All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident. –Arthur Schopenhauer

19th-century German philosopher, Arthur Schopenhauer thought truth (and in this case, we’ll extrapolate to include “new ideas”) passed through three stages: ridicule, opposition, then acceptance. While the index fund, which turned 40 last year, is a new idea no longer, based on the massive shift in assets that are moving from active to passive, one could argue their “truth” is now self-evident.

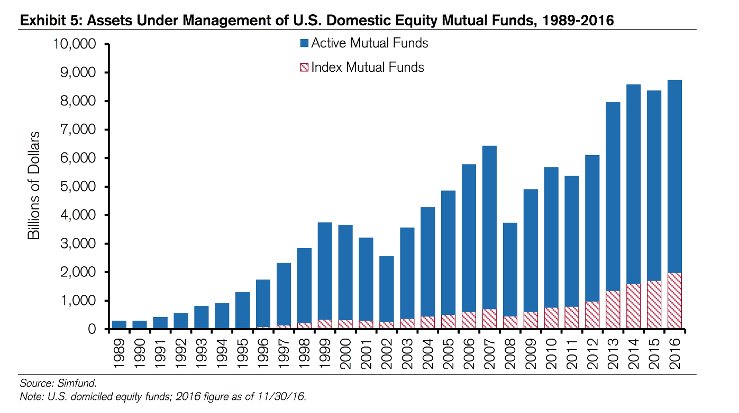

According to Michael Mauboussin and others at Credit Suisse, “Since the end of 2006, investors have withdrawn nearly $1.2 trillion from actively managed U.S. equity mutual funds and have allocated roughly $1.4 trillion to U.S. equity index funds and exchange-traded funds (ETFs).”

This shift from active to passive funds has driven total assets invested in index mutual funds to around $2 trillion with another $2 trillion invested in ETFs.

Clearly, index investing is an idea that is catching on and gaining momentum.

But sometimes it feels like people are disappointed to have to “settle” for indexing. No one wants to be passive or merely average. It can feel to many like settling for meatloaf because you can’t afford the prime rib.

So, for those who feel like index investing is giving up or settling for average, legendary investor Charlie Ellis (former chair of Yale’s investment committee, former board of directors of the Harvard Business School, founder of Greenwich Associates, former director of Vanguard group and author of sixteen books) and current Vanguard CEO Bill NcNabb have a message for you: You are not. With index investing you actually win, not settle. You get above average performance—net of fees, index funds consistently deliver top quartile performance.

Recently Ellis, on the Bloomberg Master in Business Podcast, was discussing index investing with host Barry Ritholtz and they got into what this type of investment approach should be called.

Indexing?

Passive?

Ellis’ answer: “Winning.”

As far as he’s concerned, beating the average participant makes you a winner, and index funds deliver this kind of winning performance.

And a few months before Ellis joined Ritholtz’s podcast, William McNabb the CEO of Vanguard stopped by for a visit as well. Here’s what he had to say on the topic of index funds:

“Average is not average. People used to say, “indexing, well you’re just accepting average returns.” Actually, that’s not true. As you know, if you take the average index fund’s return and compare it against the whole universe, you’re going to be in the top quartile from a performance standpoint over any long period of time. You’re not actually accepting being average. You’re saying, “I’m going to be in the top quartile, guaranteed.”

Two confident assertions of the superiority of index investing, but Larry Swedroe has the data to back up the claims in his book, The Incredible Shrinking Alpha. From Appendix A, we learn that as of October 31, 2014, the average Vanguard index fund (both domestic and international) was in the 51st percentile over the prior 10 years and 30th percentile over the trailing 15 years (1st percentile would be the best performing fund while 100th percentile would be the worst). For DFA (Dimensional Fund Advisors) funds the average ranking was 22nd percentile over ten years and 23rd percentile over 15 years. What’s more, these rankings are before any adjustment for survivorship bias which, based on calculations from John Bogle, are estimated at about 7 percent of funds per year.

Swedroe sums it up as follows:

“Again, keep in mind the impact of survivorship bias on the long-term rankings. If survivorship bias were accounted for, it is highly likely that the 15-year ranking for the Vanguard funds would be well below 50 percent. As for the 13 passively managed DFA funds, the average 10-year and 15-year rankings were 22 percent and 23 percent, respectively. Outperforming 78 percent and 77 percent of the surviving funds is hardly average performance. And if Morningstar accounted for survivorship bias, their ranking would almost certainly be considerably higher.”

No one wants to be average, or worse yet, labeled “passive.” But when it comes to investing, n indexing, with its seemingly average approach, delivers performance that’s far from average.

“Average” funds. Winning returns.

Disclosure: Cordant Wealth recommends both Vanguard and DFA funds when building client portfolios.

Sources:

Looking for Easy Games (pdf) – Credit Suisse

The Incredible Shrinking Alpha: And What You Can Do to Escape Its Clutches – Larry Swedroe and Andrew Berkin

Barry Ritholtz’s Master in Business podcast – Bloomberg

![[W]indexing: When Average Isn’t Average](https://www.cordantwealth.com/wp-content/uploads/2017/02/indexing-when-average-isnt-average.jpg)