This post isn’t meant to minimize the human impact that the Coronavirus has on those affected but simply share perspective on the impact of the outbreak to the markets and a well-diversified investment portfolio.

With Coronavirus fears dominating the headlines this week and pushing the markets into correction territory (defined as down 10% or more) it’s worth reviewing some key points on long-term investing—perspective we shared during the market drop in 2015 and again after the Brexit vote.

The headlines are different, but our advice remains largely the same.

While the financial markets don’t like uncertainty, and traders are likely going to sell first and ask questions later, it’s important to remember that we are investors, not traders.

Our time frame as investors (and your goals, objectives, and financial plan) is years and decades, not hours, days or even weeks. The current crisis, or any market movement over a week, shouldn’t derail your investment strategy. Remember, the impact of a correction, recession or bear market is built into a well-designed financial plan.

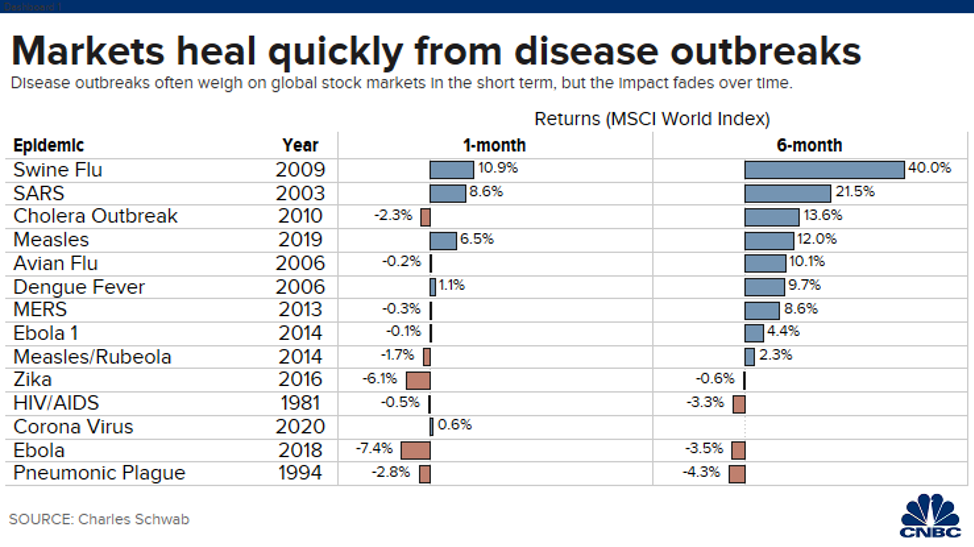

Market Reactions During Virus Emergencies

According to Jeffrey Kleintop, chief global investment strategist at Charles Schwab, who compiled the data below on the market’s reaction to past outbreaks, the financial impacts tend to be short-lived.

According to an article on CNBC which cites research from Citi found that the market drops, in past outbreaks anyway, to be mild.

As Dan Egan, Director of Behavioral Finance at Betterment said, “The people who actually come out of this the best are the people who think about things in the context of their own plan, not in terms of trying to predict the trends.”

Key Considerations

With the recent market movement in mind, here are five key things to remember about the markets and investing in stocks.

1. Things could get worse. I write this not to alarm anyone (things could also get better), but to set proper expectations. After Thursday’s 4% drop, the U.S. market (SPY) is down 11.2% since its peak on February 20. Non-US Developed markets (ACWX) are down 7.7% and Emerging Markets (EEM) 6.3% over this period.

According to analysis done by Adam Butler at BPG and Associates, since 1962 when the U.S. markets have seen a sell-off of 7% or more, the median final drawdown is 16%.

However, as Jason Zweig has pointed out in a Wall Street Journal article “Stocks could drop another 10% from here, or another 25% or 50%; they could stay flat; or they could go right back up again.” The point is no one knows, and that bring us to the second thing to remember.

2. You Don’t Just Hold Stocks. A well-diversified portfolio most likely holds a healthy allocation to cash and bonds in addition to stocks. Weeks like the last one are why. For clients, depending on their risk tolerance, we tend to hold anywhere from 20% to 60% in cash and bonds. For even our most aggressive clients (with only 20% in cash and bonds), this means five years of portfolio withdrawals (at the rule-of-thumb 4% withdrawal rate) in less volatile investments.

3. You Can’t Time the Markets. And neither can anyone else. If someone tells you they know what’s going to happen next, they’re likely either lying to you, selling you something, or extremely naïve—maybe all three. Since the bull market that started in March 2009, the U.S. market has experienced pullbacks of greater than 5% on 13 different occasions. The largest of these was the nearly 20% pullback that ended in October 2011. And yet over this period, the market is up 220% — making each of these pullbacks just a blip on the radar over the six-year period. (Preceding figures as of 2015)

What matters is “time in the markets, not timing the markets.”

Again, to quote Mr. Zweig, “After a market drop, or at any other time, no one knows what the market will do next. The one thing you can be fairly sure of is that the louder and more forcefully a market pundit voices his certainty about what is going to happen next, the more likely it is that he will turn out to be wrong.”

4. Weeks like this are a big reason stocks return more than bonds. From 1928-2014, stocks compounded at 9.6% annually versus 5.0% annually for bonds. This 4.6% difference is called the “equity risk premium.” And there are fundamental reasons for this premium: It’s compensation for stocks being lower in the capital structure than bonds and as a reward for being subject to both the downside and the upside of a company as an equity shareholder.

But, the feeling you have right now—that uncomfortable feeling in your gut making you wonder “is my portfolio alright?”—that’s also a big reason that stocks have returned more than bonds over time. In a very visceral way, owning stocks compared to bonds is simply more painful at times. These pullbacks happen and it’s not a whole lot of fun when you’re in the middle of one.

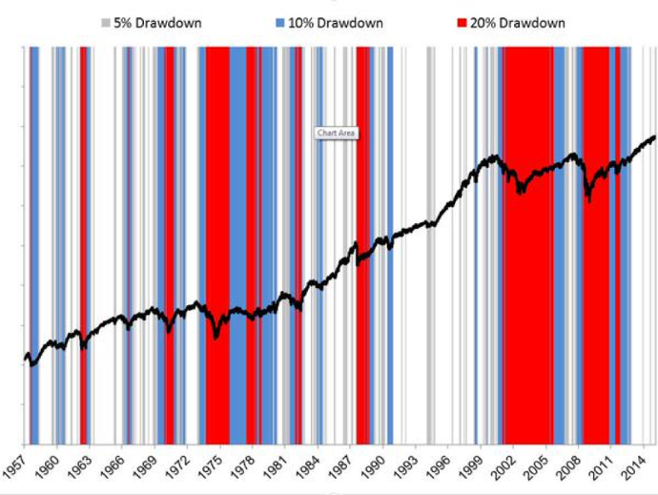

I think what’s important, then, is to step back and see the forest for the trees. These pullbacks (the trees) can seem pretty big and important when we are in the midst of them. But zooming out to the forest-level view, we get a sense of just how minor each individual pullback is to long-term market performance.

The chart below from my friend Michael Batnick at Ritholtz Wealth Management, paints this picture nicely. Notice how much of the time the stock market has spent in either a 5%, 10%, or 20% drawdown. And yet from 1957-2014, for those disciplined investors willing to ride out these drawdowns, the market has returned 10.2% annually—turning $1,000 investment into more than $250,000! What matters for the disciplined investor is again, “time in the markets, not timing the markets.”

Source: S&P 500 Index via Michael Batnick

5. Your Behavior Matters: Don’t pay the panic tax. We just saw that stock market investors spend a good chunk of their time in a drawdown. Therefore, to realize the equity premium risk, we have to avoid buying and selling, based on fear or greed, at the wrong time. We call it the “Panic Tax” and paying this tax can have a huge impact on your returns.

According to Morningstar, for the 10 years ending in 2014, investors in U.S. equity funds lost 1% annually from their returns because of these poorly timed buy and sell decisions (International fund investors fared worse, costing themselves 1.2%). For example, in 2012, the U.S. equity fund category saw the largest net outflows (-$94 billion) and taxable bonds had the highest inflow ($270 billion). Their returns in the next year: 35% for U.S. equity versus 0.15% for bonds.

So, What Should You Do? What Are We Doing?

Most of the time doing nothing, as boring as it sounds, really is the best action. But it can be difficult to “not just do something; sit there” as the saying goes. So, now that we’ve gained a little perspective, taken a deep breath so to speak, you might wonder if there are any actions worth taking.

Glad you asked.

1. Frame current market movements in light of your long-term goals. Chances are nothing that happens this week is going to deter your long-term financial goals or plan. View your investments as a means to achieve your long-term financial goals, and don’t worry about the tick-by-tick movement of your portfolio.

2. Assess Your Portfolio Risk Now. If the recent market movements have you nervous, use this as a reminder to assess the riskiness of your portfolio. Instead of trying to predict when market corrections will happen, it’s better to figure out: Are you comfortable with the way your portfolio is positioned? Are you comfortable with the risk you’re taking? And are you able to stick with your strategy in a down market?

If you’re currently a client, you’ve gone through this portfolio risk assessment already. You know what to expect from your portfolio performance both in terms of returns captured on the upside and the downside. However, if you would like to review it again, as always please give us a call.

But chances are if you’re not working with an advisor, assessing your portfolio risk isn’t something you’ve reviewed recently. Some people, still scared from 2008, are taking too little risk; they’re limiting their returns and therefore the potential to achieve their goals. Others, spoiled and complacent after the great run of the last six years, have too much risk in their portfolio. The risk here is panicking during a market correction, selling out, and missing any market recovery. Either way, taking too much risk or not enough is damaging to your portfolio returns—but, even more importantly, to achieving your financial goals.

So, does your portfolio have a level of risk you are comfortable with? A strategy you can stick with and that gives you confidence in achieving your goals? Now is the time to assess.

3. Look for opportunities. As Warren Buffett said, “Be greedy when others are fearful.” Should the market selloff continue, we will look for buying opportunities—whether that’s increasing exposure to a given region or simply rebalancing to sell appreciated bonds and buying stocks at a discount.

4. Tax-Loss Harvest. Lastly, for investors with taxable assets, now is a good time to review your positions for any losses. If you have any positions at a loss, a tax-loss harvesting strategy is designed to realize any losses in your portfolio today and use these losses to reduce your current taxes.

Again, if you are a client, we are doing this for you. We are reviewing your portfolio for any opportunity to reduce current taxes by tax-loss harvesting. And if you’re not a client, review your portfolio on your own for any tax harvesting opportunities you may have.

So, there you have it. In periods of market stress, remember to keep the big picture in mind. No one knows exactly what will happen next, but it’s a fair bet that, like they always have, stocks will go both go up and down. Because of this, it’s important your portfolio is positioned in support of your long-term goals and objectives and is designed with a level of risk you are comfortable taking.