Article Summary & Key Points

Employees of what was formerly Mentor Graphics, now Siemens, may find that they are eligible for Siemens’ Deferred Compensation Plan (DCP) and wonder if they should defer their salary and/or bonus into the plan.

In this article, we lay out 4-steps to consider as you evaluate this decision:

- Why Defer? The Benefits of Deferred Compensation

- The Risks of Deferred Compensation Plans

- Go/No Go: Individual Factors to Consider with Deferred Compensation

- Three Potential Strategies to Hedge Your Risk

Siemens offers eligible employees a 409(a) Nonqualified Deferred Compensation Plan (DCP) which provides those employees with a fairly straightforward opportunity: willingly forgo income today for a tax benefit. The benefit can be a substantial one, but of course, the benefit comes with a risk. The risk is that the income deferred becomes a liability. In other words, Siemens will need survive long enough into the future such that it can pay its liabilities—pay back the income deferred.

As a participant in any company’s deferred compensation plan, you become an unsecured creditor of your company. You should think about that opportunity as skeptically as a bank underwriter would when approving a loan.

This article will provide a framework to think about the decision to defer and offer potential options for those with money already in the plan to offset some of their risk. This framework is specific to Siemens DCP but can be generalized to any deferred compensation decision.

We’ll start by covering the advantages of deferred compensation (why would you do it in the first place), talk about the risks and how to measure them, look at the individual factors to consider when making your decision, and finally look at potential strategies for offsetting your risk.

Let’s dive in.

The Benefits of Deferred Compensation Plans

Benefits of the Siemens DCP include tax benefits and the benefit of a company match. Overtime, it’s the tax benefits that can have the most material impact so we will review these first.

Tax Benefits

Deferred compensation plans have been around for decades, and regardless of the company offering the plan, the three potential tax benefits remain consistent.

The first benefit is shifting income to years where you are subject to a lower tax rate. Initially, with top marginal tax rates as high as 90 percent in the 1960s and 70 percent in the 1970s, these plans’ primary benefit was this shift. Now, with lower tax rates (the top marginal income tax rate is 37 percent + 2.35% Medicare), tax brackets fairly compressed, and higher executive compensation (meaning potentially large payouts from deferred compensation and other assets in retirement), the contrast in pre- and post-retirement income tax brackets may not be as significant but remains material.

The second benefit is tax deferral: the ability to invest your money pre-tax and have it grow untaxed until the money is paid out.

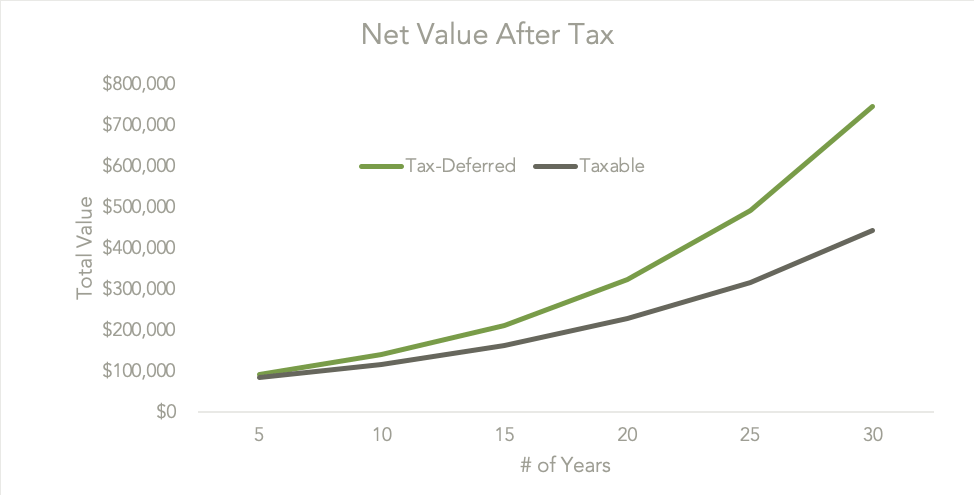

The longer the tax deferral is in place, the more valuable this is. Deferring taxes one year before retirement and then over a 10-year distribution schedule has value, but deferring taxes for 20 years (allowing your money to grow pre-tax) has a lot more value. Of course, this comes with the risk of your company not being around to make good on its deferred compensation obligations in 10 or 20 years.

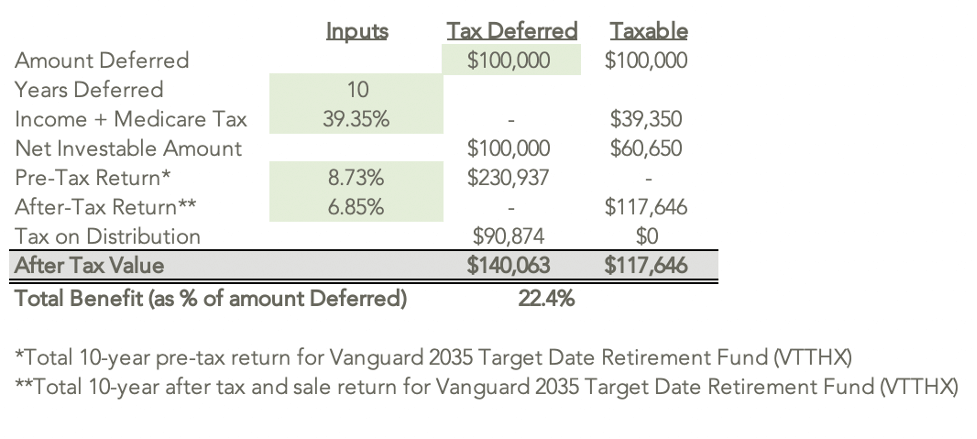

Using the assumptions listed in Table 1 below, we can see that deferring income for ten years for an individual at the top marginal tax bracket (37% income tax + 1.45% Medicare + 0.9% Medicare on wages over $200k) and earning a pre-tax return versus an after-tax return results in $22,000 more of wealth even after paying income taxes on your distribution from the deferred compensation plan.

Behold the power of compounded tax-free gains!

Table 1: Tax Calculations – Tax Deferred vs. Taxable

Furthermore, as you can see in the next chart, the longer taxes are deferred, the larger the benefit.

Source: Cordant’s Calculations using assumptions listed in Table 1

The third potential tax benefit is the result of differences in state tax rates. With Federal taxes being low by historical standards, there remains an opportunity for some to defer and potentially avoid state income tax. Consider a resident of Washington State who is employed by Siemens in Oregon. Current residents of Washington state (or future in the case of those who move out of Oregon at retirement) pay Oregon income tax on earnings while employed in Oregon. However, if the DCP’s ten-year or longer payout option is selected, the state tax is based on your state of residence at distribution. So, for many the ability to defer income and avoid the 9% Oregon state income tax by living in Washington state is another big potential benefit of the Siemens DCP. We see benefit most commonly play out for those employed in Oregon or California who move to Washington, Arizona or another state with low or no income tax in retirement.

Siemens Matching Benefit

Not to be overlooked, another benefit of these plans is the company matching benefit, but (as of the time of this posting) there is some confusion around the specifics of how the match is calculated.

The first part of the match is straight forward: the Siemens plan offers to match 6% DCP deferrals (i.e. if you defer $1,000, Siemens matches with a $60 contribution).

The confusion arises here: Siemens also states that it will match “100% of the amount of your deferrals into the DCP up to 6% of your eligible compensation that cannot be taken into account under the 401(k) Plan.” This is especially confusing for former-Mentor employees because their 401(k) plan only matches 50% of their 401(k) contributions up to 3% of salary (most of the other companies under the Siemens umbrella offer a 6% match in the 401(k)). As of the time of this posting, we have been unable to confirm whether Siemens will match 100% of 6% or 100% of 3% of salary not eligible for match in the plan.

Hopefully, this example will highlight the difference. Imagine an employee, age 55, who maxes out their 401k contribution and whose compensation totals $300k (IRS rules dictate that compensation above $290k is not eligible for 401(k) match in 2021). The employee’s contributions and company match will look like this:

- 401(k) Contributions

- Employee Max Contribution – $26,000 ($19,500 plus the $6,500 allowed by the IRS because the employee over age 50)

- Employer match – $8,700 (3% of the $290k eligible for match in a 401(k))

- Deferred Compensation Match

- If the match is truly 100% up to 6% of eligible compensation that cannot be taken into account under the 401(k) Plan, then Siemens would match 100% of the first $9,300 contributed to DCP (6% x $300k – $8,700)

- If, however, the match is up to 3% of eligible compensation then Siemens would match only the first $300 (3% x $300k – $8,700)

We will update this post once we have a confirmed answer.

The Risks of Deferred Compensation Plans

The primary risk of nonqualified deferred compensation plans is that they are, by rule, unsecured liabilities of the company. Your deferred compensation becomes just another liability. You become a creditor of your employer—and lower in priority to any creditor whose loan is secured by the company’s assets.

In addition, when you elect to receive your compensation, that is how long you defer it, is set up front and can’t be changed in most circumstances. Again, this is by IRS rules. You must select your distribution schedule before deferring any income (during your election period), and, except under rare circumstances, you cannot change that. (And typically, if you can change it, you cannot accelerate it. You must elect to receive it even further down the road).

So, you have a situation where you might not see your money until as much as ten years after you retire. For someone younger in their career, this could mean deferring money now, working for another ten years, and then getting the money paid out over the next ten years. In other words, deferring money now and not getting paid back for another 20 years.

So, accessing the financial risk of your company is important, but how to do that?

One way to look at it is simply the average failure rate of publicly traded companies. On average, around 80 public companies file bankruptcy each year. During a recession, this number obviously goes up (136 and 210 filed for bankruptcy protection in 2008 and 2009, respectively) but drops in times of economic expansion (58 and 64 filed in 2018 and 2019, respectively). Taking that 80 companies per year into the 3,700 listed companies here in the U.S. tells us that roughly 2% of public companies file bankruptcy each year.

Of course, not all companies are created equal. Smaller companies should be at higher risk, and Apple isn’t the same risk as J.C. Penny. And of course, even in the case of bankruptcy, some creditors end up recouping a portion of their money.

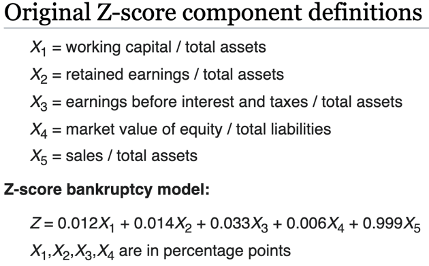

A more robust way to assess firms’ bankruptcy risk was developed by NYU Professor Edward Altman in the late 1960s, which he called the Altman Z-score. His Z-score uses a blend of publicly available financial statement information (working capital, retained earnings, profit, market value, assets, and liabilities) to predict companies’ bankruptcy risk (at least in the near term).

The higher the score, the better:

- The “Safe Zone” is a score of 3 or higher.

- The “Grey Zone” is a score between 1.81 and 2.99

- The “Distress Zone” is a score of less than 1.81

Currently, Siemens’ Altman z-score is 1.87, which is in the Grey Zone.

Any number in the Grey Zone certainly raises an eyebrow, and with deferred compensation plans, we need to look out many years in the future. Here is where factors specific to you as an individual come into play.

Go/No Go: Three Factors to Consider When Making the Deferred Compensation Decision

In addition to your company’s credit risk and future prospects, several factors specific to your financial situation need to be considered.

- Your current exposure to the company: This includes your salary and any stock you own in your company. The more dependent you are on your current salary and the more stock in your employer, the more you will be negatively impacted by poor company performance in addition to your risk in your deferred compensation plan.

- How much of your existing net worth is already in the deferred compensation plan? Because the DCP deferral is a new option for many reading this post, this may not apply now, but it could in the future. If a large portion of your net worth is already tied up in deferred compensation, the more risk you have if something goes wrong.

- How long do you have until retirement? Again, the longer you have until retirement, and therefore the longer the money will be shielded from taxes, the more significant the potential benefit.

Now, you could certainly imagine a scenario where a company stock, due to slowing growth or other factors, goes nowhere for a decade (think IBM), but the company still remains a viable company. However, it’s less likely (although not impossible: hello, Hertz!) that your company is in financial distress, but the stock price holds steady. For this reason, if you’re worried about your company’s future prospects, selling your company stock may be the right place to start.

However, if you do decide to defer money, you’ll have another three decisions to make:

- How much to defer? Siemens allows:

- Up to 50% of Base Salary paid in 2021, regardless of when earned

- Up to 50% of Sales Commissions/Sales Bonus earned in 2021

- Up to 90% of Short-Term/Annual Bonus

- When to distribute?

- The year(s) you begin receiving the income you deferred

- How to invest?

This is, without a doubt, a lot to factor in. The best way to do this (and what we do for clients) is to have a model that lets us do different scenario analysis to make an informed decision based on both individual factors and your company’s outlook.

Strategies to Offset the Risks in Deferred Compensation Plans

For the majority of those deferring compensation at the majority of public companies, things will work out fine. But for those wishing to take some risk off the table, here are a few options.

Shift Your Risk – Sell Equities

One way to reduce your risk in your employer is to sell the company stock you hold instead of making a change to your DCP. Obviously, if the company is in trouble, the stock price will decline in addition to the credit risk increasing. But you could imagine a scenario where the stock price declines but the company remains solvent. By selling stock and deferring compensation, you transition your risk from equity risk to credit risk and (at least theoretically anyway) higher up in the capital structure.

Here’s how you might combine deferring compensation along with selling your existing shares to lower your risk in the future viability of your employer and still reduce taxes along the way.

- Assume you need $120k for living expenses

- After income tax (rounded to 40%), that requires a salary/bonus of $200,000 (200,000 * (1-.40) = $120k)

- For those holding company stock, another way to generate $120k for living expenses is from selling that company stock.

- This exploits the difference in tax rates between income and capital gains.

- To generate $120,000 in cash you could sell $157,480 of company stock ($157,480*(1-.238) = $120k). Furthermore, this assumes a $0 basis…any higher basis means less tax and, therefore, fewer shares sold.

- This technique does three things:

- Allows you to save $42,000 in taxes in the current year, and

- Allows you to trade equity risk in your company for, theoretically safer, credit risk

- Shifts a concentrated equity position to a more diversified portfolio

This first technique trades one type of company-specific risk for another (and saves taxes along the way). Now let’s look at a couple of options to actually hedge the risk in your employer.

Buying Deep Out-Of-The-Money Puts

Buying a put gives you the right to sell stock at a price set today and therefore profit if the price drops below the strike price. Using puts to hedge your Deferred Compensation plan could be structured as below (please note: actual pricing was not available for Siemens put options on the day of this posting so pricing is just for illustration purposes):

- Let’s assume you have deferred $1 million into DCP.

- You buy 50,000 January 2023 put options at a $25 strike for $1.00.

- If Siemens’ share price declined to $25 between now and January 2023—which it’s assumed it would do if it is in (or on the verge) of bankruptcy—your profit equals $1 million $20 per option times 50k options.

- Your cost for this protection equals $50,000 ($1.00 x 50k).

- The total cost for this insurance is 5% of the amount hedged or close to 3% per year.

It’s common for listed options only to extend out a couple of years, so with this strategy, you would either need to roll it every other year, or you could potentially work with a trading desk to create a longer-dated, custom option.

This 3% cost per year is obviously not cheap, and many companies will prohibit executives from shorting their company stock (which buying a put is typically considered since you profit if the price of the company stock falls).

Due to these restrictions and the cost, let’s look at one more option.

Deferred Compensation Protection Trust

A more recent entrant into this space is the Deferred Compensation Protection Trust. Developed by a company called StockShield, this trust essentially pools your risk with others across various companies and industries. An example of how this works according to their website:

Twenty (20) participants, each with a certain minimum balance in an NQDC [Non-Qualified Deferred Compensation] plan sponsored by a different company in a different industry, deposit a small amount of cash (e.g., 1%) for each year of desired protection (minimum 5 years). The pooled cash is invested in U.S. Treasury Securities. At the end of the term of the trust, the assets pooled in the Trust are paid according to the number of bankruptcies.

Assuming your company files bankruptcy in the period covered, the pooled funds would be used to offset your loss. If no companies in the pool file bankruptcy, the funds are returned minus trust expenses.

1% per year for protection isn’t too bad of a deal, although you run the risk of your losses not being fully offset in the case of multiple bankruptcies.

Conclusion

There is certainly a lot to factor in when it comes to your deferred compensation decision each year. If you pass on participating, you’re potentially leaving a valuable tax benefit on the table, but if you do contribute, you increase the financial risk tied to your employer.

Hopefully, this article has been helpful, but if you’re still struggling to assess this trade-off and make a decision that tips the odds in your favor, get in touch. We’d be happy to talk about how we can build a financial decision-making model for you to run scenarios on these and any significant financial decisions you’re considering.