Today we are going to tell you everything you need to know about the Intel Minimum Pension Plan (MPP). We’ll cover:

- How the Intel pension plan works

- How your Intel pension plan benefit is calculated

- The steps you should take if you’re retiring from Intel

But first, grab your FREE resources (no email required!) 👇

Pension: Lump Sum vs. Monthly Income [Excel download]

Pension: Lump Sum vs. Monthly Income [Flowchart; pdf download]

What Issues Should I Consider Before I Retire? [Checklist; pdf download]

How Pensions Work

The basic idea of a pension plan is fairly straightforward. A pension (also called a Defined Benefit plan) is a promise, funded by your employer, to provide a certain monthly income to you in retirement. While a pension scheme is seemingly straightforward, each plan’s nuances and details can sometimes be confusing.

How the Intel Minimum Pension Works

The Intel pension plan is a minimum benefit plan. That means Intel calculates a minimum benefit for eligible employees in retirement and then compares that to the balance in your Retirement Contribution Account (or, more precisely, the monthly annuity income produced by your “RC Account”).

We’ll cover in more detail below how your benefit is calculated, but the key factors are your years of service and final average pay.

- Final Average Pay: Your average pay during the highest-earning years. Your estimated social security benefits are also used in the calculation—meant to provide a retirement benefit on the earnings not factored into your social security benefits.

- Years of Service: Your income above is multiplied by your years of service to determine your pension benefit.

That’s the calculation for your Pension Benefit.

The purpose of the minimum pension plan is to guarantee a minimum level of income in retirement in addition to the balance/benefit of your Retirement Contribution Account (“RC account”). When your Pension Benefit is calculated, Intel ensures that the RC Account is valuable enough to provide that benefit. They do this by using the Minimum Pension Plan (“MPP”) as a gap fill.

It works like this: The present value of the calculated minimum benefit is compared to the value of the RC Account (remember this is the account into which Intel used to make matching 401(k) contributions). This calculation is done using an annuity factor.

- If the RC Account is greater than the present value of the calculated minimum benefit, there is no MPP.

- If the present value of the minimum benefit is greater than the RC Account, then the MPP provides a benefit in the form of an annuity or a lump-sum distribution to make up for the shortfall (for more on evaluating whether to elect a lump sum or annuity payment, jump to this section)

I want to stress that the MPP benefit only exists when the RC account balance is calculated to be short of providing the intended minimum benefit.

How Is My Intel Pension Benefit Calculated?

The first step in learning about your pension is to understand how benefits are accumulated. If you have a pension, you have earned these benefits over the course of your working career. Typically benefits are calculated from some combination of: length of employment, age, earnings history, and estimated social security benefits.

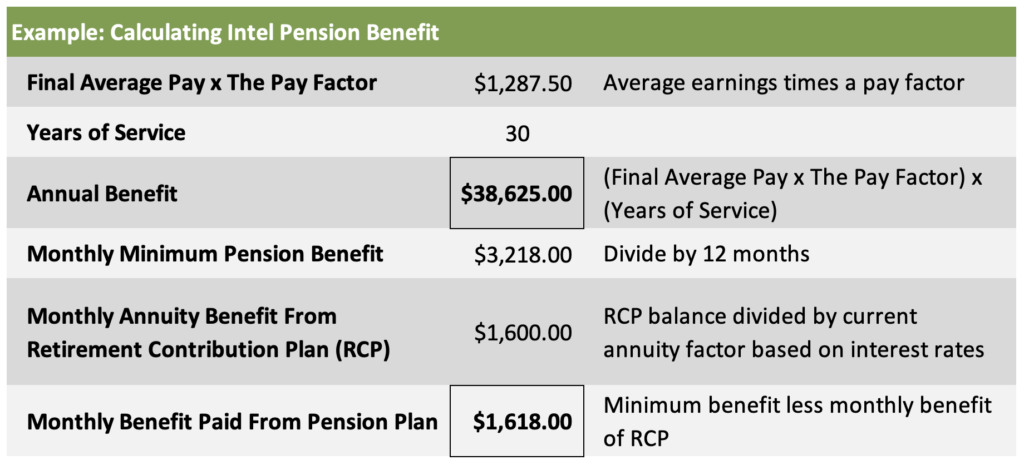

The factors determining your Intel Pension Plan benefit are:

Final Average Pay: This denotes your average pay during your highest earning years. Your estimated social security benefits are also used in the calculation—meant to provide a retirement benefit on the earnings not factored into your social security benefits.

Years of Service: Your Final Average Pay is multiplied by years of service.

Retirement Contribution (RC) Account Balance: Since Intel’s pension plan is a minimum benefit plan; your pension benefit is compared to the balance in your RC account. If your monthly pension benefit exceeds your RC plan, you will receive an additional pension benefit. You’ll receive only the balance in your RC account if it is less.

he purpose of the minimum pension plan is to provide employees a minimum level of income in retirement, even if the RC plan falls short of doing so (usually due to investment returns).

The Annuity Factor: The annuity factor is used to turn your RC account balance into a monthly income amount. The factor is determined based on your age (life expectancy) and the level of current interest rates.

The IRS publishes the rates used in pension calculations and splits them into three segments.

The first segment is used to calculate payments due in the first five years, the second to discount payments due in years 6-20, and the third to discount any payment due after 20 years.

The annuity factor decreases as interest rates rise—meaning that the monthly income benefit would increase, but a lump sum distribution would decrease as rates go up.

The calculation would look something like the following hypothetical example:

Intel Pension Plan: Steps to take when you retire

Like so many wealth management decisions, your Pension benefit must be made in light of one’s goals, objectives, other assets and income sources, and risk tolerance. There is no global rule. Option A or B isn’t always optimal. The monthly income isn’t the best choice in all cases and neither is the lump sum. There are advantages and disadvantages to either option. The key is making this decision in light of your personal situation.

Let’s look at the key steps to take when making your pension decision (Lump Sum vs. Monthly Income) with the goal of optimizing the result for your specific situation.

Step One: Determine Your Intel Pension Plan Benefit

Since Intel’s pension plan is a minimum pension plan, you first must determine whether you’re due a pension benefit or not. We covered this above, but essentially Intel looks at the balance of your Retirement Contribution account when you retire and compares this to an amount they calculate you should have based on your average compensation and years of service. If your Retirement Contribution account falls short, the minimum pension steps in to fill the gap.

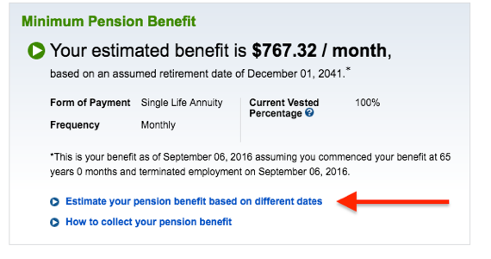

While it’s a complicated calculation, the results are easy to obtain. Login to your Fidelity NetBenefits site, then click on Pension. You will see your monthly benefit (if you have one) and you can run estimates based on different dates (red arrow in the image below). This will give you differing monthly income based on when you start taking income and will show the current lump sum benefit.

Your total benefit will not change once you retire. However, your monthly income benefit will increase the longer you defer as fewer payments are expected to be made over your lifetime.

The lump sum benefit will vary as interest rates fluctuate. The lower the interest rate, the higher your lump sum benefit will be (and vice versa).

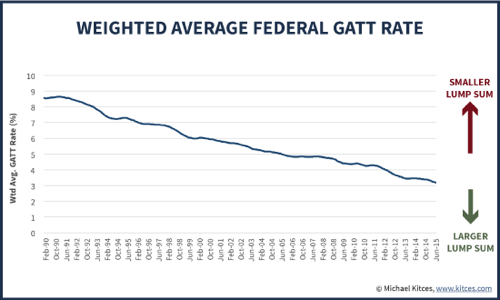

Once you retire, the fact that the lump sum varies with interest rates is a big reason to be proactive and contemplate making a decision as soon as possible. You can defer making a decision with your pension until age 65, but delaying is risky if you are considering or prefer the lump sum. Your lump sum amount is determined by discounting the monthly payments over your lifetime back to today. And the higher the discount rate (based on interest rates), the lower the lump sum amount today. (We will see how much in a second). If you prefer the lump sum benefit and interest rates rise, you are now looking at a lower lump sum balance.

Step Two: Intel Pension Quantifiable decision criteria

From a purely financial standpoint, the income vs. lump sum decision has three inputs: the lump sum amount (which is then compared to the monthly income benefit); your life expectancy; and your estimated investment returns.

Lump Sum Balance

Your lump sum depends on your life expectancy and the discount (interest) rate applied to the monthly benefits. Intel uses the life expectancy table published by the Social Security Administration.

Next, the current interest rate level will impact your lump sum balance. The lower the interest rate (or discount rate) used, the higher your lump sum balance. This is good for you as someone with a pension benefit, but bad for the company paying the benefit (as they need to set aside more to fund the pension plan or to payout a lump sum).

And as you can see below in the chart from Michael Kitces, using a common pension discount rate (the Federal General Agreement on Tariffs and Trade), discount rates are historically low currently—meaning the lump sum balances are historically high relative to monthly benefits.

Intel doesn’t use GATT rates but instead uses PPA interest rates in its discount rate. The PPA rates takes an average of three segments: The first segment discounts the payments made in the first five years, segment two the payments from years 5-15 and the third segment from years 15 on. These rates can be found on the Fidelity site.

At a 3.0% interest rate, a lump sum on an expected $2,000 joint monthly benefit for 30 years is around $470k. However, at 5% this lump sum amount falls by over $100k to $369k.

Life Expectancy

Next, you should consider your life expectancy when making the pension decision. The longer you expect to live the more valuable the monthly pension income, as you would expect more payments to be made.

Most people are going to start with the general assumptions (which you can find on the table published by the Social Security Administration or in the chart below) and customize from there based on family history, health history, etc. Additionally, you can use an online tool like the one available at Livingto100.com to further customize life expectancy to your situation.

Investment Returns

Lastly, your estimated investment returns on the lump sum should be considered. There are a couple of ways to do this. First, you could calculate an IRR for each age. This will tell you your investment return for each year to match the pension benefit.

First, you will notice that if you (and your spouse in the case of joint benefits) die young, you are better off (even with an extremely large investment loss) taking the lump sum. This makes sense since you receive a limited number of payments in retirement.

Next, you should notice that the longer one lives or expects to live, the higher the investment returns on the lump sum need to be to match the monthly income benefit.

Another way to do this analysis is to look at a scenario analysis. Looking at multiple different scenarios (by year and investment returns) you can determine the scenarios you would be better off taking the lump sum and investing it.

To help with your assessment, download your free Pension analysis tool 👇

Pension: Lump Sum vs. Monthly Income [Excel download]

Step Three: Intel Pension other decision criteria

While the numbers are an important part of making this decision, there are a few more factors to consider. Things like your individual goals, objectives, and risk tolerance are an important part of making the pension decision as well.

Goals and Objectives

Wealth is only a tool or resource to achieve what you want to get out of life, and since this varies per person, it makes sense that retirees are going to have different goals and objectives.

Some are going to prioritize assurance of lifetime spending, and therefore a stable pension benefit is attractive.

For others, caring for a spouse or other loved one is a critical factor, and therefore the joint benefit or a lump sum (as it can be passed on in death) is more attractive.

Others are thinking beyond their lifetime and prefer the lump sum asset as a way to fund charitable and estate goals.

And for others prefer the flexibility of the lump sum benefit. Not everyone has stable spending needs over their retirement, and some prefer the ability to spend more in the early years—something that is not possible with a level monthly benefit.

Risk Tolerance

Last, but certainly not least, is a proper risk tolerance assessment. The key risks one faces are related to the key inputs: life expectancy, investment return and the risk of the monthly benefit in the form of company-specific risk.

Answering the key questions surrounding these risks are important, and we find are best done looking at one’s overall financial situation and usually with a financial advisor. Key questions are:

- Do I want to bear the financial risk of living beyond the average life expectancy or would I rather give up the investment upside in return for handing off this risk?

- Do I want to take an investment risk with a portion of my retirement assets in return for the potential return and estate benefits?

- Am I comfortable with my former employer’s financial health and (or) any pension guarantee, and certain of its ability to payout my pension over my lifetime?

There are many inputs that go into weighing the pension decision. We recommend you be proactive about making the decision and analyze it taking into account your personal objectives, armed with data and after properly assessing your risk tolerance.

For those who left Intel then rejoined at a later date, the pension plan calculation will need to be requested from Fidelity and scenarios are not available on demand.

Cash Flow Considerations

- Income, Expense, and Tax Planning

- How much in spending will your assets safely support? “Will I run out of money if I stop working?”

- Will you take Social Security? What’s your claiming strategy?

- Payout and timing of Salary, Bonus, and accelerated vesting of RSUs and other equity compensation

- Intel Pension Plan payout in a Lump Sum or monthly income

- Income sources (SSI, Pension, Earned Income) and how much is needed from your portfolio

- What accounts will your money be drawn from in order to minimize taxes?

Health Care and Insurance Issues

- Are you aged 65 and eligible for Medicare?

- If not, will you fill the gap with Private insurance or COBRA and the cost of each?

- How much do I have in my SERMA account?

- Have your needs for Life Insurance changed? Will you lose coverage?

- Are you concerned about funding Long-Term care?

Intel Benefits Issues

- Are you, or will you reach, Rule of 60 or Rule of 75?

- Timing of Salary and Bonus Payouts

- SERPLUS Deferral and Staring date of payout

- Timing and potential acceleration of RSUs, OSU, PSU, and Option grants

This list is a start but by no means meant to be comprehensive. For more, see our article on Intel Severance Packages or our checklist: What Issues Should I Consider Before I Retire?

Conclusion

Understanding your Intel Pension Plan benefit and making a decision about how to take this benefit can be a lot of work. But if you are evaluating the plan, hopefully, this post provides guidance to help make the decision easier on you.

To recap, if you have a pension benefit from Intel, take the following steps:

- Understand and calculate the full details of your benefit

- Create your personal financial plan and understand how the pension impacts your ability to achieve your financial goals

- In light of your financial plan, determine when to take your pension benefit and decide on taking either the monthly income or lump sum.

And if you need help with the heavy lifting on any of this, reach out. The best place to start is your free Personalize Financial Assessment.

Information obtained herein is from sources that are believed to be reliable. However, such information is subject to change and is not independently verified. Please check with your HR for the most up-to-date plan information.

Cordant, Inc. (“Cordant”) is a registered investment advisor. Even though we have clients who are current and former Intel employees, we are not suggesting that Cordant is affiliated, associated or endorsed by Intel.