At Cordant we have the opportunity to work with many current and former Intel employees. With this opportunity comes the responsibility of ensuring that their financial plans, planning strategies, and retirement assets are up to speed with the ever-changing employee and retirement benefits programs. This year, being no different, Intel has communicated changes that impact both current employees and qualified retirees alike. Specifically, the following has been updated:

- Employee Stock Purchase Plan (2019)

- Intel’s Charitable Matching (2019)

- 401(k) After-Tax Contributions and Roth in-Plan Conversion (RIPC) (2020)

- Intel Minimum Pension and SERMA (2020)

This blog will only focus on the changes to Intel’s 401(k). Specifically, the ability to increase after-tax savings and utilize an in-plan conversion to a Roth 401(k). If you have questions about any of the other updated benefits, please don’t hesitate to contact us.

The two changes to Intel’s 401(k) benefit are:

- Increased after-tax savings (salary deferral) opportunity

- Ability to convert assets in-plan to a Roth 401(k)

Increased After-Tax Savings Opportunity

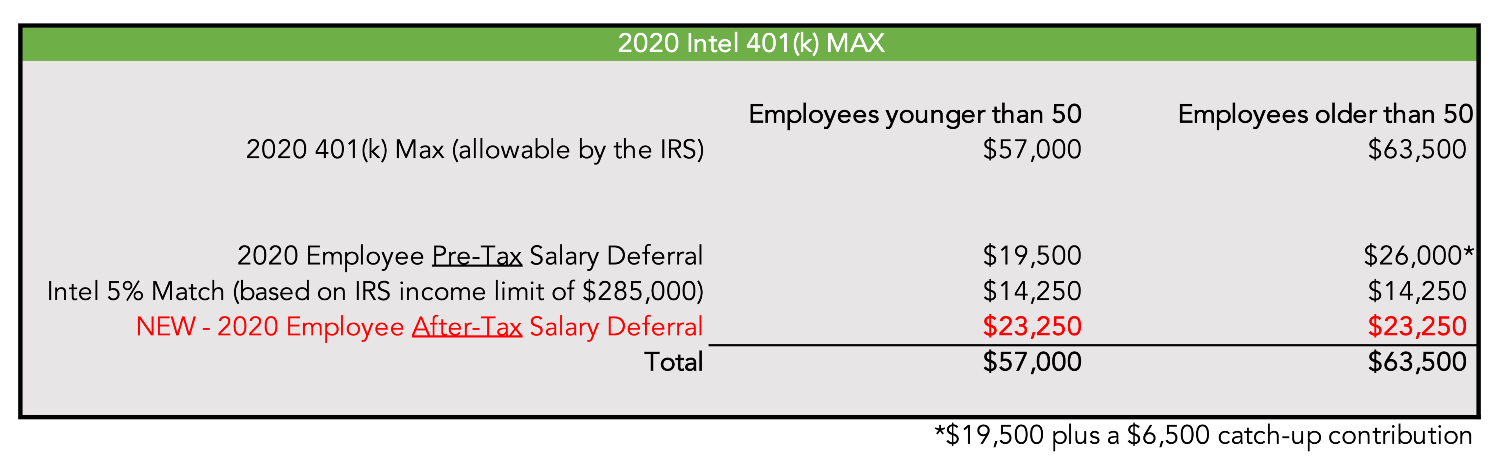

Using 2020 numbers, the IRS will allow employees to defer up to $26,000 ($19,500 if younger than 50) of pre-tax salary into their company’s 401(k) plan. For most companies, that’s where the employees’ savings opportunity ends. However, Intel employees will also have the ability to defer additional after-tax salary starting in January 2020. How much? Let’s look an example to find out.

As detailed in the example above, if we assume Intel matches $14,250 (5% for every $100,000 of employee salary, up to $285,000), Intel employees can take advantage of the after-tax deferral to sock away an additional $23,250. Of course, if your income is less than the IRS limit of $285,000, you’ll be able to defer more after-tax salary.

Ability to convert assets in-plan to a Roth 401(k)

So, why does this matter? What’s the difference between deferring after-tax salary into a 401(k) versus investing the excess cash flow into a taxable brokerage account or IRA? I’m glad you asked because this is it where it gets fun!

Anyone with earned income can make a yearly IRA contribution of $7,000 ($6,000 if younger then 50). Depending on one’s income level, they may be able to contribute to a Roth IRA or make a deductible IRA contribution. However, many Intel employees are over the income limit and are left to make a non-deductible IRA contribution. While non-deductible IRA contributions aren’t all bad, they aren’t the greatest mechanism for optimization. Using the old-school corporate hierarchy of office configuration, when it comes to tax optimization, Roth IRAs get the corner office, Traditional IRAs the window office and non-deductible IRAs are left to the cubicles.

For employees that have been stuck cubicle land (i.e. with non-deductible IRA contributions), the new after-tax salary deferral feature allows them to not only fund a Roth vehicle, but defer up to 3 times more than a normal IRA contribution.

Should I take advantage of this?

The answer is a resounding yes! But before you do, follow the checklist below to ensure this makes sense for you:

- Can my cash flow support it? Make sure the loss of income doesn’t hamper your ability to pay for routine living expenses

- Do I have an emergency savings account? Always a good idea to maintain a cash buffer of about 3-6 months of living expenses.

- Do I have any large expenditures on the horizon? Don’t be caught off guard when tax season arrives and a large cash payment is required.

- Am I funding an HSA? This is the Taj Mahal of saving vehicles. You can read more about the benefits of Health Savings Accounts here.

Will I have a separate account to invest?

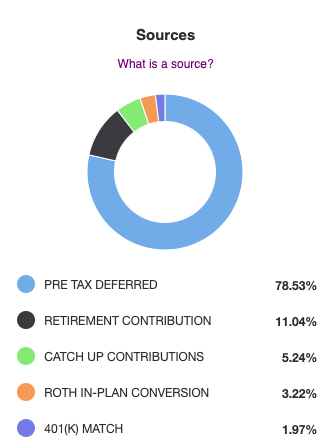

As of now, the Roth 401k will not show up as a separate account. Regardless of the source of the funds, you will continue to have only one account to manage the investments.

This simplifies the management process, but it doesn’t allow for asset location optimization. While it’s unclear whether Intel will add this feature in the future, it’s important to remember that what’s lost in optimization is made up for by the ability to defer post-tax salary into a Roth 401k.

How do I set this up?

- Elect the After-Tax Deferral option (not the Roth 401(k) option) in Net Benefits

- Call Fidelity after January 3, 2020 to request after-tax deferral conversion to Roth 401(k)

There are many moving parts when it comes to Intel’s benefits program. If you are concerned that you’re leaving money on the table or want to ensure you are optimized, get in touch.

[ratemypost]

The information contained in this post is based on Cordant’s understanding of the Intel 401(k) plan as of the date of the post. The Plan is subject to change by Intel. Please see your latest Plan document for the most up to date information.