Dimensional Fund Advisors (DFA), an asset manager we utilize in our client portfolios, produced a webinar for clients that focused on putting the recent market volatility in perspective. While DFA’s performance track record speaks for itself, what sets them apart in the industry is their ability to assimilate complex historical data into intuitive themes that allow investors to achieve superior returns while having a better investor experience along the way. If you have time, I encourage you to watch the video here. If not, below are three key takeaways from the webinar.

1. The Emotional Roller Coaster

Since its peak on February 19th, the stock market (S&P 500) has dropped as much as 34%. Market drops are never fun but dealing with a global pandemic and the somber reality of COVID-19 adds another element. And while the Coronavirus pandemic is the primary catalyst for the anxiety in the financial markets, other current events are impacting prices on a daily basis as well – trade wars, oil shocks and election headlines, to name a few. As market participants process this new information, we’re seeing big swings, or volatility, in the stock market on a daily basis, leading to what feels like an emotional roller coaster.

While this analogy isn’t new, it’s never been more relevant. For each trading day during the week of March 16th, the market didn’t have consecutive days in the same direction.

There are a lot of unknowns right now, but here’s what we do know:

- After big drops, markets tend to experience higher volatility

- Timing the market is never recommended, but heightened volatility makes this even more difficult to execute

- Like a roller coaster, thrill seekers expect to experience adrenaline pumping highs and lows, yet the only way they can get hurt is getting out of their seat before the ride is over. In other words, hold tight!

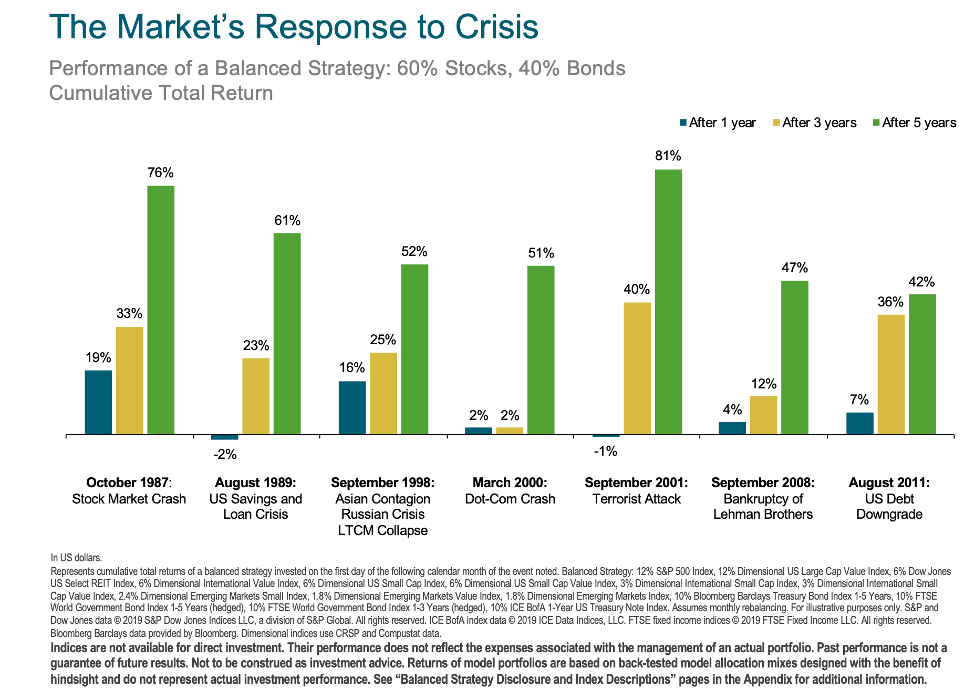

2. “This time is different”

“Yeah, markets generally recover after these types of things, but this time is different.” This is a common reaction when markets fall in response to bad news. And it’s correct. Things are different this time. The NCAA tournament has never been canceled, the education system has never been shut down on such a large scale and American culture has never been brought to a screeching halt like this before.

Of course, things were different after 9/11, the 2008 financial crisis and the 2016 election. The point is that, yes, things are different this time, but things are different all the time. There is a main constant through all these events – a very important fundamental investing principle: markets work. The rapid decline and subsequent swings are a great example of the stock market incorporating new information into prices.

Think about this – if the stock market didn’t react to the recent events, would you feel better? Investors take on an unknown risk that comes with owning stocks and for that, they expect a positive return. As history has shown, our world is dynamic and ever changing but the one constant has been the ability of the market to reward those that can maintain their strategy in face of uncertainty.

3. Put your bonds in a drawer

With the 24/7 news cycle today, it’s difficult to mentally separate the recent news from a long-term investing strategy. It’s human nature to extrapolate the impact of current events into the future. In light of this, the question is: how does one maintain a long-term perspective in the face of a major market event? While it’s not easy, people have done this for years with their bond investments. We’ve written about this before but let’s revisit this concept.

Back in the old days when an investor would purchase a bond, they would receive a certificate as proof of purchase. In order to receive the regular coupon payment, they were required to clip a coupon from the certificate and mail it in to receive the payment. All the while, the price of the purchased bond was fluctuating with the natural ebbs and flows of the market, but the investor never pulled the bond out of the drawer to reassess the investment. Their only concern was getting their money back at the date of maturity.

While different in many ways from bonds, stock investors stand to benefit if they can mentally put their stocks in a drawer. By ignoring the short-term swings in the market and maintaining a long-term perspective, the odds are they’ll have a better investing experience.

In conclusion, since the publication of DFA’s webcast, markets have continued to experience volatility and will most likely continue to do so. Don’t take this as a sign of worry but a signal that markets work. By having a better perspective on why markets behave the way they do and thinking about things in a different light, you can increase the odds of, not only increasing your returns but, enhancing your investing experience.

To quote Tom Hanks’ character in the hit baseball movie, A League of Their Own, “It’s supposed to be hard. If it wasn’t hard, everyone would do it. The hard is what makes it great.”