In Our Bear Market Playbook, we included rebalancing as part of the game plan when markets drop. Often overlooked as obvious and boring, it’s effective and, therefore, not to be neglected.

Most of the time, rebalancing is a risk management strategy as stocks get sold to fund other portfolio diversifiers. But during a market downturn, like Q1 2020, there is a return enhancement or a rebalancing bonus that shows up.

In this post, I want to quantify this rebalancing bonus and make two additional points. First, that’s it’s okay to rebalance “early.” Don’t expect to call the bottom. And second, that disciplined rebalancing is uncomfortable. You’re not going to feel like buying stocks on the way down, nor will you feel like selling them on the way up—Buy low. Sell high.

To set the stage, let’s walk through an example of a portfolio that was systematically rebalanced over the last 13+ years—a period that covers both the 2008/2009 financial crises and now the Coronavirus lock-down. This simple portfolio consists of 60% stocks and 40% bonds and gets rebalanced when the allocation to stocks deviated by more than 10% from its initial target (i.e., greater than 66% or less than 54% in stocks).

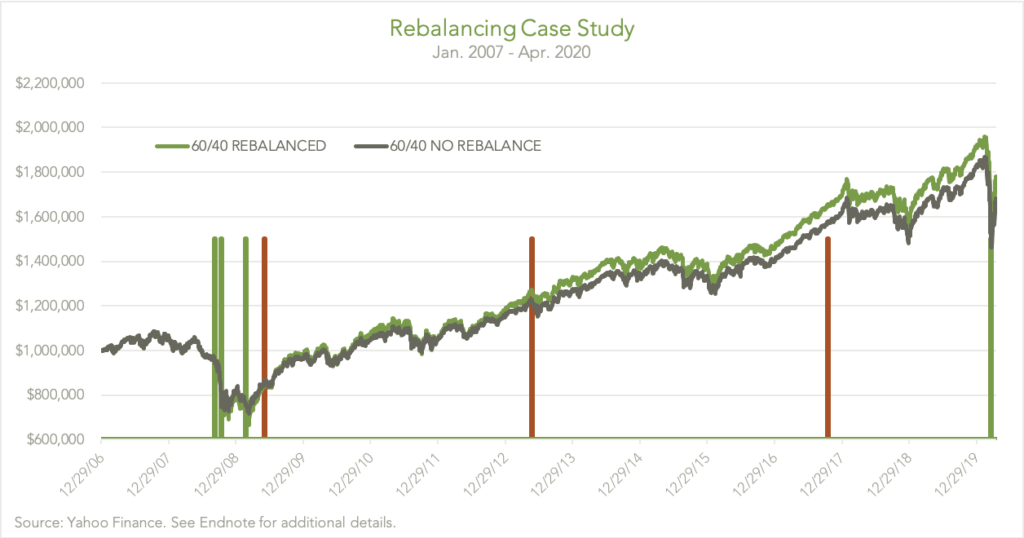

In the chart below, we can see how the rebalanced portfolio (green line) compared to a portfolio that was not rebalanced (grey line). The vertical bars represent the rebalance dates, with the green bars indicating a rebalance that calls for buying stocks to bring the allocation up to the 60% target. The red bars indicate the opposite—stocks get sold to bring the allocation down to the 60% target.

Notice the rebalance into stocks coming in late-2008 and early 2009 (when the market was dropping) and again in March of 2020. Stocks get sold on the way up—in 2009, 2013 and 2017.

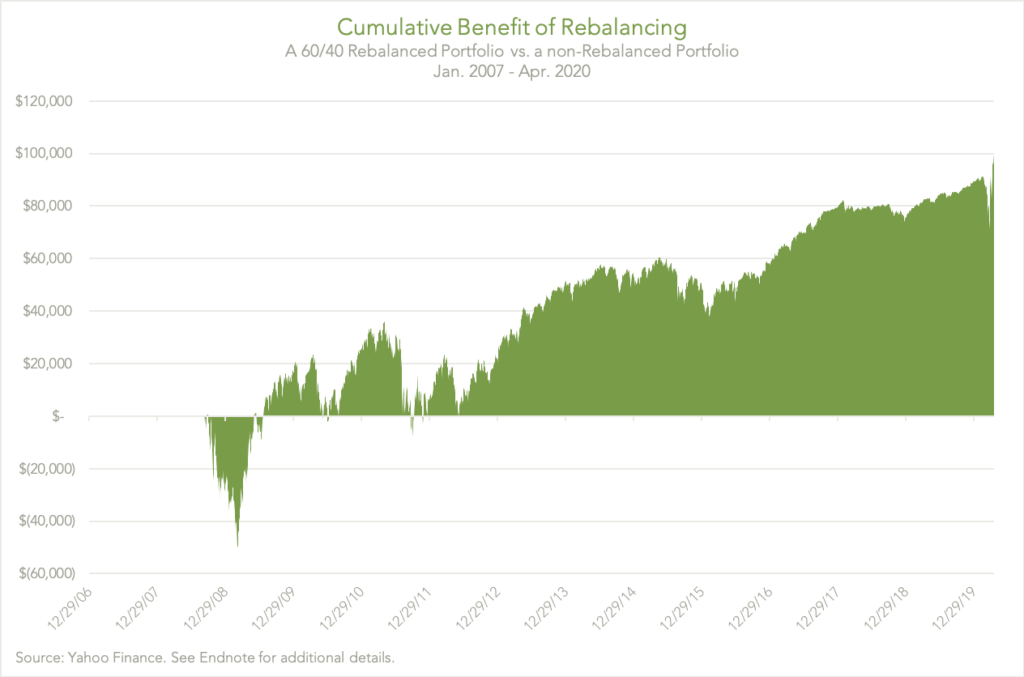

The benefits of this disciplined rebalancing approach can be seen more clearly in the next chart, which plots the difference in performance between the two methods. Over this period, rebalancing the portfolio added nearly $100,000 of wealth to a $1 million-dollar portfolio, or a benefit of 0.4% annualized per year. The portfolio that wasn’t rebalanced ended up being worth nearly $1.7m vs. $1.8m for the rebalanced portfolio.

What’s interesting is that the 0.4% annualized benefit over this period comes close to prior estimates done by others on the benefits of disciplined rebalancing. In their Advisor Alpha whitepaper, Vanguard estimates the benefit of rebalancing to be 0.35% annually. Investor and author Bill Bernstein, in his “The Rebalancing Bonus” paper, calculated the benefit from rebalancing a 50/50 portfolio over the long-term period of 1926-1994 to be 0.49% annually.

Rebalance Timing

This year, we rebalanced most clients’ portfolios between March 13th and 23rd (timing depending on risk tolerance, cash flows, and other client-specific factors), which turned out to be decent timing but certainly wasn’t known in advance.

In fact, as can be seen in the first chart above, with a rebalancing approach based on tolerance bands, usually, you will be “early” to rebalancing. Meaning that during a bear market, you will probably get your alert to rebalance before the market bottoms. Using our scenario above, the portfolio was rebalanced in September 2008, again in October (with the markets dropping 27% over this period) and again in February of 2009.

With a crystal ball, you ideally would have waited to rebalance until the market bottomed in March of 2009. The obvious problem with this strategy is that it’s impossible to know when the bottom is in. The cost of being early in 2008 was, at one point, $50,000 versus not rebalancing. But this difference was recovered by June 2009, which resulted in a nearly $100,000 benefit over the entire period.

Simple, Not Easy

As I mentioned above, rebalancing requires acting counter to the direction the market is moving, which makes pulling the trigger uncomfortable. Early in a bear market, it’s not going to feel like rebalancing is the right decision. Waiting for a better time will be preferred. And once things do recover, it will be tempting to “let it ride” and not rebalance back into bonds.

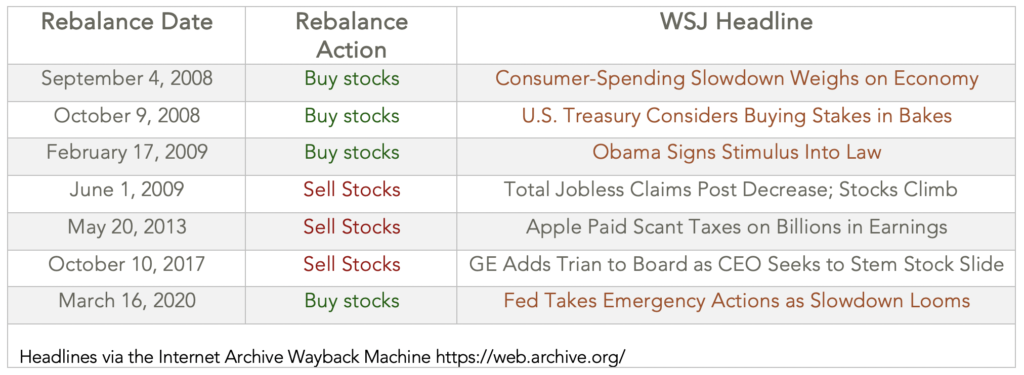

Consider the rebalance dates from our example above and the following headlines pulled from the Wall Street Journal on the respective rebalance days[1]. Buying stocks typically requires acting when the news is negative—acting counter to the prevailing news of the day.

I’ll be honest, rebalancing over the period of March 13th to 23rd didn’t feel like the right time to do it. But we have a process in place and a team that holds each other accountable to the process in order to get it done.

Like so many things that “work” in investing, rebalancing is a simple concept that’s not always easy to carry out in the real world as the big benefits tend to show up in moments of market stress when taking action feels uncomfortable.

As always, if we can be of any help or if you would like to discuss your rebalancing strategy, you can get in touch here.

*Endnote: Stocks are represented by the ETF ACWI from 03/28/2008 onwards (the funds inception date) and by SPY from 12/31/2006-03/27/2008. Bonds are represented by the ETF AGG for the entire period (12/31/2006-04/14/2020). For the ‘No Rebalance 60/40′, the investor is assumed to start with $600,000 in stocks and $400,000 in bonds. The investor simply holds the positions and accepts the changes to the portfolio allocation mandated by buy and hold returns. The ‘Rebalanced 60/40’ investor is assumed to start with the same $600,000 in stocks and $400,000 in bonds. However, when this investor’s stock allocation drifts below 54% or above 66%, the portfolio is rebalanced back to target.

[1] Or as close as available via the Internet Archive.