Restricted Stock Units (RSUs) are a popular form of equity compensation at many companies, including Microsoft. They can be used to motivate employees and align their incentives with those of the company by allowing them to share in its success.

In this guide on Microsoft RSUs, I’ll explain:

- How Microsoft RSUs work

- Tax savings strategies for your RSU income

- And, why you should incorporate them into your investment strategy

What is a Restricted Stock Unit (RSU?)

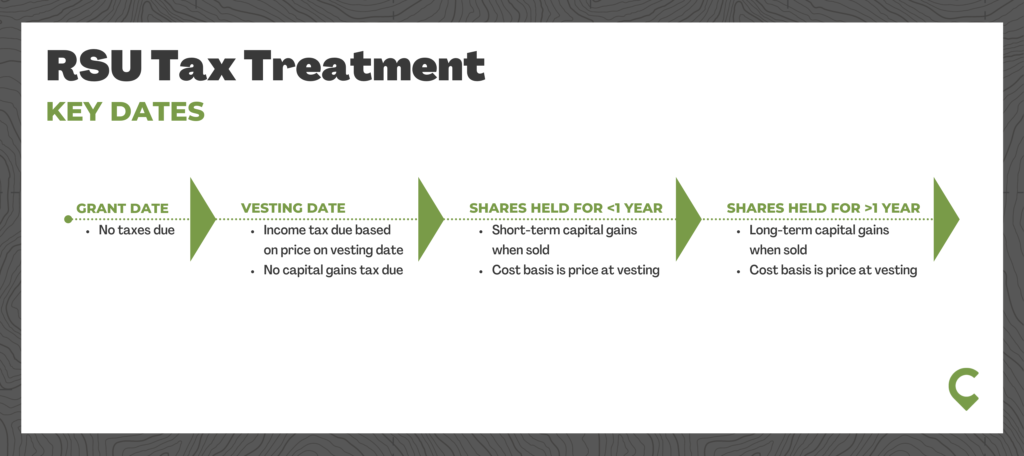

RSUs are a form of compensation similar to your salary or a cash bonus. However, they differ in that, as equity compensation, RSUs are tied to the price of Microsoft’s stock, meaning their value to you can increase or decrease over time. The two critical dates associated with RSU compensation are the grant date and the vesting date.

- The Grant Date: The date Microsoft promises the “restricted” shares of stock to you.

- The Vesting Date: When the shares are no longer “restricted” and are owned by you.

On the vesting date, RSUs are taxed as ordinary income and will not receive special tax treatment as capital gains do. Because RSUs are taxed as regular income when they vest, it’s helpful to consider them as cash bonuses with an upside. Ask yourself the following question: If Microsoft paid me a cash bonus, would I take that bonus and buy shares in the company? If not, you should sell the shares at vesting.

How Microsoft RSUs Work

There are two primary types of Microsoft RSUs granted—on-hire stock awards and annual stock awards.

Additionally, certain employees may receive, from time to time, extra RSU grants as part of performance rewards, leadership awards, retention or stock refreshers.

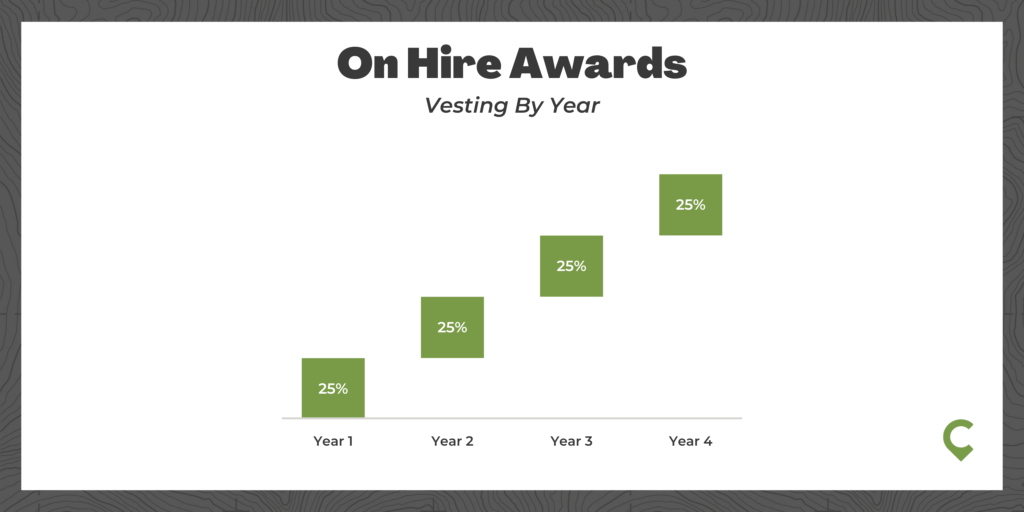

- On-hire stock awards are granted when you are hired and vest (typically) 25% per year over four years. Your first vesting will happen on your first anniversary with the company.

- Annual stock awards vest over a five-year period (20% per year) and vest every quarter. This means that 5% of your total award will vest each quarter. At Microsoft, RSUs vest in February, May, August and November.

Here’s an example of how RSUs at Microsoft work in practice:

- Ellie Engineer was granted 1,000 RSU shares in December 2021.

- 20% of Ellie’s RSUs (200 shares) vest in 2022 (50 each quarter in February, May, August and November).

- Assume the stock price is $250 on each of the vesting dates. This becomes Ellie’s cost basis if he holds the shares.

- Ellie will owe taxes on $50,000 of RSU income for 2022.

- Since Ellie is in the 35% Federal tax bracket, her total tax bill on these shares is $17,500.

Vesting Schedule for Microsoft RSUs

As mentioned above, Microsoft has two types of RSU vesting schedules.

On-hire stock awards vest annually over a period of four years.

Annual stock awards vest quarterly over five years.

Due to the different vesting periods, it’s important to include RSU income as part of your tax estimates and cash flow planning.

In the RSU strategy section below, we’ll cover ideas to use RSU income as a tool to reduce your tax bill and increase your retirement savings.

How Many RSUs Does Microsoft Give?

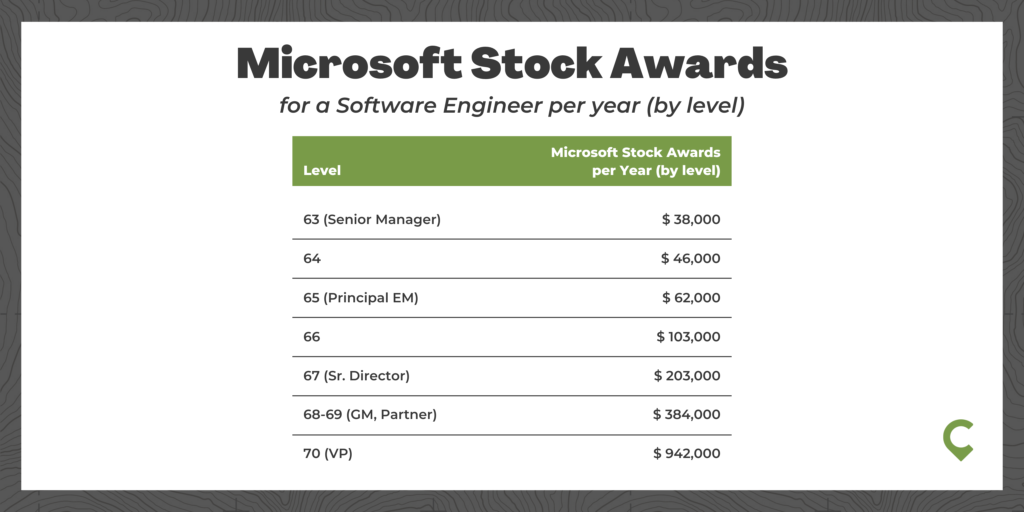

The amount of your ongoing RSUs grants will vary by your grade level and position.

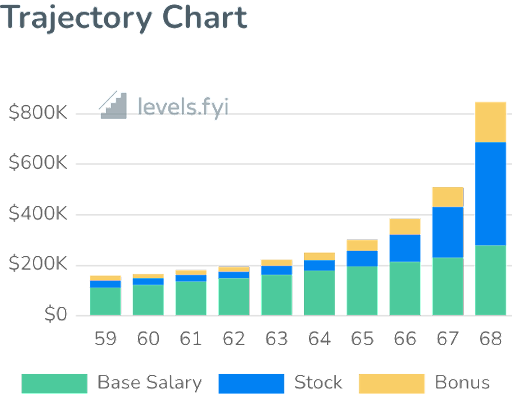

For example, a level 59 Software engineer at Microsoft should expect around 18% of their total compensation to be in the form of RSU. At level 67, stock compensation increases to around 40% of your total compensation.

The mix of salary, bonuses and RSU (stock) income by level for a Software Engineer at Microsoft can be seen in the chart below from levels.fyi.

Again, according to data from levels.fyi, the average Microsoft stock awards by level for a Software Engineer role are as follows.

RSU Taxation for Microsoft Employees

Compared to other versions of equity compensation (stock options and ESPP), restricted stock unit (RSU) taxation is pretty straightforward.

Your Microsoft RSUs are taxed:

- As ordinary income to you in the year they vest.

- If you sell your shares immediately, there is no capital gain tax, and you only pay ordinary income taxes.

- If the shares are held beyond the vesting date, any gain (or loss) is taxed as a capital gain (or loss).

The tax treatment of RSUs is the same as if you were to receive a cash bonus (on the vesting date) and then immediately used that cash to buy your company’s stock.

By framing your Microsoft RSUs as a cash bonus, you will be well on your way to mastering RSU taxes.

A summary of the key dates for RSU taxes is below.

👉 Download your free RSU Tax Calculator (excel)

RSU Tax Strategy for Microsoft Employees

Remember, because RSUs get taxed as income in the year they vest, there is no strategy to reduce your RSU taxes directly.

However, as we’ll share below, with some proactive planning, you can use your RSUs to offset other income (thereby reducing your total tax bill) or delay capital gains taxes.

Let’s dive into the four (4) unique RSU tax strategies you can use as a Microsoft employee to reduce your tax bill today.

1. Using Microsoft RSUs to MAXIMIZE Tax-Deferred Contributions

Contributing to your Microsoft 401(k), Deferred Compensation (available to grade level 67 and higher), or an individual retirement account (IRA) reduces your taxable income in the current year.

You can use your RSUs to boost your retirement savings and reduce taxes today.

Let’s look at a simplified example.

- Marcia, a grade 67 Microsoft employee, has 500 vested Microsoft RSUs worth $150/share and no capital gains.

- She sells her RSUs, netting her $75,000.

- She uses this money to max out her 401(k) and IRA contributions and the rest to fund her Deferred Compensation account.

- By doing this, she reduces her taxable income in the current year by $75k, which saves her over $26k on her federal tax bill!

- Additionally, by selling her Microsoft shares, she diversifies her investment portfolio and boosts the amount of money she has in tax-advantaged accounts.

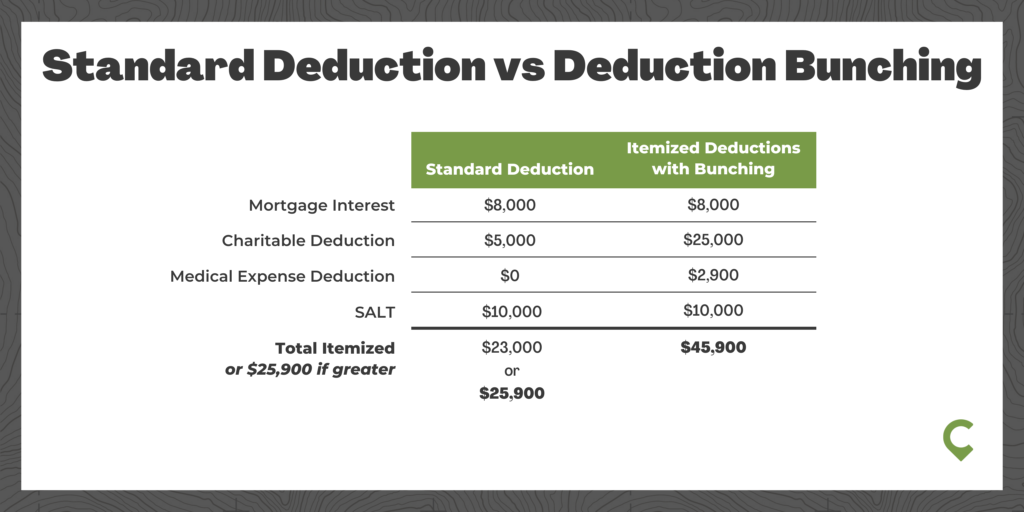

2. Deduction Bunching

Deduction bunching is squeezing as many deductions as possible into one tax year to boost itemized deductions above the standard deduction amount (in 2022, $25,900 for couples and $12,950 for individuals) and therefore minimize taxes in that year.

The most common itemized deductions are:

- Mortgage interest

- Charitable donations

- Medical expenses

- State and local taxes (known as SALT deductions), including real estate taxes

Because SALT deductions remain capped at $10k, and mortgage interest doesn’t lend itself to bunching, the opportunities here are mainly with charitable donations and possibly with medical expenses.

Let’s look at an example.

- Marcia and her husband Mark are Microsoft employees who give $5k annually to charities and have some known upcoming medical expenses.

- Additionally, they will have $50k of RSUs vest in 2022 but typically take the standard deduction of $25,900

- By using their RSU to fund the next five years of charitable giving in the current year and pulling forward their known medical expenses into the current year (think elective procedures where the timing is somewhat flexible and can be paid upfront, like braces), they can boost deductions and save on taxes.

The bunching strategy results in an additional tax deduction of $20,000 in the current year with no reduction in subsequent years (since you will use the Standard Deduction) and saves you nearly $7,000 on your tax bill today.

3. Donor Advised Funds (DAF)

Let’s say you have the ability to pull five years of charitable giving forward, as in our example above. But, like many people, you would still prefer to give the funds over the five years while getting the tax deduction.

How can you achieve this? Enter the donor-advised fund (DAF).

Here is a quick summary explaining how a DAF works:

- Open a charitable fund in your name

- Contributions to the fund are deductible in the year received

- Assets can be invested and grow tax-free

- Grants can be made to charities at any time in the future

Moreover, highly appreciated securities can be used to fund a DAF—not only scoring a tax deduction in the funding year but also avoiding capital gains tax on the donated securities.

Essentially, utilizing a DAF allows the charitable bunching strategy combined with the capability to give as you typically would. The only downside is that you must be able to fund the account upfront, and the donation is irreversible. Once you’ve funded a DAF, the money must be given to charity.

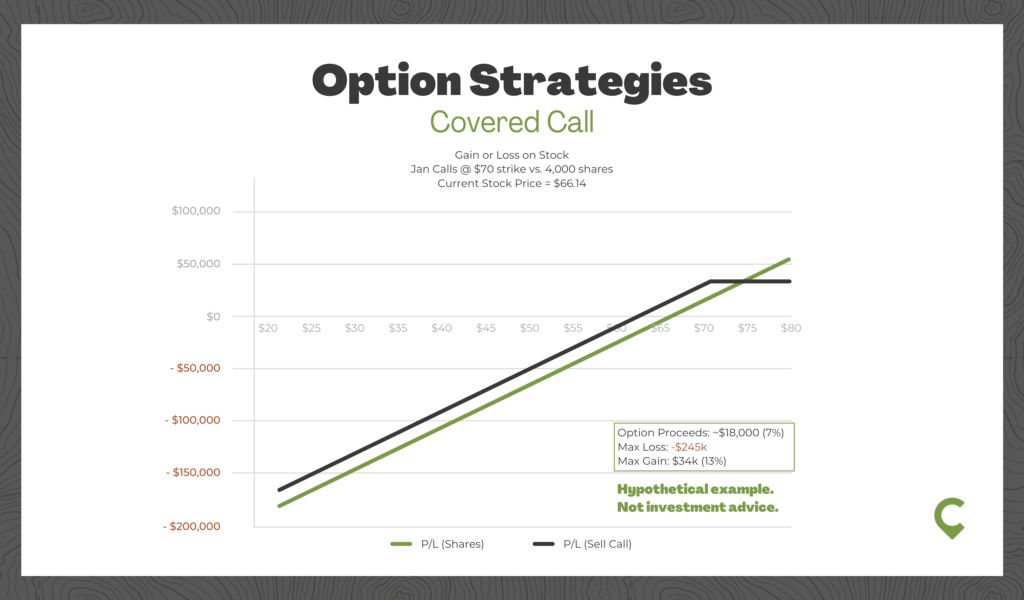

4. Defer Taxes by Hedging With Options

Lastly, for those with highly appreciated shares, options can be a way to hedge your exposure while deferring your tax bill.

A quick caveat—options can be risky and should be fully understood before implementing any strategy. Additionally, like with anything, there is no free lunch. Hedging a position comes with tradeoffs, even if generating income in the process.

Let’s look at a couple of the most common strategies: The covered call and the collar.

Covered Call

Under this strategy, call options are sold above the current price (called out of the money). This generates income but caps your potential for gain with essentially all the risk of loss remaining.

By giving up your upside in the stock and getting paid a premium for doing so, you are using your Microsoft stock to generate income. But remember, you will still share in the losses if the stock price drops.

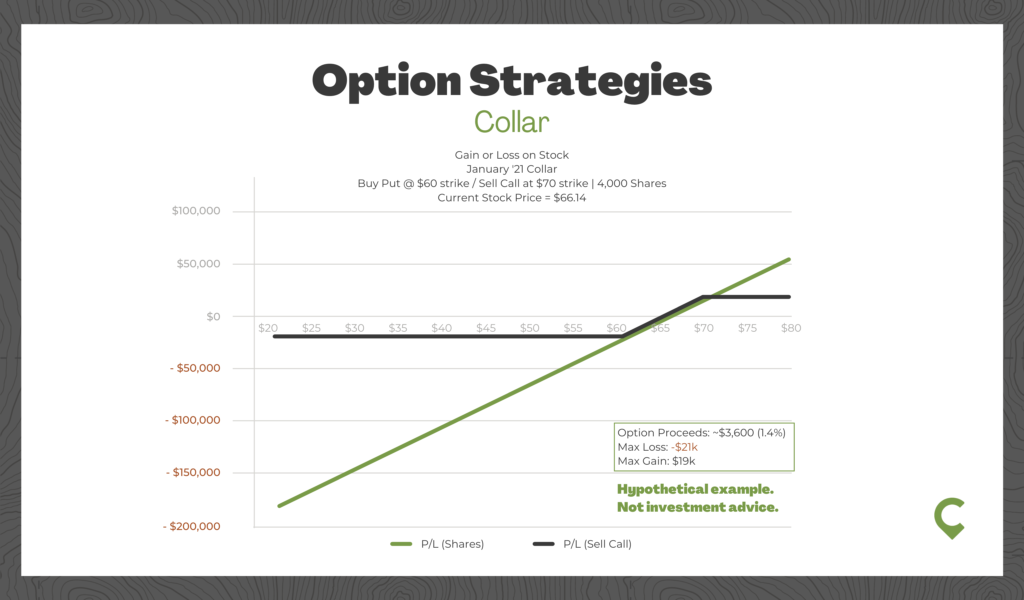

Collar

Unlike the covered call strategy, a collar strategy does hedge the downside by buying a put. However, instead of just buying a put (which is expensive), a call is also sold to offset some or all of the costs.

Either of these strategies could be suitable for your given situation, but the point is they aren’t without risks and tradeoffs. However, they could help you defer the sale of your RSUs until a more favorable time.

Advantages and Disadvantages of RSUs

While everyone loves additional compensation ( 🎉), there are a few pros and cons to be aware of with your RSU income.

Benefits of RSUs

- Upside: Because the value of your RSUs is tied to Microsoft’s share price, if the company does well and the stock price increases, you get to share in the upside of the company.

- Retains Value: Unlike stock options, whose value can be quite volatile and may expire worthless (when the stock’s value is less than the strike price), your RSUs will always have value at vesting as long as the stock is trading above $0.

- Simple: Compared to other forms of equity compensation, the mechanics of RSU and their tax treatment is pretty straightforward.

Drawbacks of RSUs

- Downside: The flip side of participating if Microsoft’s stock does well is sharing the downside if the stock price declines. Your RSU income falls as the price of the stock drops.

- Vesting Period: The shares aren’t yours until the vesting period is met. You will forfeit this income if you leave the company before your RSU shares are vested.

- Taxes: RSUs have no favorable tax treatment and are taxed at your marginal income tax bracket.

Incorporating RSUs Into Your Investment Strategy

When thinking about your wealth management strategy, the best way to frame your RSUs is:

“If your company gave you a cash bonus, would you use that cash bonus to buy your company stock?”

If the answer is “no,” you should probably sell your shares when they vest and reinvest the proceeds in a well-diversified portfolio.

Research from John Rekenthaler at Morningstar showed that with any individual stock, your odds are only 1 in 5 of beating a broadly diversified index and only about 1 in 2 of even outperforming bonds.

And research by Longboard Asset Management revealed that from 1983-2006, nearly 2 in 5 stocks actually lost money (39%), almost 1 in 5 lost at least 75% of their value (18.5%), and 2 in 3 underperformed the Russell 3000 index.

Diversifying your portfolio has three main benefits:

- Risk Reduction

- Volatility Reduction

- Improving Returns (on average)

But it does come with one main drawback—no lottery tickets. Concentration gives you a chance (with low odds) to get rich quickly, but it isn’t a good way to stay rich.

👉 See this for a case study on how to build a diversified portfolio

FAQs About Microsoft RSUs

Does Microsoft Give RSUs?

Yes. RSUs are part of the compensation structure at Microsoft.

You can get RSUs in three ways: Signing bonus, ongoing/yearly, and retention/refreshers.

Are RSUs Taxed Differently?

RSUs are taxed as ordinary income in the year they vest. Microsoft will withhold taxes at the federal supplemental wages withholding rate of 22% up to $1 million of income and 37% for wages in excess of $1 million.

Are RSUs better than Stock Options?

RSUs are like options with a $0 strike price. So, an RSU share is always at least as valuable as one stock option. However, because of this, companies typically grant more shares of options than RSUs. A rule of thumb for Technology employees is that four stock options are roughly equivalent to one RSU share.

Does Microsoft Give RSU Refreshers?

Stocks refreshers are an initial grant of stock by your employer. Many companies will grant refreshers during a performance review cycle to provide incentives to the best performers and to remain competitive for top talent in the marketplace.

These refreshers could also be called retention bonuses and have a separate grant date and vesting schedule.

At Microsoft, stock refreshers are not part of your initial offer letter. Instead, according to Moonchaser.io, a website that helps tech employees negotiate their compensation, Microsoft, as a general rule, “provides very small refreshers” that “vest over five years vs. the industry standard of 4 years.”

Final Thoughts and Action Items

Hopefully, this guide has given you more knowledge about how your Microsoft RSUs work, get taxed and some strategies to make the most of this compensation.

To take action, consider doing the following:

- Calculate your RSU vesting schedule and tax implications

- Determine if your tax withholding covers your RSU tax liability (and make a plan if not)

- Decide how much of your company stock you want to hold and use that to guide your strategy for selling RSUs as they vest

- Use your RSU income to max your tax-deferred accounts and charitable giving to reduce taxes.

The information contained in this post is based on Cordant’s understanding of the Microsoft RSUs at the time it was written. The Plan is subject to change by Microsoft. Please see your latest Plan document for the most up-to-date information.