Need Help?

Table of Contents

Toggle- What Are RSUs

- How Do RSUs Work?

- Types of RSUs

- Types of RSU Vesting Schedules

- The Advantages and Disadvantages of RSUs

- RSU Taxes Explained

- RSU Tax Strategy – 4 (Unique) Ways to Lower Your Taxes in 2023

- RSUs vs. Stock Options

- Incorporating RSUs Into Your Investment Strategy

- Trading Window and 10b5-1 Trading Plan

- RSU FAQs: Common Restricted Stock Unit Questions

- Final Thoughts and Action Items

In this article, I’m sharing everything you need to know about how Restricted Stock Units (RSUs) are taxed.

I’m also covering:

- What are RSUs

- RSUs vs Options

- Little-known RSU tax strategies

If you’re ready to master RSU taxes and avoid overpaying the IRS in 2023, this article is for you.

KEY POINTS:

- RSUs are a popular form of stock compensation that are taxed as income as they vest.

- Shares held after vesting are taxed as capital gains when they are sold.

- Understanding RSU taxes will help you keep more money in your pocket and improve investment returns.

- Proactively managing RSUs will reduce concentration, income, and career risk.

- Executives and insiders need to follow company and SEC guidelines when buying/selling company stock.

What Are RSUs

Restricted Stock Units (RSUs) are a form of compensation tied to the value of your employer’s stock price. Think of RSUs as a cash bonus that can go up or down in value.

As their name suggests, RSUs are “restricted.” In other words, you can't sell them until you meet the vesting criteria—typically a certain number of months or years.

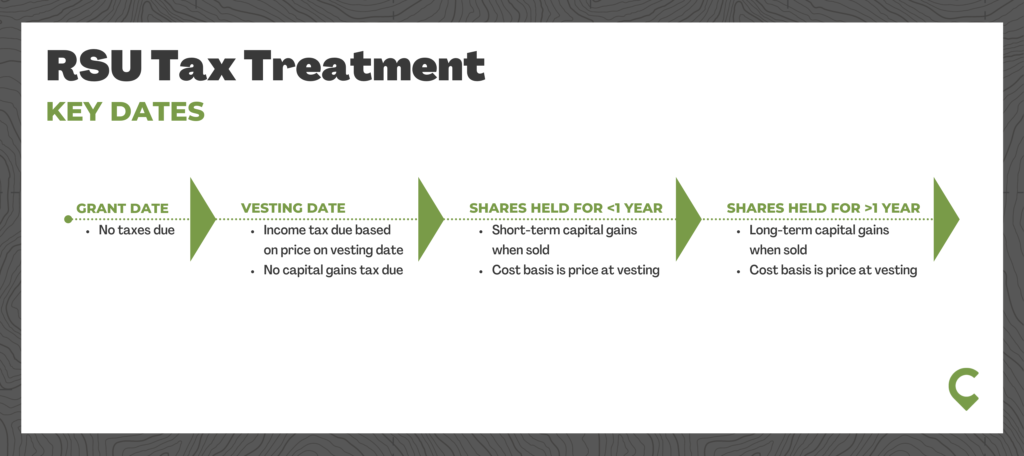

The two key dates for RSUs are:

- The grant date. When a company promises “restricted” shares of stock to employees.

- The vesting date. When the shares are no longer “restricted” and become owned by the employee.

RSUs are taxed as income at vesting. Shares typically vest in tranches over a period of time—four years is common.

Restricted Stock Units (RSUs) have become a popular type of compensation for those employed in the Tech industry. And in some cases (e.g., Amazon employees), RSU compensation can make up over 50% of total annual pay.

Therefore, as a Tech employee, it’s critical to know the ins and outs of RSUs.

For those visual learners, here’s a quick video explaining what RSUs are and how they work.

How Do RSUs Work?

Compared to other types of equity comp, RSUs are straightforward once a few of the key terms are defined:

- Grant Date: On this date, your company promises a specific number of “restricted” shares to you, the employee. These shares are earned over a vesting period, which is typically over a period of months or years but could also be tied to specific performance objectives.

- Vesting Date: The date on when the shares officially become yours (a.k.a., they are no longer “restricted”). A typical vesting schedule is where 25% of the shares vest per year over four years.

- RSU Taxes: RSU compensation is taxed as ordinary income when the shares vest and based on your shares’ value on the vesting date. Think of them like a cash bonus that’s linked to the price of your company’s stock. If you hold the shares for a year or longer after vesting, any gain (or loss) is taxed as long-term capital gains (shares held less than one year from vesting are taxed at short-term capital gains tax rates).

Here's an example of how RSUs work in practice:

- Eddy Engineer was granted 4,000 RSU shares in April 2021.

- 25% of Eddy's RSUs (1,000 shares) vest in April of 2022 with equal vesting over four years.

- The share price is $50 on the vesting date. This becomes Eddy's cost basis if he holds the shares.

- Eddy will owe taxes on $50,000 of RSU income for 2022.

- Since Eddy is in the 35% Federal tax bracket, his total tax bill on these shares is $17,500.

Like the example above, most vesting schedules are time-based with equal vesting over a 4-year period. However, other types of RSUs and vesting schedules exist which we’ll cover next.

Types of RSUs

There are two common types of RSUs—Single-Trigger and Double-Trigger.

Single-Trigger RSUs only have one vesting criteria (typically time-based) and are standard for publicly traded companies.

Double Trigger RSUs have a second set of criteria (typically related to a liquidity event for the company) and are common in private companies. A common double vesting RSU practice is a time-based vesting schedule in combination with an IPO or acquisition for your company. In this case, the RSUs don’t have value to you unless the company IPO and, importantly, if you leave your employer you can’t hold onto the shares since they haven’t fully vested.

Types of RSU Vesting Schedules

There are also two types of RSU vesting schedules:

- “Graded” Vesting Schedule. With this type of schedule, RSUs vest periodically over a series of years. They could vest equally or according to another schedule (e.g., 40% in year 1 and then 20% in each of the next 3 years).

- “Cliff” Vesting Schedule. With a "Cliff" vesting schedule, 100% of your RSUs vest at once. This "Cliff" could be triggered after a specific period of service or tied to the achievement of company or individual performance

Separation from your employer usually stops vesting. However, some employers will offer acceleration of a year (or more) of vesting as part of severance or retirement packages (or potentially in the case of death or disability).

The Advantages and Disadvantages of RSUs

As a popular form of equity compensation, RSUs have a number of benefits but also some drawbacks.

Benefits of RSUs

- Straightforward: Compared to other forms of equity compensation, how RSUs work and their tax treatment is pretty simple

- Upside: Compared to a cash bonus, RSUs give you the potential to participate in the success of your employer in the form of an increasing stock price

- Retains Value: However, unlike stock options which have a set strike price, RSUs are always worth something at vesting (unless the extreme case of your company’s stock price going to $0).

Drawbacks of RSUs

- Vesting: The shares aren’t yours until the vesting criteria is met (i.e., if you leave your employer, you forfeit this income)

- Illiquidity: In the case of a private company, the shares cannot be transferred or sold until a liquidity event for the company takes place

- Downside: Compared to a cash bonus, if the value of your company’s stock decreases between the grant and vesting date, your RSU income decreases

RSU Taxes Explained

Restricted Stock Units (RSUs) are taxed differently than other forms of equity comp, such as Options and Employer Stock Purchase Plans (ESPP).

Compared to these other forms of equity compensation, RSU taxation is pretty straightforward but does have a few unique characteristics everyone needs to understand.

Here is how RSUs are taxed:

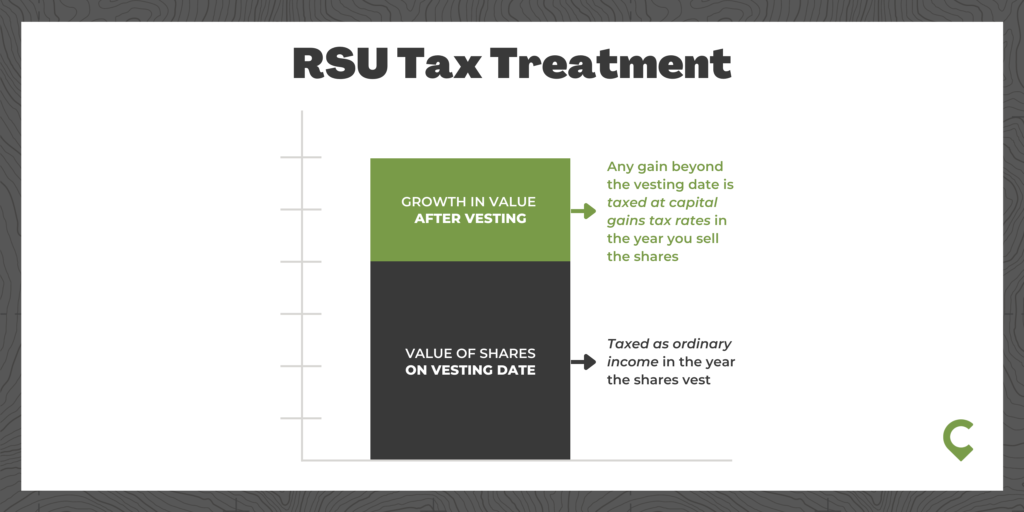

- RSUs are taxed as income to you when they vest.

- If you sell your shares immediately, there is no capital gain tax, and you only pay ordinary income taxes.

- If instead, the shares are held beyond the vesting date, any gain (or loss) is taxed as a capital gain (or loss).

The tax treatment of RSUs is the same as if you were to receive a cash bonus (on the vesting date) and then immediately used that cash to buy your company’s stock. Just think about RSUs like a cash bonus and you are well on your way to mastering RSU taxes.

To summarize:

- RSU tax at vesting date is: The # of shares vesting x price of shares = Income taxed in the current year

- If held beyond the vesting date, the RSU tax when shares are sold is: (Sales price – price at vesting) x # of shares = Capital gain (or loss)

An RSU taxation example:

- Eddy Engineer has 1,000 shares that vest in April of 2022

- His company stock is trading at $10/share on the vesting date and this becomes Eddy's cost basis if he holds the shares

- Eddy will owe ordinary income taxes on $10,000 of RSU income in 2022 (1,000 shares vested x $10/share)

- If he holds his stock for two (2) more years and then sells it for $30/share, he will have a $20,000 capital gain ($30 – $10 x 1,000 shares)

At vesting, you are subject to tax and withholding on the shares, which includes federal, Social Security, Medicare, state, and local taxes. Your company may offer you a choice for how to pay the tax, or it may have a mandatory method.

There are three common ways to cover the RSU tax bill:

- Your company “tenders” the number of shares needed to cover the withholding tax

- You fund the withholding out of pocket and hold 100% of the vested shares

- All the vested RSUs could be sold, essentially turning it into a cash bonus tied to the price of your company’s stock

It’s important to note that even if you have a capital loss on the shares, you will still owe income tax based on the price at vesting.

In an extreme example, when a company stock goes to zero, the amount you are taxed on as income equals your capital loss. But as income is taxed at higher rates than capital gains (losses) in most cases, you would end up losing money on your “bonus.”

The 2023 income taxes rates are as follows:

| Federal Income Tax

Brackets |

Income

(Married, filling jointly) |

Income

(Single Filers) |

| 10% | $0 to $22,000 | $0 to $11,000 |

| 12% | $22,001 to $89,450 | $11,001 to $44,725 |

| 22% | $89,451 to $190,750 | $44,726 to $95,375 |

| 24% | $190,751 to $364,200 | $95,376 to $182,100 |

| 32% | $364,201 to $462,500 | $182,101 to $231,250 |

| 35% | $462,501 to $693,750 | $231,251 to $578,125 |

| 37% | $693,751 or more | $578,126 or more |

The 2023 long-term capital gains tax rates are as follows (short-term gains are taxed according to income tax rates):

| Long-Term Capital Gains

Tax Rates |

Income

(Married, filling jointly) |

Income

(Single Filers) |

| 0% | < $89,250 | < $44,625 |

| 15% | $89,251 to $553,850 | $44,626 to $492,300 |

| 20% | > $553,850 | > $492,300 |

What about tax withholding on my RSU income?

Most companies don’t withhold taxes according to your W-4 rate but will instead use the flat IRS rate for supplemental wage income. For 2023, that rate is 22% on supplemental wages up to $1 million and 37% for wages in excess of $1 million.

Please note that if your RSU income is taxed above 22% when your taxes are filed, depending on your other tax withholdings, you may owe additional taxes when you file. You may consider withholding additional federal taxes from your paycheck or setting aside money to cover your tax bill at year-end if you anticipate that you will be in this situation.

RSU Tax Calculator

Now that we've walked through how RSUs get taxed, it's time to actually calculate your tax bill. We created a free excel tool to help with that. Based on your inputs, it will calculate your RSU tax bill, if you're likely under withheld, and the amount you potentially still own when you file your taxes.

👉 Get your free RSU Tax Calculator (excel) here.

Now that we’ve reviewed how RSUs work and how they are taxed let’s examine four tax strategies to reduce your tax bill.

RSU Wash Sales

One question that comes up from time to time is: Can my vesting RSUs trigger a wash sale?

And the answer is yes.

The IRS determines a wash sale happens when a security is sold for a loss and a substantially similar security is purchased 30 days before or 30 days after the sale.

If this happens, your loss is disallowed.

RSU Tax Strategy – 4 (Unique) Ways to Lower Your Taxes in 2023

As a reminder, RSUs are taxed as income when they vest. There is no strategy to reduce or defer this tax directly.

However, as I’ll share below, with some proactive planning, you can use your RSUs to offset other income (thereby reducing your total tax bill) or delay capital gains taxes.

Let’s dive into the four (4) unique RSU tax strategies to consider in 2022.

1. Using RSUs to MAXIMIZE Tax-Deferred Contributions

Contributing to your employer-sponsored 401(k) account or an individual retirement account (IRA) comes with a tax benefit, as a contribution to these accounts reduces your taxable income in the current year. But an additional planning opportunity exists for anyone who is holding vested RSUs but not maxing out these accounts due to cash flow constraints.

If you are holding RSUs to delay paying taxes on the gains, the proceeds from the sale can be used to max out tax-deferred accounts and offset your tax bill (in addition to diversifying your investment portfolio).

The maximum employer 401(k) contribution for 2023 is $22,500 with an additional $7,500 catch-up contribution for those turning 50 or older in 2023. And the maximum IRA contribution is $6,500 with a $1,000 catch-up contribution available.

Let’s look at an example.

Marcia has 2,000 vested RSUs worth $10/share and a cost basis of $5/share. She has held the shares for more than two years and is contributing $11k of the allowable $20,500 in her employer's 401(k) plan. She is not contributing to an IRA account.

Additionally, her income places her in the 15% and 24% tax brackets for capital gains and income, respectively.

In this scenario, Marcia could sell her 2,000 shares for $20k, increasing the capital gains tax liability in the table below by $1,500 ($5 gain x 2,000 shares x 15% tax rate). Then she could use the first $9,500 of the proceeds to max out her 401(k) account—netting a tax reduction of $2,280 ($9,500 x 24%). With the remaining money, she could contribute up to $6k to a traditional IRA account and reduce her tax bill by up to another $1,440 ($6,000 x 24%)—subject to phaseouts based on income.

Here's what this looks like:

All in, this strategy could save Marcia up to $2,220 in taxes ($3,720 saved – $1,500 in capital gains tax) and add $6,720 to cash flow in the current year ($4,500 cash flow after retirement savings + $2,200 tax savings) while allowing her to diversify her investment portfolio and save money in a tax-advantaged account.

Now, for those of you already maxing out your retirement accounts, the next strategy might be for you.

2. Deduction Bunching

With the increase of the standard deduction to $25,900 for couples and $12,950 for individuals as part of the 2017 Tax Cuts and Jobs Act, deduction bunching becomes that much more important for anyone looking to itemize deductions as part of their tax returns.

Essentially, deduction bunching is squeezing as many deductions as possible into one tax year in order to boost itemized deductions above the standard amount and therefore minimize taxes in that year.

Because RSUs are taxed as income in the year they vest, if you have a large tranche of RSUs vesting in any given year, you should consider bunching deductions to offset some of this income.

The most common itemized deductions are:

- Mortgage Interest

- Charitable donations

- Medical expenses

- And State and Local taxes (known as SALT deductions) including real estate taxes

Because SALT deductions remain capped at $10k, and mortgage interest doesn’t lend itself to bunching, the opportunities here are mainly with charitable donations and possibly with medical expenses.

Medical expense deductions, starting in 2020, are limited to the “total qualified unreimbursed medical care expenses that exceed 10% of your adjusted gross income.” If you have a year with high medical expenses pushing you over the 10% threshold, the opportunity exists to prepay any upcoming costs and to pull as much of the deduction into the current year as possible.

For example, if your kid is due for braces, your orthodontist may allow for payments to be spread out over a couple of years. But, if you are over the 10% AGI threshold and can swing it from a cash flow perspective, you should consider paying the full cost upfront in order to bunch the expenses and pull the tax benefit into the current year.

Charitable giving is the same. If you are charitable and can afford to, in a high-income year driven by RSUs, you can pull five years of giving forward into the current year in order to bunch deductions and further reduce your tax bill. (In the next section, I’ll look at a popular vehicle to make this process easier.)

A side-by-side comparison of how this would look is below. In this scenario, we compare the standard deduction (without bunching) to itemized deductions with bunching. We assume an extra $2k in medical expenses (which are deductible) and bunching five years of charitable contributions at $5k per year + an extra $900 to make round numbers.

| Standard Deduction | Itemized Deductions with Bunching | |

| Mortgage Interest | $8,000 | $8,000 |

| Charitable Deduction | $5,000 | $25,900 |

| Medical Expense Deduction |

$0 | $2,000 |

| SALT | $10,000 | $10,000 |

| Total Itemized or $25,900 if greater |

$23,000 or $25,900 |

$45,900 |

The bunching strategy results in an additional tax deduction of $20,000 in the current year with no reduction in subsequent years (since you will use the Standard Deduction) and saves you nearly $4,500 on your tax bill today.

3. Donor Advised Funds (DAF)

Let’s say you have the ability to pull five years of charitable giving forward, as in our example above. But, like many people, you would still prefer to give the funds over the five years while getting the tax deduction.

How can you achieve this? Enter the donor-advised fund (DAF).

Here is a quick summary explaining how a DAF works:

- Open a Charitable fund in your name

- Contributions to the fund are deductible in the year received

- Assets can be invested and grow tax-free

- Grants can be made to charities at any time in the future

What’s more, highly appreciated securities can be used to fund a DAF—not only scoring a tax deduction in the funding year but also avoiding capital gains tax on the donated securities.

Essentially, utilizing a DAF allows the charitable bunching strategy combined with the capability to give as you typically would. The only downside is that you must have the ability to fund the account upfront, and the donation is irreversible. Once you’ve funded a DAF, the money must be given to charity.

4. Defer Taxes by Hedging With Options

While our first three strategies covered reducing your tax bill today, our last planning strategy explores a way to hedge your RSU position and delay the sale—either because you need to maintain a position in your company stock or to delay the tax bill to a potentially more favorable year.

A quick caveat—options can be risky and should be fully understood before implementing any strategy. Additionally, like with anything, there is no free lunch. Hedging a position, even if generating income in the process, comes with tradeoffs.

Let’s look at a couple of the most common strategies: The covered call and the collar.

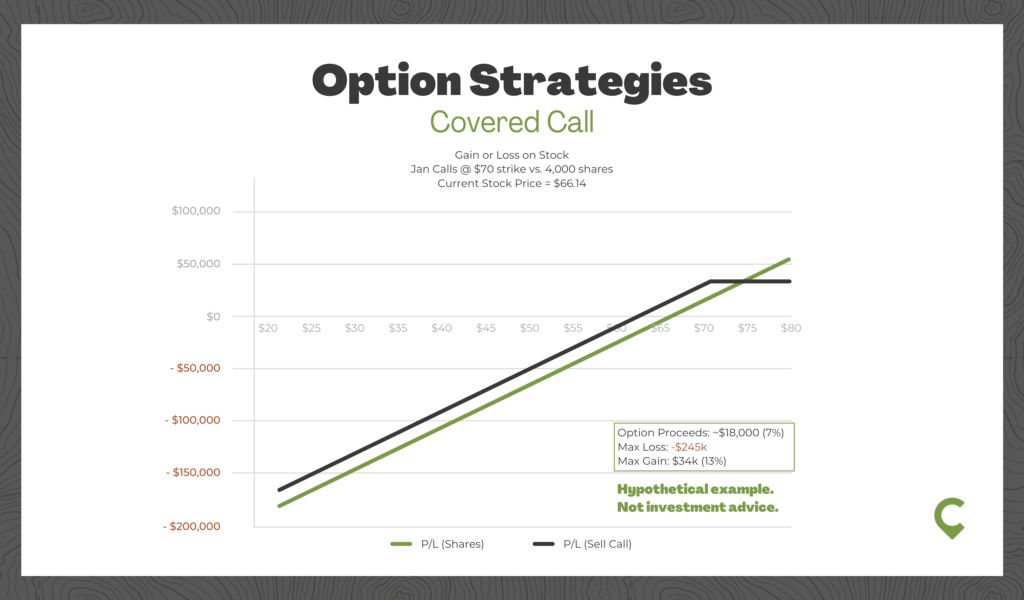

Covered Call

Under this strategy, call options are sold above the current price (called out of the money). This generates income but caps your potential for gain with essentially all the risk of loss remaining.

In the scenario below, using Intel’s stock from February of 2020, we depict this strategy of selling $70 calls that expire in January 2021. This brings in a premium of ~7% but caps your maximum gain on the position at 13%—at a price of $70 per share or higher. However, as you can see, the downside is essentially uncapped save for the 7% premium generated.

The tradeoff for generating this premium income is capping your return at 13% and still taking the downside of the stock. However, if the stock price doesn’t move over the next year, you have generated a nice healthy income stream over the period.

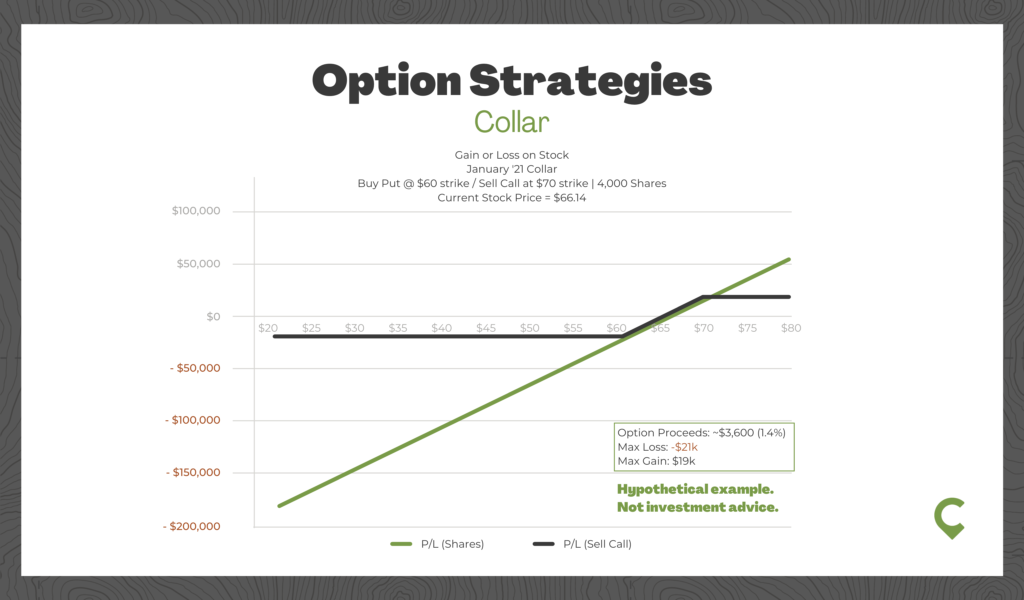

Collar

Unlike the covered call strategy, a collar strategy does hedge the downside by buying a put. However, instead of just buying a put (which is expensive), a call is also sold to offset some or all of the costs.

In our example below, selling January 2021 calls and buying puts on Intel stock leads to a premium income of 1.4%. The tradeoff is minimal income and a narrow range of potential outcomes.

Either of these strategies could be right for your given situation, but the point is they aren’t without risks and tradeoffs. However, they could help you defer the sale of your RSUs until a more favorable time.

RSUs vs. Stock Options

Unlike stock options, RSUs are almost always worth something even if the stock price of your company falls. For example, 1,000 RSUs at a company whose stock fell from $20/share to $10/share is still worth $10,000 versus potentially nothing with options.

However, with options, the advantage (or disadvantage) is the built-in leverage. Under RSUs, the difference between a stock price of $10 and $30 on 1,000 shares is $10k to $30k. However, this same range with 10,000 options (with a strike price of $18 as in the example above) results in a difference in value to the employee of $0-$120k.

Incorporating RSUs Into Your Investment Strategy

Think about it this way:

"If your company gave you a cash bonus, would you use that cash bonus to buy your company stock?"

If the answer is “no” you should probably sell your shares when they vest and reinvest the proceeds in a well-diversified portfolio.

Because of the increased risk of investing in individual companies, the vast majority of which will end up underperforming the market, it typically doesn’t make investment sense to hold onto the shares.

Research by Longboard Asset Management revealed that from 1983-2006, nearly 2 in 5 stocks actually lost money (39%), almost 1 in 5 lost at least 75% of their value (18.5%), and 2 in 3 underperformed the Russell 3000 index.

Now, it’s understandable to want to benefit from the potential success of your company, but this should be limited, as a rule of thumb, to around 10% and no more than 20% of your net worth.

Remember that not only do you have risk in the stock, but you also have career risk as well. If things go poorly at your company, not only does your stock and net worth get hit, but you might be out of a job and a paycheck at the same time.

However, if you did hold on to your RSUs and are fortunate to have capital gains (good for you!), taxes may now act as a barrier to diversifying. Is there anything to do?

Two ideas:

- If you have appreciated RSUs but aren’t maxing out your tax-deferred accounts (401(k), IRA, or HSA), your RSUs can be sold to fund these contributions and to diversify your portfolio. These pre-tax contributions can help reduce your tax bill that was just increased by realizing the capital gains.

- If you are charitably inclined, these shares can be allocated to a Donor Advised Fund, which can then be diversified and used to fund future charitable giving.

Trading Window and 10b5-1 Trading Plan

If you are a company executive or considered an insider with access to material, non-public information, take care to execute any liquidation or diversification strategy within your company’s and SEC guidelines. The two key guidelines are:

- A Trading Window: The period set by the company in which they allow executives and insiders to trade the company’s stock.

- A Rule 10b5-1 trading plan: A prearranged program for periodic purchases or sale of company stock that meet SEC criteria and avoid insider trading violations.

RSU FAQs: Common Restricted Stock Unit Questions

RSU stock income is reported on your pay stub after vesting. The RSU Offset may be shown in the deduction line since you don’t receive cash in your pay at vesting but instead in your brokerage account when the shares are sold.

No. The value of your shares at vesting is taxed as income, and anything above this amount, if you continue to hold the shares, is taxed at capital gains. The second taxable event (the capital gains tax) doesn’t apply to any portion you have already paid income tax on.

RSUs compensation is taxed at your ordinary-income tax rate. If you choose to hold your shares after they vest, any gain (or loss) is taxed as a capital gain (or loss).

RSU income is taxed when your shares vest. Your employer will typically withhold taxes at the federal supplemental wages withholding rate, which is 22% up to $1 million of income and 37% for wages in excess of $1 million.

Yes. At vesting, RSU income is reported on your W2, and any taxes withheld are included as well.

RSUs are like options with a $0 strike price. So, a RSU share is always at least as valuable as one stock option. However, because of this, companies typically grant more shares of options than RSUs. A rule of thumb for Technology employees is that four Options are roughly equivalent to one RSU share.

Final Thoughts and Action Items

Whew! Congrats for making it to the end of this 4,000 word article on RSUs!

But you’re not done yet, knowledge is only valuable if you put it into action.

Your mission, if you choose to accept it, is to:

- Calculate your RSU vesting schedule and tax implications

- Determine if your tax withholding covers your RSU tax liability (and make a plan if not)

- Decide how much of your company stock you want to hold and use that to guide your strategy for selling RSUs as they vest

- Considerer using your RSU income to max your tax-deferred accounts and charitable giving to reduce taxes.