation (pdf)

Microsoft DCP Program Specifics

The Microsoft Deferred Compensation Plan is available to employees at level 67 or higher and working in the United States as part of an eligible company.

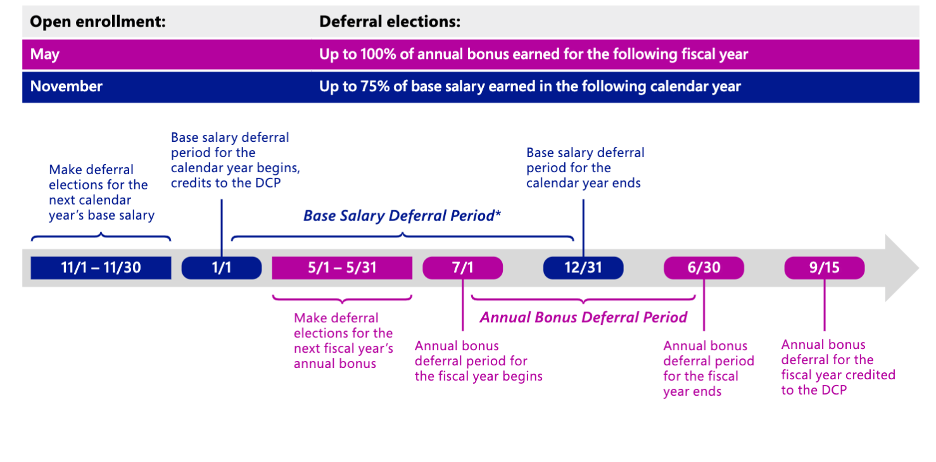

As mentioned above, the enrollment window is open from November 1st through November 30th for base salary deferrals. Salary deferrals start on January 1st and end on December 31st of the next calendar year.

Deferral elections from income from your Microsoft annual bonus happen during the month of May with the annual bonus period running from July 1st through June 30th. The deferred income from the annual bonus is credited to your account on September 15th of each year.

Source: Microsoft DCP Handbook 2020

Contributions: How much can I defer?

- Salary: 0–75% of base salary (in 1% increments)

- Bonus: 0–100% of annual bonus or Executive Incentive Program cash award (in 1% increments)

- New Hire Deferrals: New hires can also elect to defer up to 90% of certain compensation if this election is made prior to their hire date.

Distributions

You can elect to distribute your deferred compensation while still employed by Microsoft or after your employment ends.

You must make two choices regarding your DCP distributions: the distribution date and how the balance will be paid out. We’ll cover these below.

Choice #1 – Distribution Date

You can elect a different distribution date for your salary and bonus. The options are:

- Month and Year: Your first option for the timing of your distribution is to select a specific month and year for the distribution. You must defer compensation for at least 12 months.

- “At Termination”: Funds begin being paid out when you leave Microsoft.

A Special Planning Opportunity for Microsoft DCP Distributions

A somewhat unique feature of the Microsoft DCP program is the flexibility in the ability to re-defer distributions. If you elect a specific month/year for your distribution, you are allowed to change that date as long as it’s extended at least five years, and this election is made more than 12 months before the scheduled distribution.

This can be an attractive option for employees who are many years from retirement. Instead of deferring until retirement and spreading the payouts over 15 years, rolling distributions by five years allows these employees to manage the credit risk and concentration risk that can build up via many years of deferrals into a DCP.

Other Special Cases are made in the case of Death or Disability. In this case, the funds will be paid out to your beneficiaries in a lump sum within one month for deferrals made prior to 2014 or within six months for deferrals made after 2014.

Choice #2 – Distribution Period

Here you have two options:

- Lump-Sum Distribution: The deferrals elected for lump-sum distributions are paid out 100% in that year.

- 3 to 15-year installments: The balance is paid out in annual installments per the number of years elected.

The longer the distributions are deferred, the greater the tax benefit, but the more risk you take. So next, let’s look at how to quantify that risk.

What’s the Risk of the Microsoft Deferred Compensation Plan?

As a non-qualified deferred compensation plan, your DCP account is, by rule, an unsecured liability of Microsoft. This means that if Microsoft goes bankrupt, you could lose part, a majority, or all of your balance in this account. By participating, you become a creditor of your employer—and lower in priority than any creditor whose loan is secured by the company’s assets.

This is the primary risk and the main drawback of participating in the Plan.

So, how do you think about assessing this risk to capture potential benefits?

We like to think about this in terms of factors specific to Microsoft and factors specific to your personal situation.

Microsoft-Specific Risk Factors

The key question here is how likely it is that Microsoft will default on its deferred compensation obligations and the magnitude of the default if so.

We recommend assessing company-specific risk by looking at three things:

First, how likely is any publicly traded company to file bankruptcy?

On average, about 2% of companies file for bankruptcy each year, although that’s higher in years where there is a recession and lower in non-recessionary years.

Secondly, what happens in the case of bankruptcy?

In many cases of bankruptcy, the company reorganizes, makes good on its liabilities, and pays some or all of its deferred compensation obligations. Here are a couple of examples from past corporate bankruptcies:

- CIT Group – November 2009 Chapter 11 bankruptcy. Executive benefits, including deferred compensation plans, survived intact.

- GM – June 2009 Chapter 11 bankruptcy. Participants received a two-thirds “haircut” of any benefits in excess of $100,000 annual distributions.

Lastly, how likely is Microsoft to file for bankruptcy?

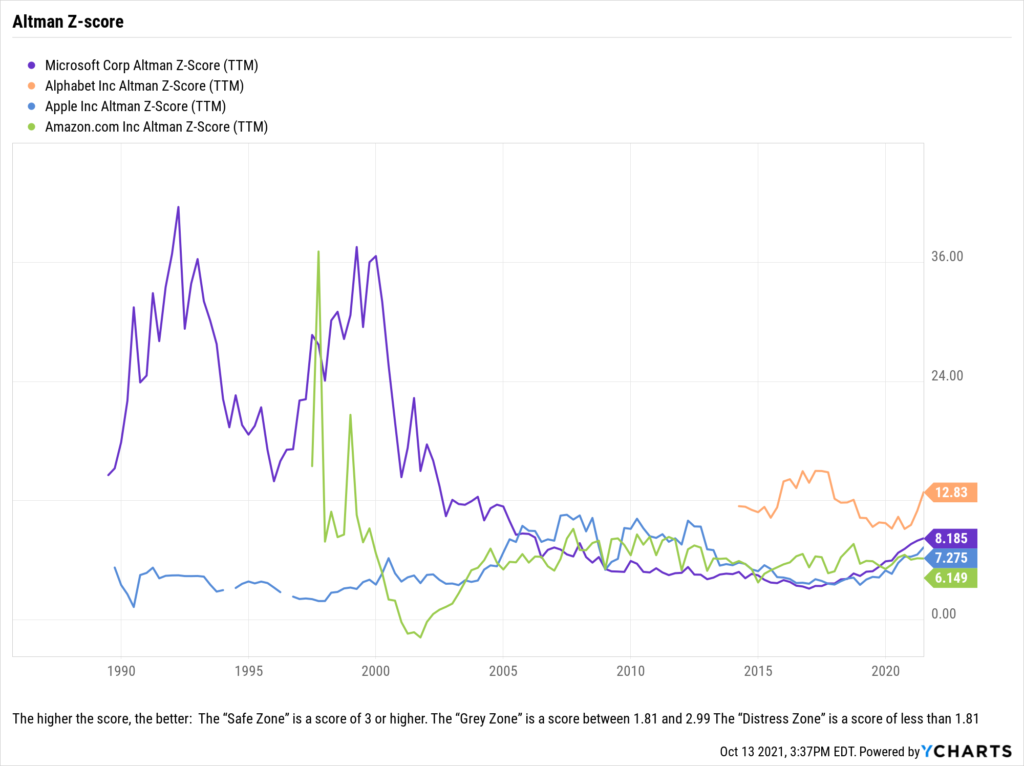

The Altman Z-score, developed by NYU Professor Edward Altman in the late 1960s, is a metric devised to assess a firm’s bankruptcy risk. Altman’s Z-score uses a blend of publicly available financial statement information (working capital, retained earnings, profit, market value, assets, and liabilities) to predict companies’ bankruptcy risk (at least in the near term).

The higher the score, the better:

- The “Safe Zone” is a score of 3 or higher.

- The “Grey Zone” is a score between 1.81 and 2.99

- The “Distress Zone” is a score of less than 1.81

Currently, Microsoft’s Altman z-score is 8.19, which has been trending up since reaching a low around 2017. This score puts them in the safe zone and above (“safer than”) other Tech giants such as Apple and Amazon.

Microsoft appears safe in the short term, but with deferred compensation plans, we need to look out for years in the future. Here is where factors specific to you as an individual come into play.

Personal Risk Factors

In addition, to assess the risk of Microsoft, you should determine three personal risk factors.

- Your distribution timeline. The longer you defer the money, the greater the benefit from the tax deferral, but the more risk you take.

- Action item: Calculate your distribution timeline for prior deferrals

- Your current exposure to Microsoft. This includes money in the deferred compensation plan in addition to Microsoft stock (RSUs, ESPP shares, other shares) and any Microsoft options.

- Action item: Calculate total exposure to Microsoft (DCP balance + Market Value of Microsoft Stock + Microsoft Options / Total Net Worth)

- What percentage of your total net worth is in the DCP account? The higher the percentage, the greater the risk and the more cautious you should be about deferring additional income.

- Action item: Calculate DCP balance as percent of total net worth (DCP balance / Total Net Worth)

If, after doing these calculations, you are concerned about your total exposure to Microsoft, see the risk reduction strategies outlined here for deferred compensation plans.

Three Remaining Microsoft Deferred Compensation Plan Questions

The other key questions we hear each year with deferred compensation are:

- What are the tax benefits?

- How much should I defer?

- What distribution schedule should I elect?

For more information on each of these, you can download our full guide here.

The information contained in this post is based on Cordant’s understanding of the Microsoft DCP plan as of the time it was written. The Plan is subject to change by Microsoft. Please see your latest Plan document for the most up-to-date information.